Navigating Rates

Active management offers solution to 60:40 struggles

A major reset in bond yields has improved the outlook for the embattled “60:40” portfolio. But the active management that multi asset strategies can add on top of that baseline will be key to taking advantage of a diverging global economic outlook which will bring greater differences in asset performance.

Key takeaways

- The stalwart 60:40 portfolio has struggled in recent times, prompting many to ask whether the time is up for the concept.

- After a damaging period where equities and bonds moved in unison, higher bond yields mean a more balanced environment where bonds should once again offer a diversification benefit for 60:40 portfolios.

- Potential equity returns – historically the engine of growth for 60:40 – look more muted given arguably lofty valuations.

- With differences in asset performance growing, active management away from the 60:40 baseline could be key to taking advantage of greater economic divergence.

The 60:40 portfolio – holding 60% in equities and 40% in high-quality bonds – has been declared “dead” in some quarters after enduring two years of poor relative performance.

Despite staging a modest comeback in 2023 as pressure on bonds eased and equities rallied, relying on a static 60:40 portfolio may not be enough in the medium-term. With a diverging global economic outlook creating the potential for certain assets to outperform, we think the active management multi asset portfolios can add around the 60:40 baseline will be crucial to generating excess return in the coming years.

What went wrong for 60:40?

The basic idea behind 60:40 is that over time equities provide growth, but in periods when equities struggle bonds generally do better (they are negatively correlated), helping to reduce downside risk to the portfolio.

