Embracing Disruption

Advanced Driver Assistance Systems (ADAS)

Picture this: you’re running late, circling a car park in a crowded shopping mall. Every parking spot seems impossibly tight. Squeezing your car in feels like a test of nerves and patience. But what if all it takes is a tap on your app. Your car glides effortlessly into the tight space, parking perfectly while you watch on….

This isn’t science fiction. For millions of drivers in China, these kind of breakthroughs are no longer futuristic perks – they are becoming part of everyday life. As Advanced Driver Assistance Systems (ADAS) features become increasingly common on China’s roads, they are steadily transforming the driving experience and offering a glimpse into the future of mobility.

Behind these everyday conveniences is a rapidly evolving technology landscape. China’s journey in smart mobility began years ago, laying the foundation for today’s breakthroughs. The emergence of powerful domestic AI models like DeepSeek has accelerated this progress, making advanced features such as self-parking, intelligent suspension, and integration with urban planning increasingly common.

What is ADAS: The bridge to autonomous mobility

ADAS is not a new term. It was introduced around 20 years ago and refers to a suite of technologies designed to support drivers and enhance vehicle safety. These technologies have developed rapidly and are now increasingly working towards support for autonomous driving, for example in features such as adaptive cruise control, lane-keeping assist, collision avoidance, and automated parking.

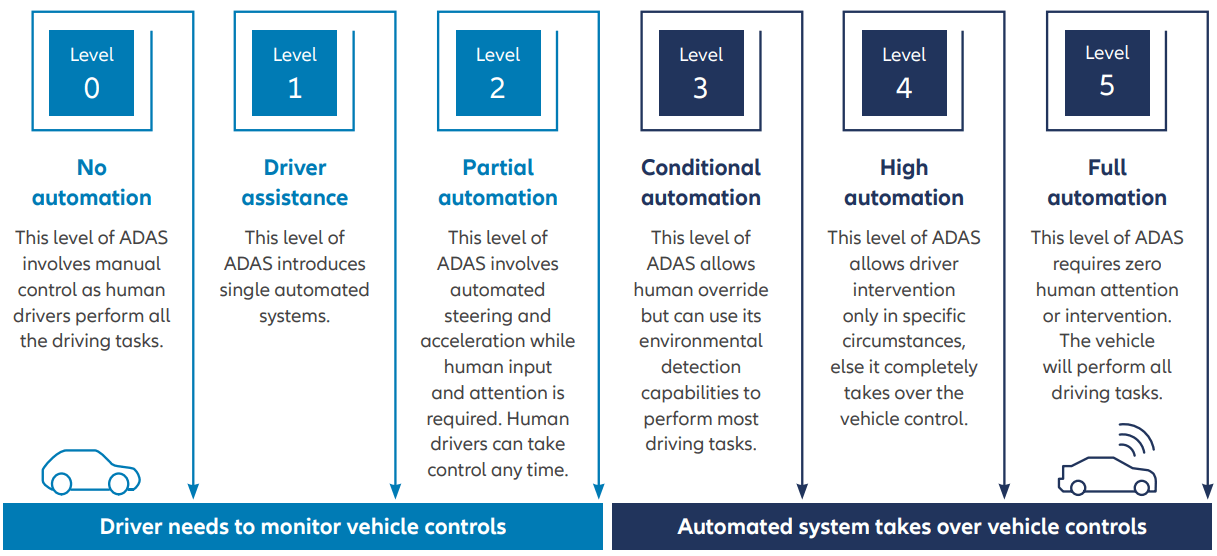

ADAS systems can be classified by automation levels. The level of automation ranges from L0 (no automation) to L5 (full autonomy with no human input required). In practice, the term ADAS often refers to systems at Level 2 and above, where a vehicle can actively manage certain driving tasks under specific conditions. In China, for example, Level 2 and above features are becoming standard in many new vehicles and these include navigate-on-autopilot (NOA) on highways and in-city, automatic lane changes, and self-parking.

Different levels of Advanced Driver Assistance System

Source: binarysemantics.com, April 2024.

