Achieving Sustainability

Avoided emissions: how investors can judge companies’ net-zero credentials

The increasing frequency and severity of weather-related events due to climate change has highlighted the urgent need to take action and achieve net-zero greenhouse gas (GHG) emissions by 2050.1 Investors can turn to “avoided emissions” – the positive impact of a more sustainable product or service – to assess which potential investments can make the most significant contribution to achieving this target.

Key takeaways

- Avoided emissions reflect emissions savings achieved by a product, service, or project in wider society. Avoided emissions is a key complementary metric to more established scope 1, 2 and 3 measures.

- Climate solutions such as solar, wind, grid technologies and sustainable biogas are key to boosting avoided emissions.

- There is a lack of methodological clarity around avoided emissions, but greater application across private and public markets will formalise measurement approaches.

- Measures of avoided emissions can help channel investment to solutions that make the most significant contribution to achieving net zero emissions by 2050.

Following on from our July 2023 thematic paper on scope 3 emissions, in this piece we seek to break down the concept of avoided emissions, its importance in achieving climate objectives and how it is being integrated into financial markets.

What are avoided emissions?

Many investors will be familiar with companies reporting on their own carbon footprint in terms of scope 1, 2 and 3 emissions. These metrics capture GHG emissions produced across the entire value chain, from the energy used to run factories and operate delivery trucks to the emissions produced by a company’s suppliers and its customers when using its products.

In contrast, avoided emissions seek to capture the broader positive contribution (if any) of a product or service to the economy outside of the company’s own value chain.2 Solar panels or heat pumps, for example, can help residential customers “avoid” emissions when they use these products versus fossilfuel alternatives such as gas boilers. Exhibit 1 summarises some of the key climate solutions that can contribute to avoided emissions.