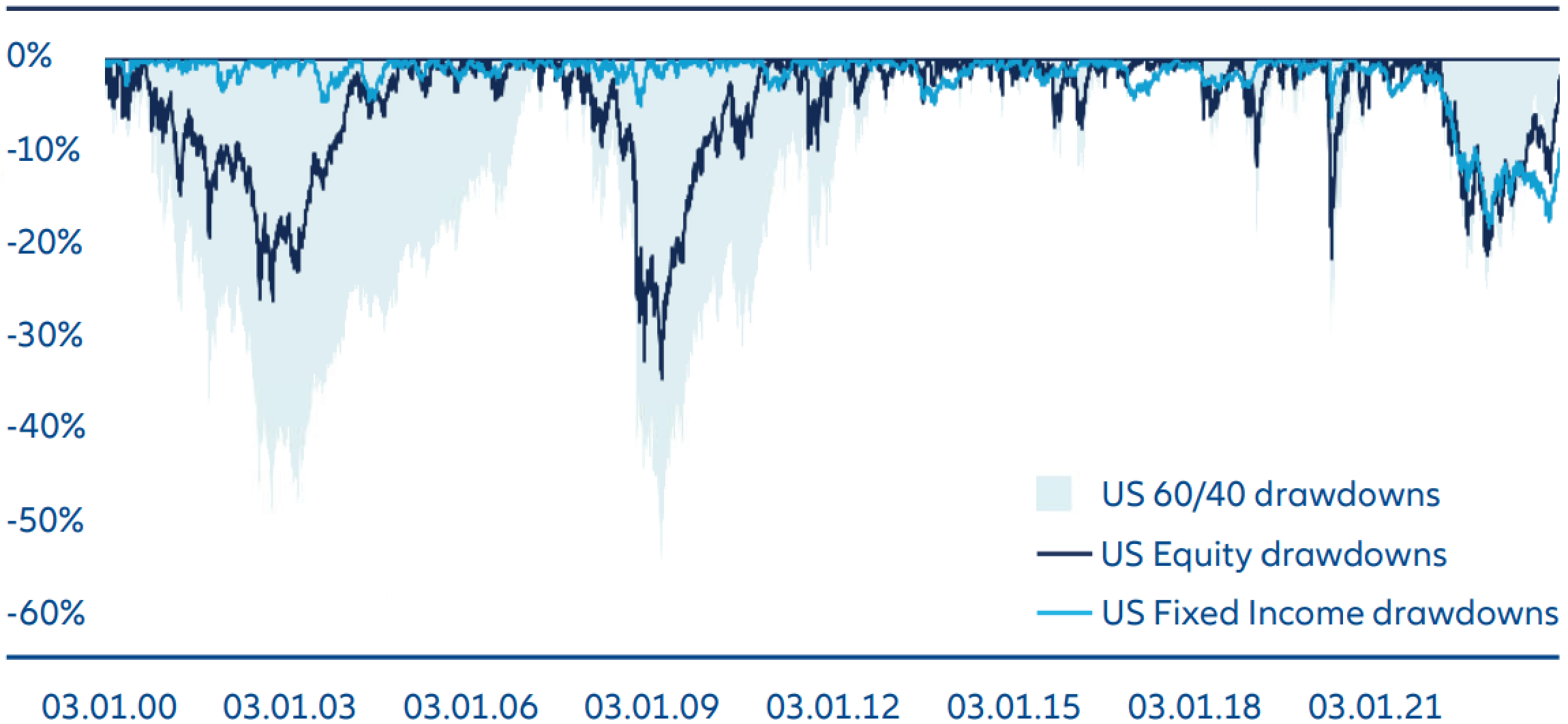

In 2022 this relationship broke down in spectacular fashion. As Exhibit 1 shows, 60:40 drawdowns since 2000 have largely been driven by equity performance, with 2022 being the notable exception as bonds performed just as badly.

This led to one of the worst ever years for 60:40 returns as a generic US-centric 60:40 portfolio lost 20% against cash. 60:40 fared better in 2023 as equities surged and bonds stabilised, but its poor relative performance across the last two years has led many commentators to declare the concept outdated or even “dead”.

Exhibit 1: Contribution of equities and bonds to US-centric 60:40 portfolio drawdowns

Source: Bloomberg, AllianzGI, 31 December 2023. Equities = MSCI USA total net return in USD, bonds = Bloomberg US Aggregate total return value in USD. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

Bonds: normal service resumes?

For the better part of a decade, one of the biggest concerns for investors has been ultra-low yields in fixed income markets, which have reduced the effectiveness of bonds as diversifiers.

However, the bond market sell-off across 2022 and 2023 has gone a long way to resolving this issue. When bond yields are higher, they provide a bigger cushion against both potential defaults and mark-to-market losses if bond prices drop.

With broad bond market yields now well above 4%, that starting yield means 60:40 portfolios are much less likely to suffer the sort of negative impact they got from bonds in 2022 going forward.

