Achieving Sustainability

Getting physical: when climate change hits home

Scientists have been warning of the negative effects on the planet of rising emissions and warming temperatures for several decades. But the frequency and severity of weather-related events require a deeper understanding of how we can adapt to live with these risks – and the investments needed.

Key takeaways

- Weather-related events are a major financial risk for countries and companies, but their materiality is not well understood across financial institutions.

- We have developed an in-house physical risk screening and scoring system to assess country-level exposure.

- Granularity by location is needed, as it remains a challenge in assessing corporate exposure.

- Although some industries – eg, insurance – are using adaptation measures, there is a need to improve data and invest in adaptation infrastructure.

The pace of climate change has accelerated through the 2020s1 but the urgency to limit future temperature rises has been compounded by current hotter temperatures, which are already causing significant impacts and present considerable risks.

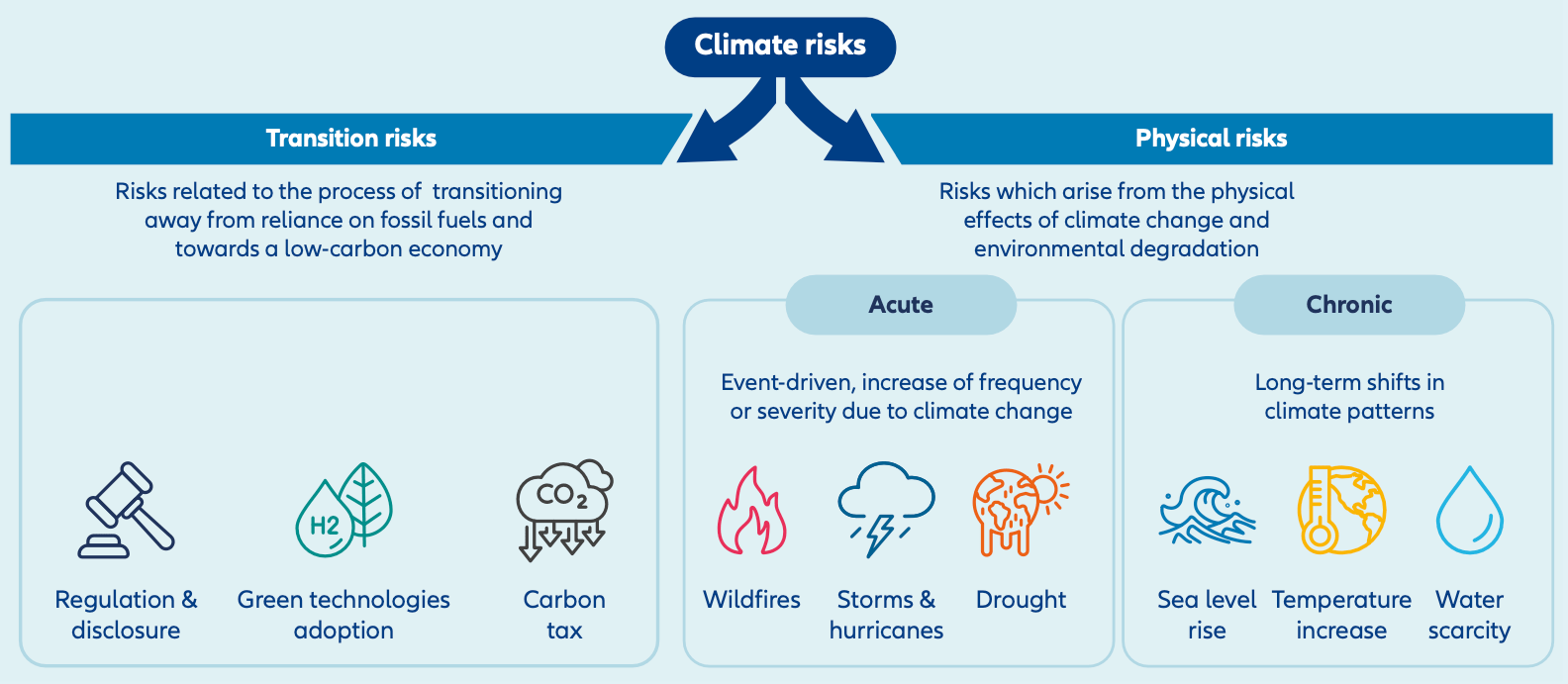

These physical climate risks come from the physical effects of climate change and environmental degradation, including weather-related events, such as storms, heatwaves, droughts and floods. While there is an understanding of these risks, less is known about when, where, how often and how severely they will have an impact. Decoding the financial materiality of these risks, modelling their impact and focusing on adaptation to higher temperatures are important issues for financial institutions to address.