Exhibit 1: Example climate solutions according to the IPCC

Source: IPCC (2022).3

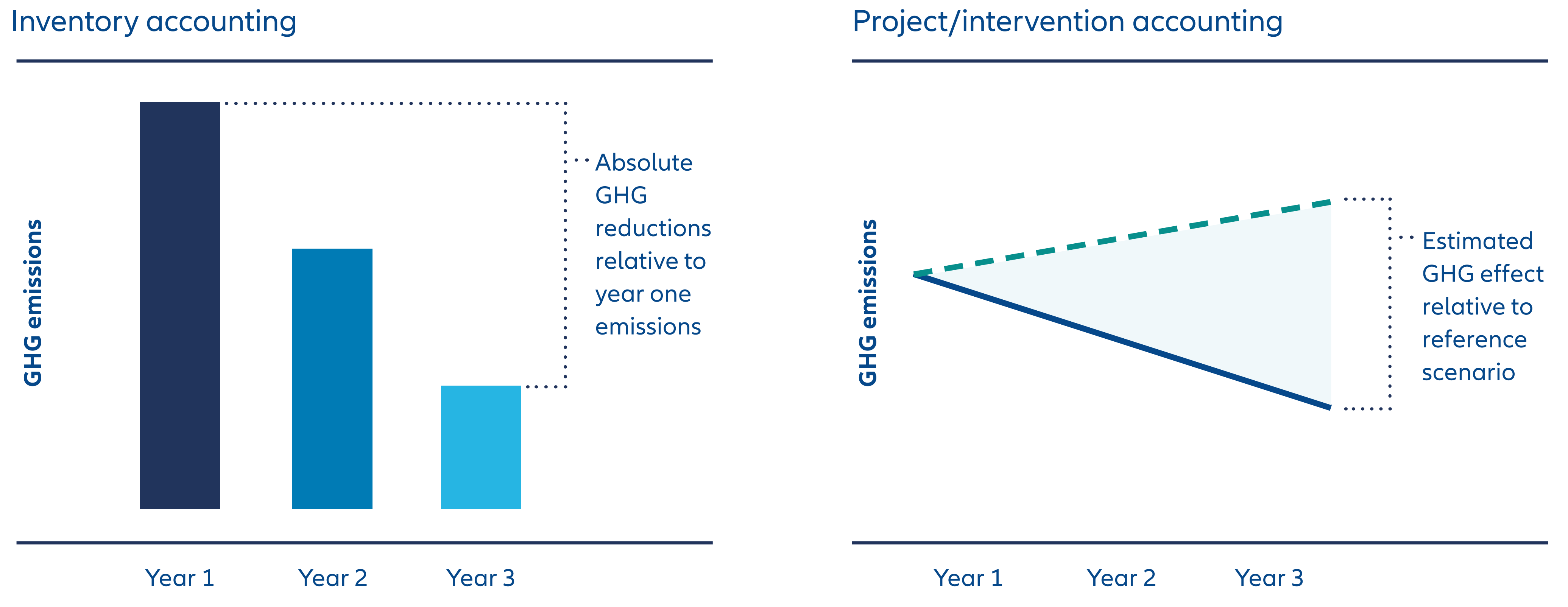

In comparison to measuring a company’s own historical carbon footprint, this forward-looking approach measures the positive contribution of a company’s product versus a “reference scenario”, including alternative solutions, market developments and regulation over time (see Exhibit 2).

Exhibit 2: Illustrative explanation of inventory GHG accounting at company-level versus avoided emissions as project/intervention accounting at society-level

Source: WBCSD (2023).4

What are the most common misconceptions about avoided emissions?

The concept of avoided emissions has been developing for several decades,5 but common misunderstandings persist on identifying and measuring them.

Avoided emissions can substitute the reduction of scope 1, 2 and 3 emissions.

Avoided emissions are sometimes referred to as “scope 4” emissions. Avoided emissions do not contribute to a company’s decarbonisation science-based targets6 and fall under a separate accounting system (see Exhibit 2). Renewable energy purchases to decarbonise a product’s manufacture, for example, would contribute to lowering scope 2 emissions but not avoided emissions. However, if emissions in broader society are reduced due to a company’s product versus its alternatives serving the same function, these are avoided emissions and can complement a company’s profile in supporting net zero ambitions.

A reduction in scope 3 emissions is the same as avoided emissions.

Scope 3 emissions consider emissions in a company’s value chain before and after a company’s direct operations and are accounted for historically at the company level.7 Avoided emissions are forward-looking and anticipate the “additionality” of a specific product’s positive contribution relative to alternatives.

That said, a product’s improved energy efficiency can both lower a company’s own scope 3 emissions and increase the level of emissions avoided outside of a company’s own value chain – they are separate accounting approaches. This is critical since:

- If a highly efficient solution is popular it will increase avoided emissions, but it could result in higher absolute scope 3 emissions for the producing company (albeit with better intensity).

- Avoided emissions are expressed relative to existing “reference points”, and these may decrease over time as higher standards are adopted more broadly.

Carbon dioxide removal (CDR) projects should be considered avoided emissions.

CDR projects (also referred to as “negative emissions”) removes CO2 from the atmosphere and durably stores it in geological, terrestrial, or ocean reservoirs or in products.8 CDR activities can be accounted for both as avoided emissions and in a company’s scope 1, 2 and 3 emissions. However, purchased emissions removal credits should not. Having both metrics strengthens the actions companies can take to contribute to net zero targets.9 For example, instead of simply changing agricultural suppliers to reduce scope 3 emissions, a company may instead partner to implement bioenergy projects, contributing to an overall reduction in emissions to the atmosphere.

Why is the focus on avoided emissions so critical?