ADAS market penetration – China compared to rest of the world

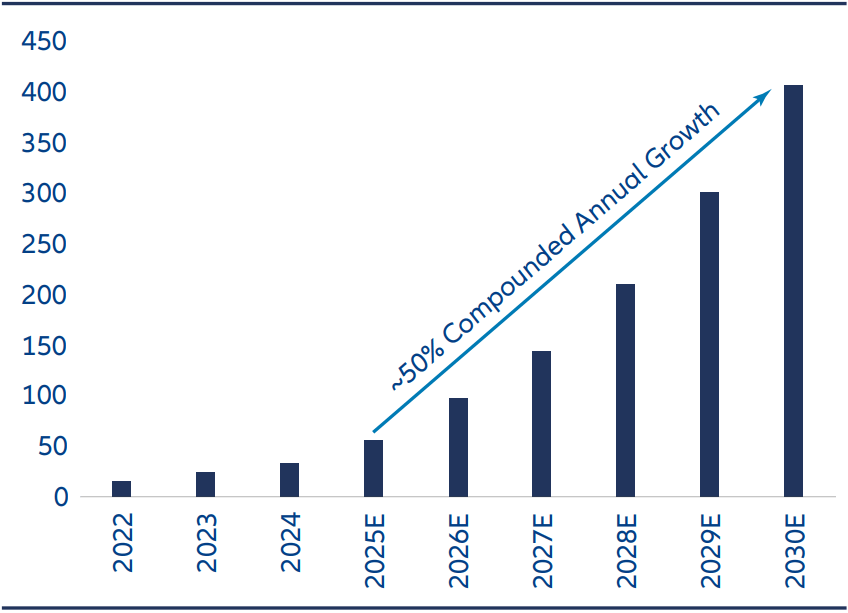

While global ADAS adoption has been led by Tesla in the U.S. and a range of Chinese automakers, China’s pace of advancement is particularly striking. The country’s ADAS market is projected to experience compound annual growth of close to 50% in the coming five years, taking the market size to more than RMB 400 billion (USD 55 billion). And by 2030, more than 80% of vehicles in China are expected to feature some form of ADAS.1

A recent high profile example is BYD, the largest Chinese EV brand, which unveiled its “God’s Eye” ADAS platform in February 2025. Powered by DeepSeek AI and utilizing a multi-sensor approach (LiDAR, cameras, radar), BYD is including ‘God’s Eye’ across its entire lineup at no extra cost – even in entry-level models priced from RMB 69,800 (US$9,500). In comparison, Tesla’s Full Self Driving (FSD) model costs Rmb64,000 (US$8,800) in China.2 BYD’s strategic move underscores China’s cost leadership and is reshaping global expectations around accessibility to advanced driving technology.

Beyond private vehicles, robotaxis are another fast-growing ADAS application. Fully driverless services are already operational in cities such as Beijing, Shanghai, Shenzhen, and Wuhan, accessible via standard ride-hailing apps.

China’s rapid ADAS penetration is also fuelled by a favourable policy environment and heavy investment in smart urban infrastructure. Many cities have equipped roads, traffic systems, and parking facilities with realtime data networks, enabling vehicles to anticipate congestion, locate parking, and optimize routes — making daily driving not only more efficient but also much more intuitive.

Exhibit 1: China ADAS penetration forecast

Source: Morgan Stanley, as at 1 December 2024

Exhibit 2: Market size for China ADAS solutions (RMB bn)

Source: Morgan Stanley, as at 1 December 2024.

The ADAS infrastructure and Chinese companies’ penetration

Sensors – the ‘Eyes and Ears’ of ADAS

Sensors form the foundation of ADAS, acting as the vehicle’s perception systems. Cameras are the most common sensor type, enabling functionality such as real-time detection of obstacles, lane markings, and traffic signs. However, there are very different systems used by different providers. Tesla, for example, uses a “pure vision” approach with a suite of cameras and advanced computer vision algorithms. In China, other automakers are increasingly integrating LiDAR – Light Detection and Ranging – alongside cameras to enhance detection reliability, especially in challenging conditions such as poor weather conditions or visual obstructions. Huawei, for example, equips its ADAS-enabled cars with both cameras and LiDAR in addition to radars for more robust perception.

Algorithms – the ‘Brain’ of ADAS

The data collected by sensors is processed by sophisticated algorithms that interpret the driving environment and translate insights into driving actions. These algorithms are central to vehicle decision-making. AI models can help train these systems using vast datasets from real-world driving scenarios, improving their ability to recognize road signs, navigate traffic, and respond to dynamic conditions.

Chips – the ‘Computing Power’ behind ADAS

As vehicles become more intelligent, the need for high-performance computing continues to grow. Advanced smart driving chips are essential for processing large volumes of sensor data in real time, enabling fast and accurate decision-making. This demand is driving innovation in chip design to support the increasing complexity of ADAS functions. Across the supply chain of this ADAS infrastructure, Chinese automakers are either increasingly using specialist domestic suppliers or in some cases turning to in-house, full-stack development.

Leveraging their vast and growing datasets from real-world Chinese driving conditions with its unique traffic set-up and culture, domestic providers have a natural advantage over foreign providers. Chinese companies now have global leadership in areas such as sensor-based ADAS technologies. Their dominance is even more pronounced in the LiDAR segment, where the top three players are Chinese and together account for around 76% of global automotive market share.3 This highlights China’s leading role in integrating advanced sensor solutions into ADAS systems.

Summary

In our view, China’s rapid embrace of ADAS is turning once-futuristic features — such as effortless self-parking and intuitive urban navigation —into daily realities. What sets China apart is not just the adoption of these technologies, but the speed at which leading automakers are pushing the envelope on performance, reliability and affordability. By leveraging its manufacturing scale, policy support, and technological leadership, China is setting new standards in smart mobility. This momentum is creating ripple effects across the automotive technology chain, opening up a wide spectrum of “Created in China” investment opportunities across technology and advanced manufacturing.

1 Morgan Stanley, December 2024.

2 Carnewschina.com, March 2025.

3 Yole Group, March 2025.