Exhibit 1 shows two types of climate risks: transition risks – related to the transition to a lower carbon economy, and physical risks – relating to climate change impacts. Physical risks are categorised into “acute” event-driven risks and long-term “chronic” shifts in climate patterns.

Exhibit 1 – Climate, physical and transition risks

Source: Allianz Global Investors, July 2025

Understanding climate implications

While there may be uncertainty about the timing and severity of these risks, the damage they will cause to individuals, com- munities, buildings and, as result, entire economies is certain. Modelling which events will happen, where they will happen and with what level of frequency and severity remains underdeveloped. Furthermore, the interplay of events (eg, sudden rainstorm after a drought) requires consideration.

Enhancing modelling technologies will be critical in advancing climate adaptation measures and directing investment, in the first instance, towards protecting those living in the most vulnerable locations, and preventing loss of life.

The physical risks described earlier translate directly into financially material risks. These can result from the significant consequences of acute event-driven losses, longer-term environmental and social damage from chronic risks, and lastly, the rising costs of adapting buildings and infrastructure to these risks. Addressing these three types of financial risk requires an estimated investment of more than USD 200 billion annually.2

Several recent devastating weather events starkly highlight these risks and their consequences:

- In Valencia, Spain in October 2024 torrential rain and flooding caused loss of life and the destruction of many homes, businesses, vehicles and transport infrastructure.

- Just a few months later, low humidity – and also hurricane-force winds – contributed to the January 2025 California wildfires with tragic consequences for the community. Thousands were evacuated and many homes destroyed, while 57,000 acres of land were burnt.

- The US state of Texas is still reeling from another disastrous weather-related event of July 2025, where the stark implications of insufficient flood defences and no flood alert system caused extreme and catastrophic flash flooding along the Guadelupe river.

The events in Valencia, California and Texas highlight not only the cost to address casualty and property costs, but also the significant financial impact of economic disruption. The economic loss from heatwaves, droughts, and floods in the European Union alone in summer 2025 amounted to EUR 43 billion, and is estimated to rise to EUR 129 billion by 2029.3

Protecting the most vulnerable

The greater frequency and severity of these risks will impact wider economies of affected areas, not just localised areas, and could pressure sovereign credit ratings. One study suggests up to 63 countries could suffer climate-induced sovereign credit downgrades by 20304 – effectively reducing their credit status based on exposure to physical climate risks.

The climate insurance protection gap is likely to widen given that most climate-related damage and losses currently remain uninsured. Countries, companies and citizens are forced to cover the gap, for example through higher premiums for homeowners and business owners located near flood prone waters.

For the lowest-income nations, this could be particularly punitive. They are likely to be most vulnerable to climate-related physical risks while also finding that their ability to finance adaptation is increasingly undermined by any credit rating downgrades.

We believe it is therefore critical to understand at a country level the nature and extent of physical risk exposure. Institutions like the Network for Greening the Financial System (NGFS) are leading the way in identifying the extent of economic losses related to physical risks under different future temperature scenarios.