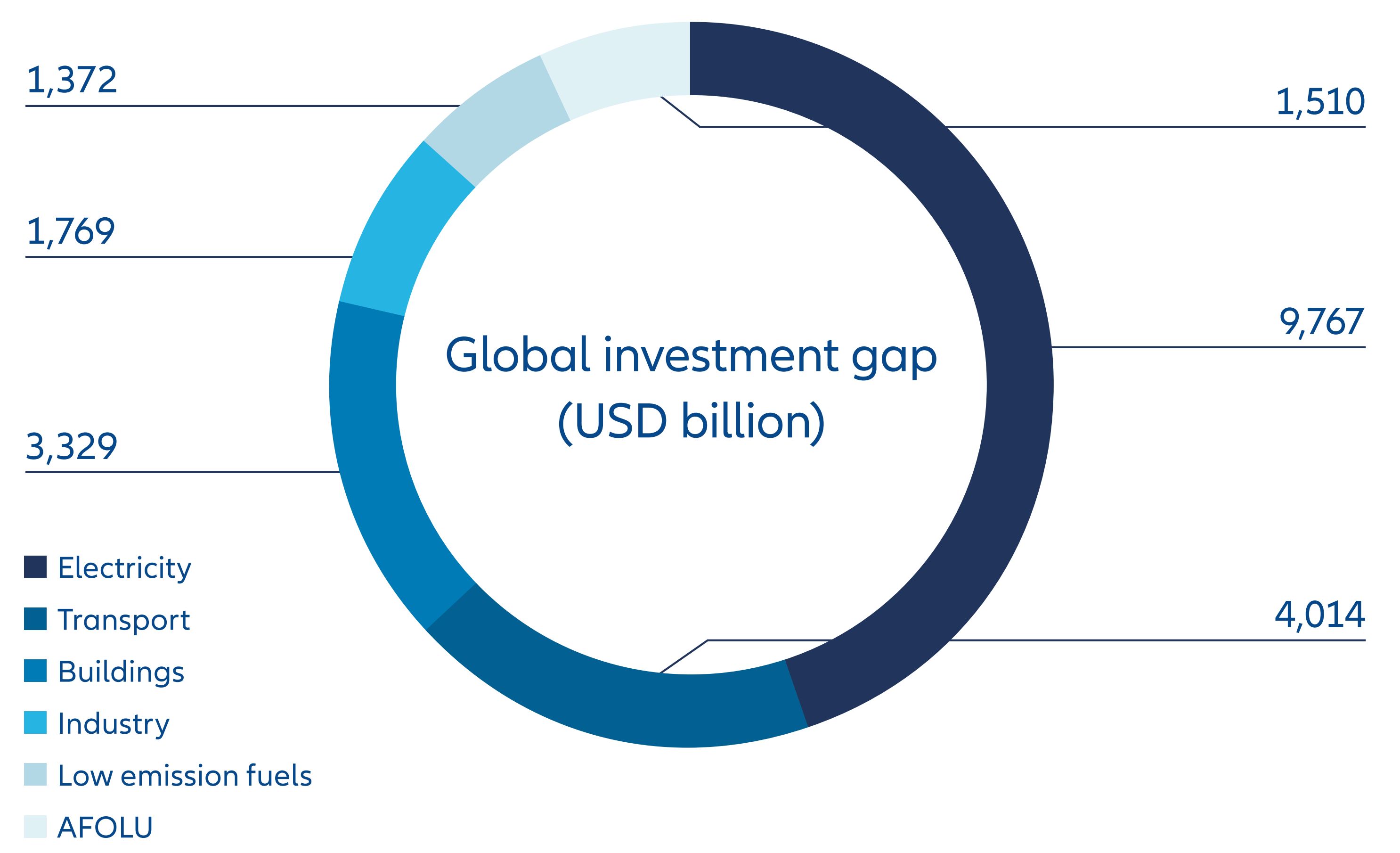

Very simply, we need solutions to solve problems. Unfortunately, the investment gap is significant (see Exhibit 3) and our ability to minimise global emissions and achieve net zero will be greatly constrained without both rapidly scaling existing technologies and new, innovative products.