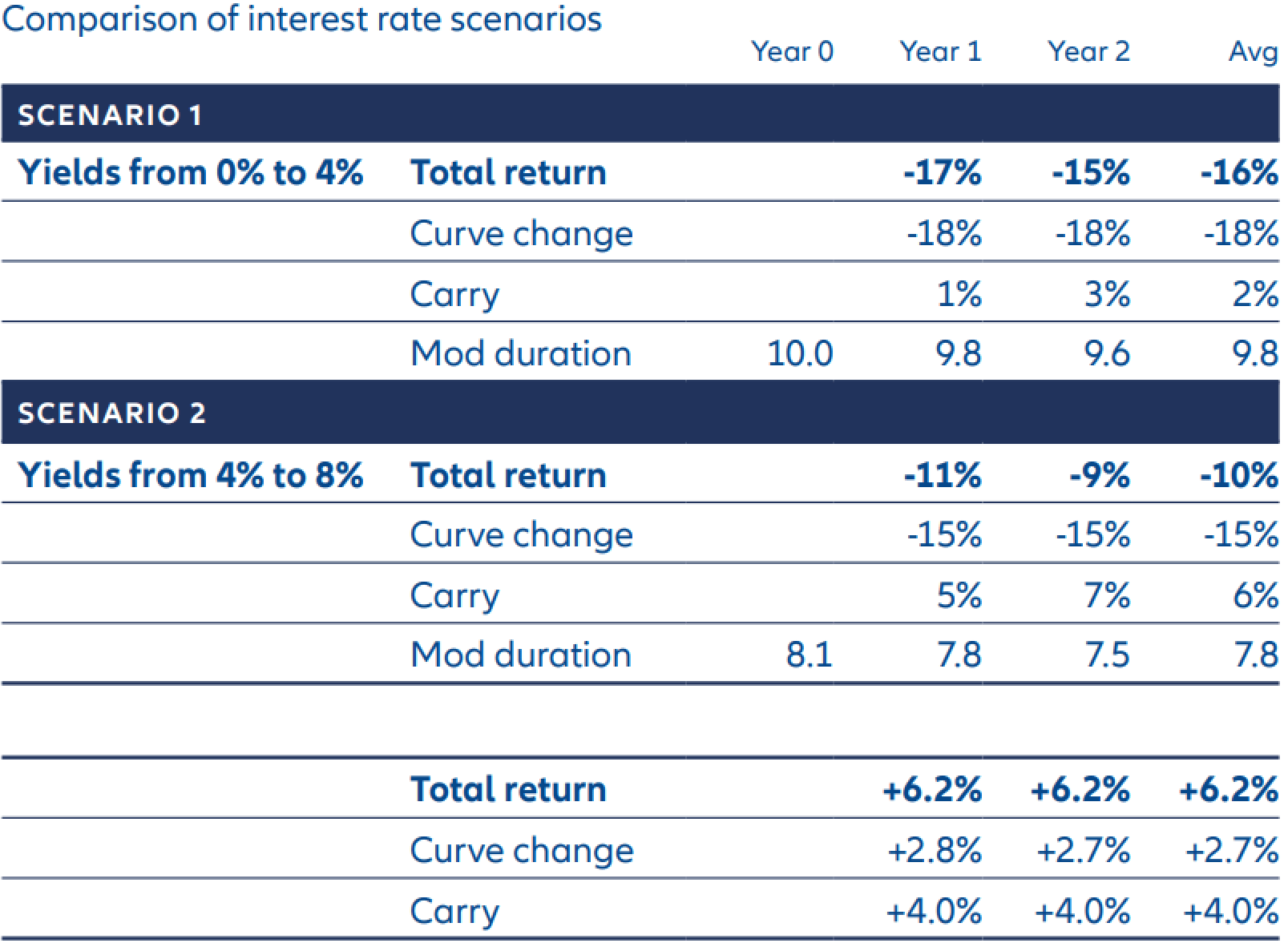

To illustrate this, we have simulated two scenarios.1 The first simulates a shift in bond yields from zero to 4% over the course of 24 months, which approximately represents what we have seen over the past two years. The second simulates a rise in bond yields from 4% to 8% over the same period. This aims to mimic a similarly difficult environment, but with the current yield level as a starting point.

Exhibit 2 shows the vastly different outcomes, with the 4% starting yield in the second scenario helping to preserve total return. This suggests that if markets were to experience the sharp rise in bond yields of the last two years all over again (an extreme and unlikely scenario), bonds would suffer only around two-thirds of the losses they did first time around.

In other words, today’s bond valuations appear far more favourable than they were at the end of 2021, and bonds are more likely to offer 60:40 portfolios a diversification benefit against poor equity performance.

Exhibit 2: Interest rate scenarios and corresponding bond returns

Source: AllianzGI, risklab, January 2024. The scenarios are based on parallel shifts of a flat yield curve. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

Equities: where is the upside?

Equities are historically the main driver of capital gains for 60:40 portfolios. Assessing potential equity returns is far from straightforward, but without diving into deeper economic analysis, one very useful metric is valuations. Valuations tend to have a more limited influence on outcomes during shorter investment horizons (for example six months), but over longer periods (for example 10 years) the entry point can have a strong bearing on subsequent returns.