Quantifying climate exposure

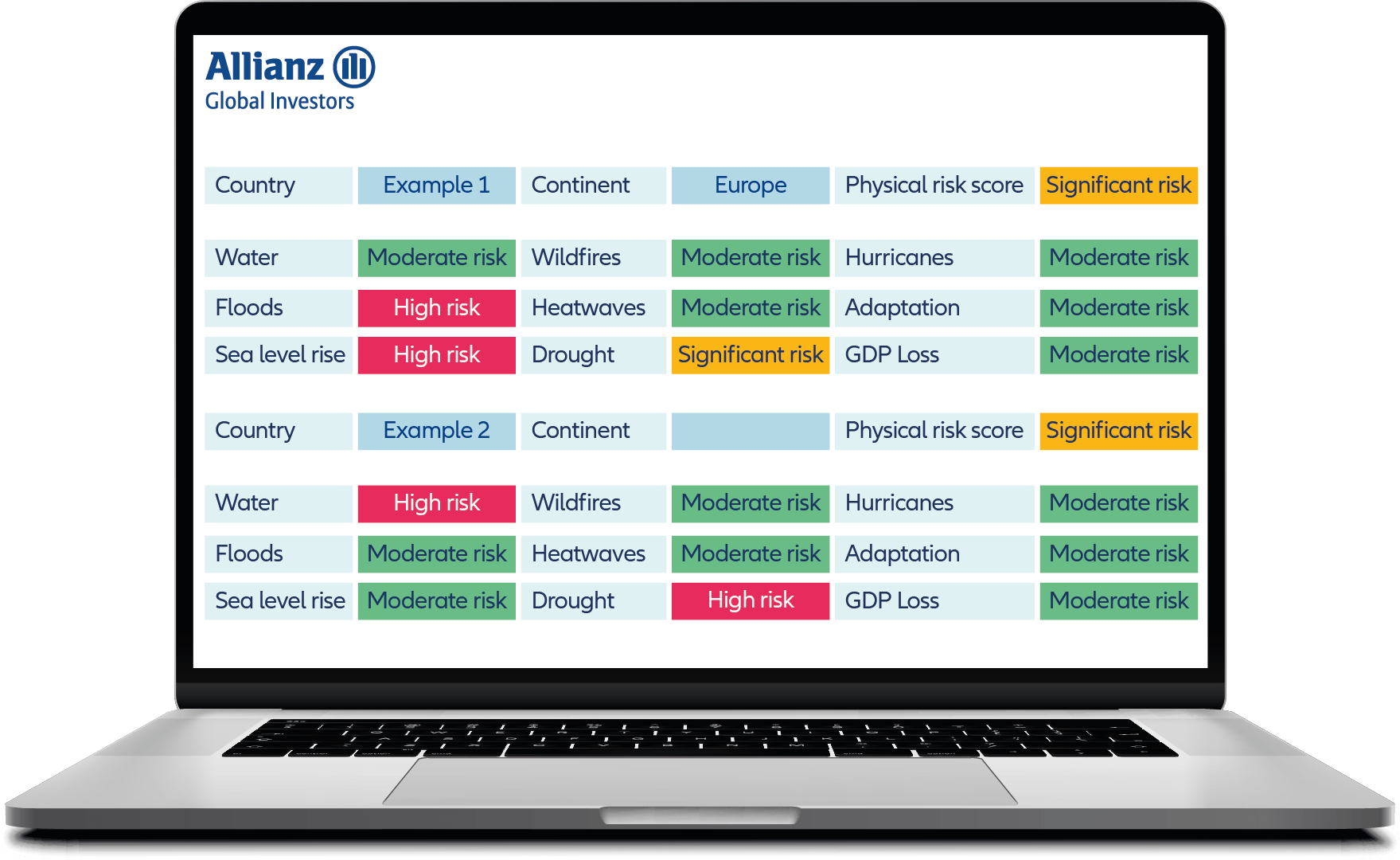

To support our investment decision-making and aid us in identifying targets for engagement we have developed a physical risk screening and scoring system to assess and compare countries’ exposure to different types of risk, their adaptation needs, and the potential impact on gross domestic product (GDP). The system uses publicly available and academic data5 for nine financially material physical risks (see Exhibit 2) to calculate an overall physical risk score. Weightings within the score can be adapted to focus on specific risks, scenarios or timelines.6

Our screening and scoring system extends to overall country-level physical risk assessment – as shown in Exhibit 2. It does not yet cover specific locations within a country – which is a level of granularity that will be key for large countries such as India, where the physical risks of Chennai and New Delhi, for example, will not be the same.

Exhibit 2 – Extract from the dashboard of the screening and scoring system

Source: Allianz Global Investors 2025 – derived from the datasets of the seven sources detailed in endnote 5

Nine physical climate risks are included in the screening and scoring system: drought, wildfire, sea level rise, water scarcity, flood, heatwave, hurricane, climate adaptation, and GDP loss