Exhibit 3: Estimated global gap in climate solution finance between 2021 and 2030 to achieve net zero emissions by 2050

Source: IIGCC (2021).10

How do avoided emissions link to climate action frameworks?

Net zero will require climate solutions. To facilitate the necessary finance, these solutions need the support of industry initiatives and relevant technical guidance. For example, the guidance on transition finance published by the Glasgow Financial Alliance for Net Zero (GFANZ)10 or the Climate Investment Roadmap developed by the Institutional Investors Group on Climate Change (IIGCC).11 The latter recommends avoided emissions as a key climate solution indicator, which coupled with revenue and capex metrics can help to quantify how much a portfolio is invested in climate solutions.

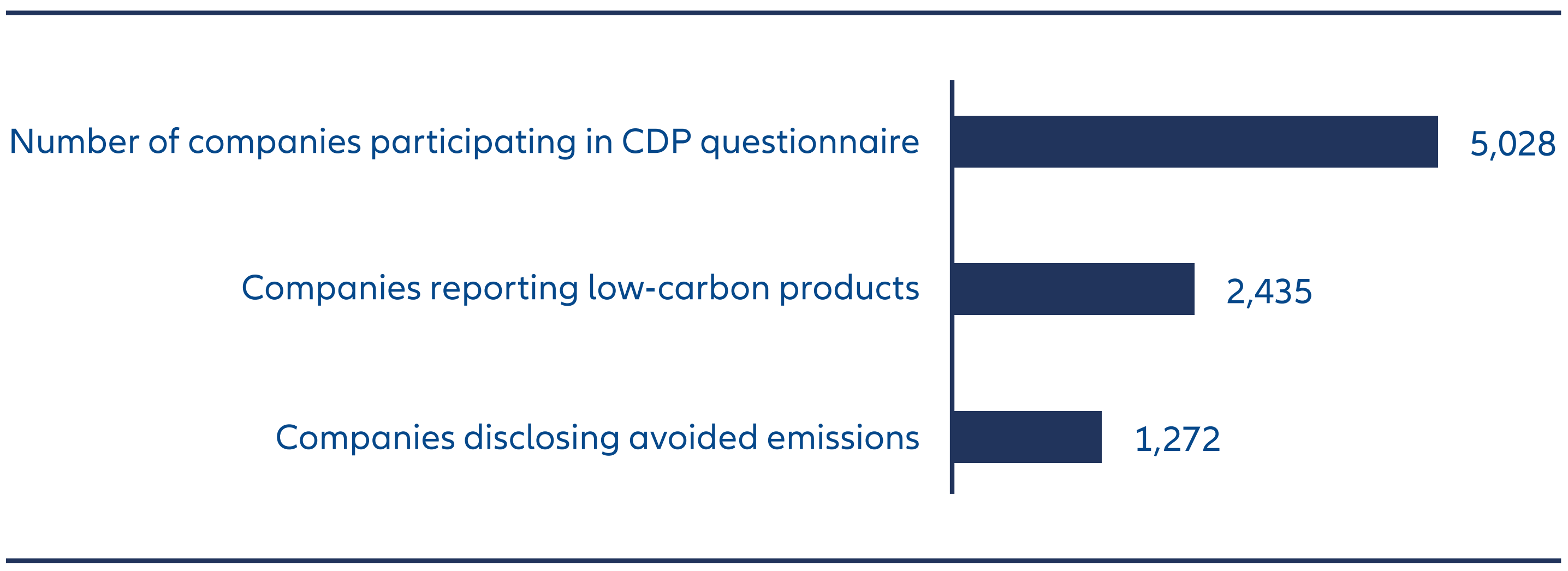

The developing industry guidance coincides with rising interest in integrating and measuring avoided emissions in investments. In 2022, around 50% of companies reporting low-carbon products also reported on avoided emissions in the CDP Climate Questionnaire (see Exhibit 4). That said, data and methodologies remain under-developed, and robust engagement is required to substantiate third-party or in-house avoided emission estimates.

Exhibit 4: Number of companies participating in different CDP Climate disclosures

Source: Allianz Global Investors and CDP (2022).12

How are avoided emissions being integrated into investments?

Climate investing can be broadly split into two categories: decarbonising portfolios and investing in solutions (see Exhibit 5). Where decarbonising portfolios capture adopters of climate solutions, we link “avoided emissions” to the enablers of these solutions.

Exhibit 5: Climate strategies

Source: Morningstar, September 2023

Avoided emissions technologies remain at a relatively immature phase of development, where the focus has been to finance and scale up earlystage solutions and infrastructure. It is therefore unsurprising that private markets are more mature in integrating avoided emissions into investments, especially in the private equity and venture capital segments. Climate-orientated private market funds have gained the greatest share of impact fund launches in recent years, accounting for 33% of new assets under management launched across the first three quarters of 202313, and some of the largest funds are focused on climate solutions.14 As outlined in our 2023 whitepaper, avoided emissions has become a key indicator for positive climate outcomes in impact investing portfolios.

While public markets currently lag the private markets in focus on the topic, there are several ways we anticipate this will increase:

- Climate solutions now represent 19% of public climate funds,15 but represent much higher shares in China and Rest of the World16 investors. Avoided emissions is a key technology in climate solutions, and with these areas focused on climate solutions, investment in avoided emission solutions and technologies should benefit from this specific focus.