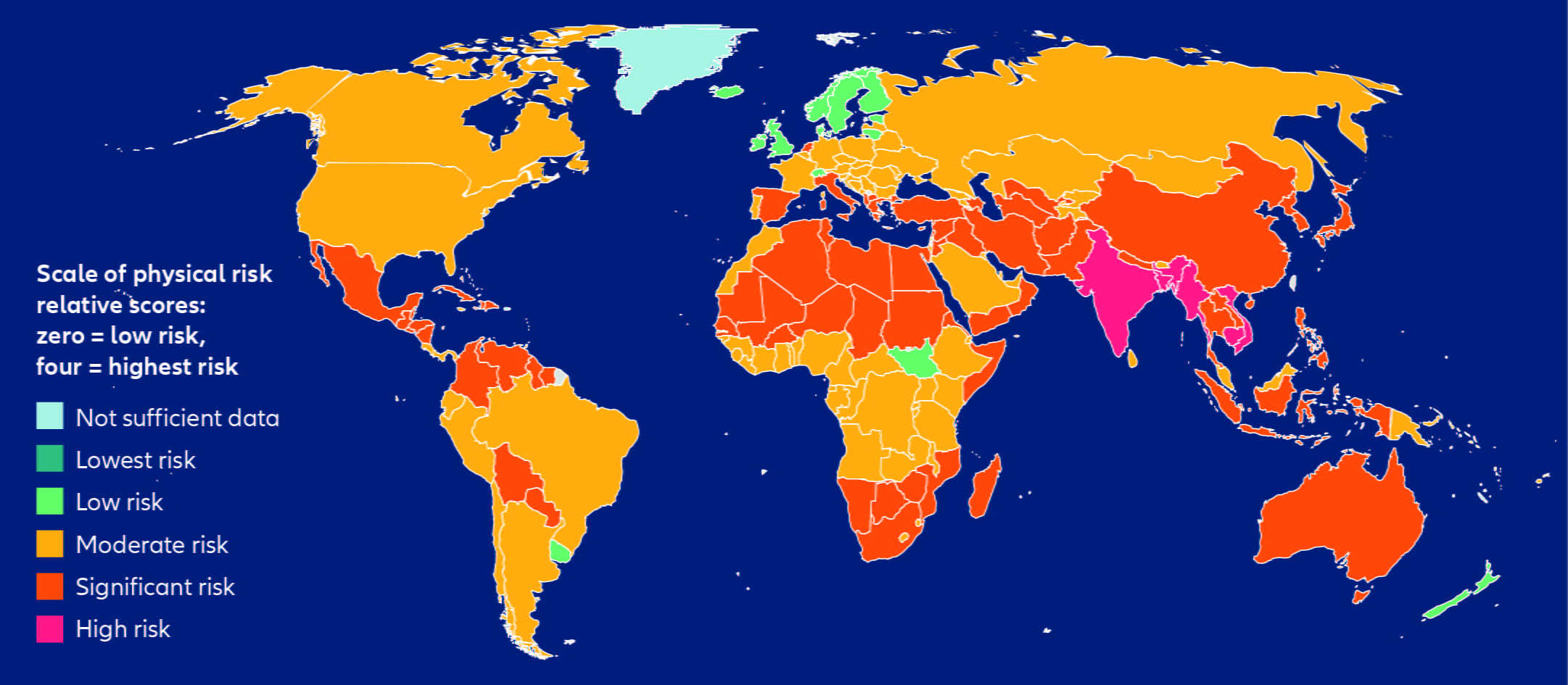

The global map in Exhibit 3 shows our physical risk composite scores with broad groupings across regions. South East Asia appears to be the most vulnerable to risks, while Southern Europe, Central America, Central Asia, and Saharan and Southern Africa are also high risk. Despite Northern Europe screening for lower risks relative to other regions, it remains vulnerable to specific types of physical risks.

An interesting case is the Netherlands, which screens as having the highest risk in Northern Europe, due to high exposure to floods and sea level rises. That said, we recognise the work of Rijkswaterstaat, the government agency, on adaptation measures for water management, which are considered in the adaptation- specific score.

Exhibit 3 – AllianzGI physical risk composite scores

Source: Allianz Global Investors, 2025 and Australian Bureau of Statistics, GeoNames, Microsoft Navinfo, Open Places, OpenStreetMap Foundation,TomTom, Zenrin

Seeing the bigger picture

We know that improving physical risk models is integral to a better understanding of the financial materiality of such risks. However, a critical challenge in building these models is the extent to which the data for the incidences and impacts of past events can be used accurately to assess future risks when climate change impacts are escalating and changing. Consequently, we expect climate modelling to remain highly dynamic.

Furthermore, in comparison to physical risk modelling for countries, the task of assessing companies involves the complexity of their activities and operating assets across regions or continents. Modellling company risks becomes more complex when looking beyond a company’s own operations to the risks within its supply chain, especially where critical operations are located in more vulnerable, lower-income countries. This difference between the location of a climate event and the location of its impacts presents a challenge to regulatory reporting and sustainability disclosures. It is illustrated by the example of the 2017 hurricane in Puerto Rico which disrupted the pharmaceutical supply chain and revealed the vulnerability of locating significant medical device production capacity in Puerto Rico to serve the mainland US market. As a result US hospitals experienced severe shortages of saline solutions for several months.7

While it is highly challenging to quantify acute and chronic physical risks, this endeavour is being encouraged through regulation and other initiatives – such as the focus on geographical traceability of goods in the EU regulation against deforestation, and the Carbon Disclosure Project questionnaires on environmental impacts. But disclosures will need to evolve significantly for investors to have greater conviction on assessing and pricing these risks.