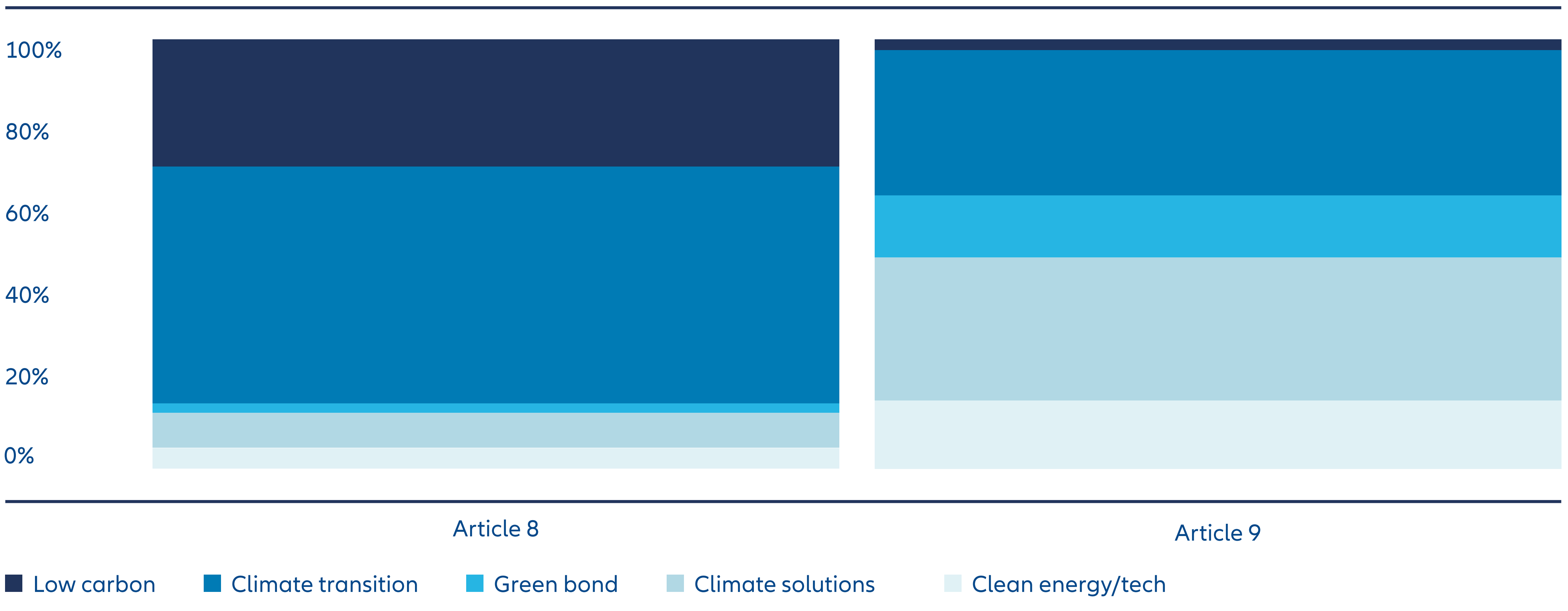

- Climate solutions represent the largest climate strategy focus for Article 9 Climate funds (see Exhibit 6), an area of renewed focus after areas of clarification from the European Union’s Sustainable Finance Disclosure Regulation (SFDR).

- We anticipate specific activities supporting avoided emissions will be linked to contributing to environmental goals, which can be captured for Sustainable Investment Share or SDG alignment KPIs.

- Avoided emissions is fast becoming a key indicator in objectives for green bonds (assisted by improved data from the likes of S&P Global).17

- Lastly, we expect initiatives like the CDP Climate Questionnaire to prompt improving disclosures on climate mitigation and adaptation, which will increasingly include avoided emissions.

What are the next steps for avoided emissions?

The interest in climate solutions and the potential capital available was evident at COP 28, but the widespread adoption of avoided emissions to channel this investment largely depends on the continued methodological convergence around its measurement. This will enhance both the credibility and comparability of the metric. Defining common, sector-specific reference scenarios to measure the “additionality” of climate solutions will also be critical in ensuring comparability. Once consensus is reached, these can be hard-coded into binding criteria like taxonomies, science-based frameworks and regulation related to the energy transition.

A huge amount of investment is needed to bridge the climate solution financing gap to achieve net-zero emissions by 2050. Measures of avoided emissions can help solve this by channelling investment to solutions that make the most significant contribution to achieving this target. Its established use in private markets impact investing and its growing prominence in public markets should see increasing application but methodological standardisation will need to evolve swiftly to enable its integration and ensure the world has the best opportunity to hit a 2050 net-zero ambition.

Exhibit 6: Article 8 and 9 climate funds by strategy

Source: Morningstar, September 2023.18

1 IPCC (2021). Summary for Policymakers. In: Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change.

2/4 WBCSD (2023). Guidance on Avoided Emissions: Helping business drive innovations and scale solutions toward Net Zero.

3 IPCC (2022). Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change.

5 Mission Innovation (2023). The history of solution providers and avoided emissions/climate handprint in 35 steps.

6 SBTi (2023). SBTi Corporate Manual.

7 GHG Protocol (2013). Corporate Value Chain (Scope 3) Accounting and Reporting Standard.

8 IPCC (2022). Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change.

9 GHG Protocol (2023). Land Sector and Removals Guidance. Part 1: Accounting and Reporting Requirements and Guidance (Draft).

10 GFANZ (2023). Scaling Transition Finance and Real-economy Decarbonization: Supplement to the 2022 Net-zero Transition Plans report.

11 IIGCC (2022). Climate Investment Roadmap

12 CDP (2022). Corporate Responses Dataset 2022.

13 Pitchbook (2023). 2023 Impact Investing Update, December 2023.

14 A look at the 5 biggest US PE impact funds – PitchBook, June 2023.

15 “Investing in times of Climate Change”, Morningstar, September 2023.

16 Includes Australia, Canada, South Korea, Taiwan, Japan, Malaysia, Israel, India, Singapore, Chile, New Zealand, Brazil, Thailand, and Indonesia.

17 S&P Global (2022). Measuring the impact of green bonds, October 2022.

18 “Investing in times of Climate Change”, Morningstar, September 2023.