We see the insurance industry taking the lead on modelling climate risks. The rising frequency and severity of insured loss events means some locations find it increasingly difficult to obtain property insurance. The industry’s capabilities in assessing the probability of negative events, and the financial estimate of insured assets at risk, are critical to how they price insurance and assign capital to contingent liabilities. It is at national level that the location and level of adaptation to these physical risks should be defined – using the global insurance industry’s capabilities. This will reduce the insurance “gap” by providing the insight needed to secure the basis for extending insurance.

Adapting for resilience

We expect physical risks to be increasingly integrated into formal credit risk assessments of both sovereign nations and companies in the coming years. Adaptation – a country’s preparedness to deal with the risks typical of their geography and environmental conditions – will be integral to this.

In addressing physical climate risks, the primary focus to date has been on mitigation strategies to minimise the extent of future emissions and temperature increases. However, as mentioned earlier, there is already a necessity to adapt to the impact of current temperature rises, as well as future temperature scenarios. Adaptation has several implications:

High costs: There are considerable upfront costs associated with adaptation measures – which can include constructing dykes close to factories or installing pumping devices or drainage systems. But these remain a prudent and necessary investment compared to the current estimates of potential future economic damage. However, advances in modelling indicate future higher economic risks, especially – as shown in the differences between the fourth and fifth Network for Greening the Financial System calculation8 – estimations of costs keep rising, which heightens the case for investment.

Uncertain solutions: The trajectory of adaptation solutions remains uncertain, ranging from lower cost, low-tech traditional methods (eg, painting walls white

to reduce indoor temperatures) to higher cost, advanced technologies (eg, large-scale infrastructure like the MOSE flood defence project in Venice).

New opportunities: While our primary focus has been on risks, it is important to recognise that adaptation also offers economic opportunities, as noted in our blog

post, “Emerging into a warmer world”. The increasing frequency and severity of climate events will necessitate the integration of adaptation concepts and technologies into daily life, fostering the growth of new sectors. This is especially the case in higher risk developing economies.

Engaging global stakeholders

We continue to see increasing interest in understanding how physical risks are likely to be integrated into investment decisions in the future. The geoeconomic fragmentation of recent times may well heighten these exposures. The environmental, social, and economic significance of physical risks will likely drive a push for greater location-based risk assessment disclosures and governance of physical risk management. Engagement with countries and companies will be key while data and modelling capabilities mature.

Meanwhile, action is needed now as the planet grows warmer. For financial institutions the materiality of these risks has become critical. The “internationally recognised indicators for climate adaptations” – part of the UN led Global Goal on Adaptation – should give much needed clarity on this crucial topic but are still to be published. International climate negotiations with a focus on adaptation must continue and target successful outcomes.

1The last ten years have been the warmest ten years on record and 2024 was the first year that the global temperature exceeded 1.5°C above the

pre-industrial level – Copernicus, Global Climate Highlights 2024, January 2025

2Climate Policy Initiative, Global Landscape of Climate Finance 2024

3SSRN, Dry-roasted NUTS: early estimates of the regional impact of 2025 extreme weather, September 2025

4Klusak, Patrycja & Agarwala, Matthew & Burke, Matt & Kraemer, Moritz & Mohaddes, Kamiar, Rising Temperatures, Falling Ratings: The Effect of Climate Change on Sovereign Creditworthiness, August 2023 Management Science. 69. 10.1287/mnsc.2023.4869.

5Full list of data sources used for calculating physical risk scores: World Resources Institute “Aqueduct 4.0: Updated decision-relevant global water risk indicators.”, 2023; Nature Communications, Flood exposure and poverty in 188 countries, June 2022; Copernicus, country profile, 2025; Climate Adapt, Climatological Heatwave Days, 2025;

World Bank Group, DataBank | The World Bank, 2025; University of Notre Dame, Country Index // Notre Dame Global Adaptation Initiative //University of Notre Dame, 2025; Publications Office of the European Union, Luxembourg, 2022; IMF, Climate Change Indicators Dashboard NGFS GDP Losses & Benefits | Climate Change Indicators Dashboard , 2025. No other data sources are taken into consideration.

6This is based upon a proprietary calculation. The overall physical risks score for each country is relative as each country is ranked against other

countries by its exposure to physical risks.

7International Journal of Disaster Risk Reduction, Leveraging a Bayesian network approach to model and analyze supplier vulnerability to severe weather risk: A case study of the U.S. pharmaceutical supply chain following Hurricane Maria - ScienceDirect , October 2018

8What is new in the 2024 version (Version 5) of the NGFS long-term scenarios? NGFS Scenarios Portal, 2025