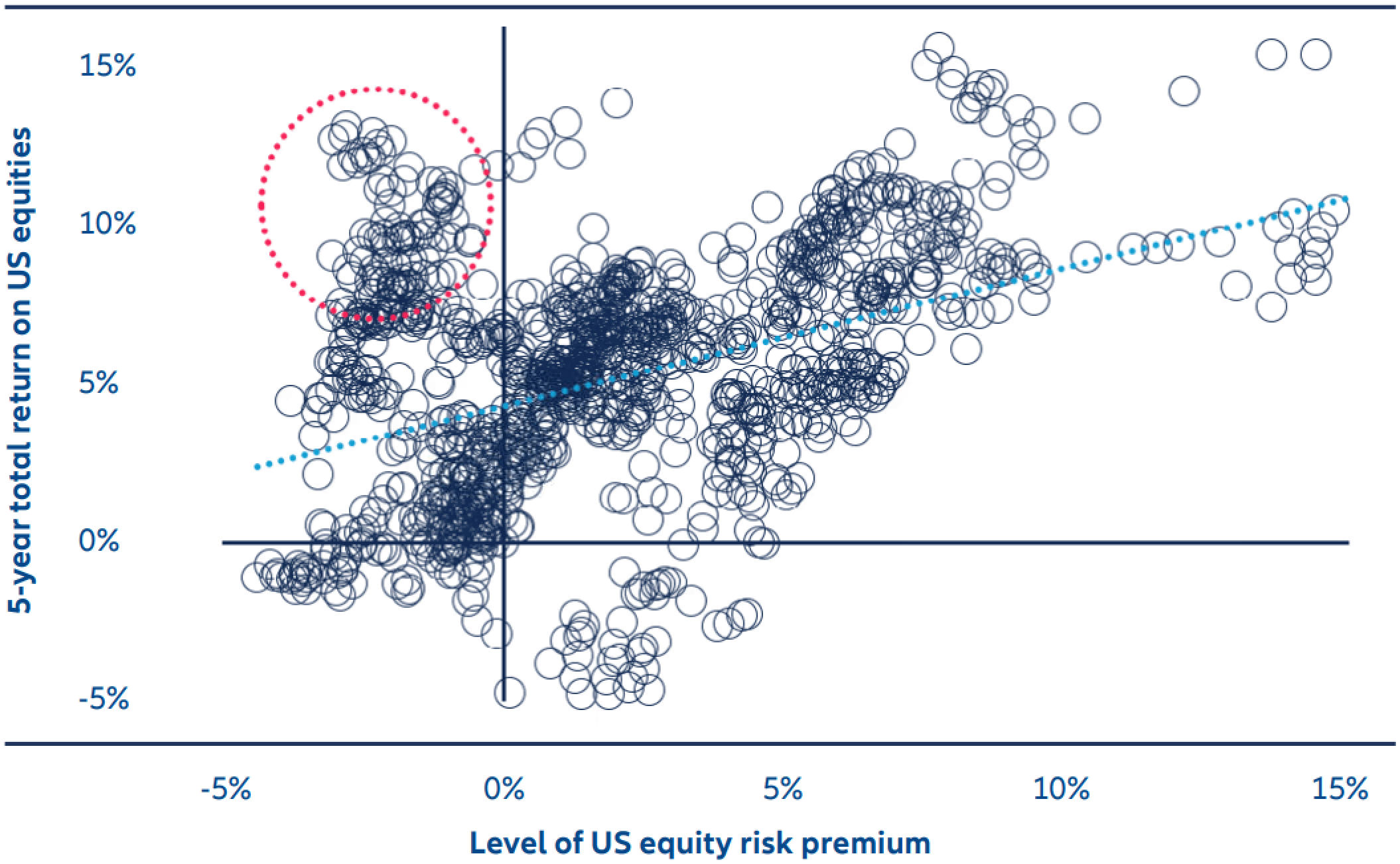

Importantly, the equity risk premium (expected excess return over holding US Treasuries) on US equities has recently turned negative. In other words, investors are asking for very little compensation in return for owning equity risk over 10-year US government bonds, which can indicate that equity valuations are stretched.

As Exhibit 3 shows, equity risk premium and subsequent fiveyear equity returns are positively correlated, so a negative equity risk premium may suggest more muted equity performance going forward.

Exhibit 3: US equity risk premium vs long-term US equity performance

Source: Robert J. Shiller, data used in “Irrational Exuberance” 2000, 2005, 2015, updated; http://www.econ.yale.edu/~shiller/data.htm, Jan 1920 – Sept 2023. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

That said, there are periods such as the dot com bubble in the late 1990s (the orange circle) where a negative equity risk premium is no barrier to healthy medium-term equity performance. This is no surprise: investor exuberance can chase valuations higher for long periods before a catalyst (such as a recession) provokes a correction.

The question, then, is whether today’s negative equity risk premium foretells a period of overexuberance like the late 1990s (where strong gains can still be had before any potential correction), or a period more like the 1970s where a negative equity risk premium accurately forecast a poor run for equities.

Clearly, some parallels can be drawn between today and the late 1990s, with recent gains driven by the “Magnificent Seven” technology stocks and excitement around the potential of artificial intelligence (AI). In addition, while a “soft landing” for the US has become the consensus view, we think a recession still looks the more likely outcome – another challenge to the medium-term equity outlook.

The outlook for 60:40 returns is challenging

If bond valuations look favourable but equity valuations less so, what does that mean for 60:40 portfolios?

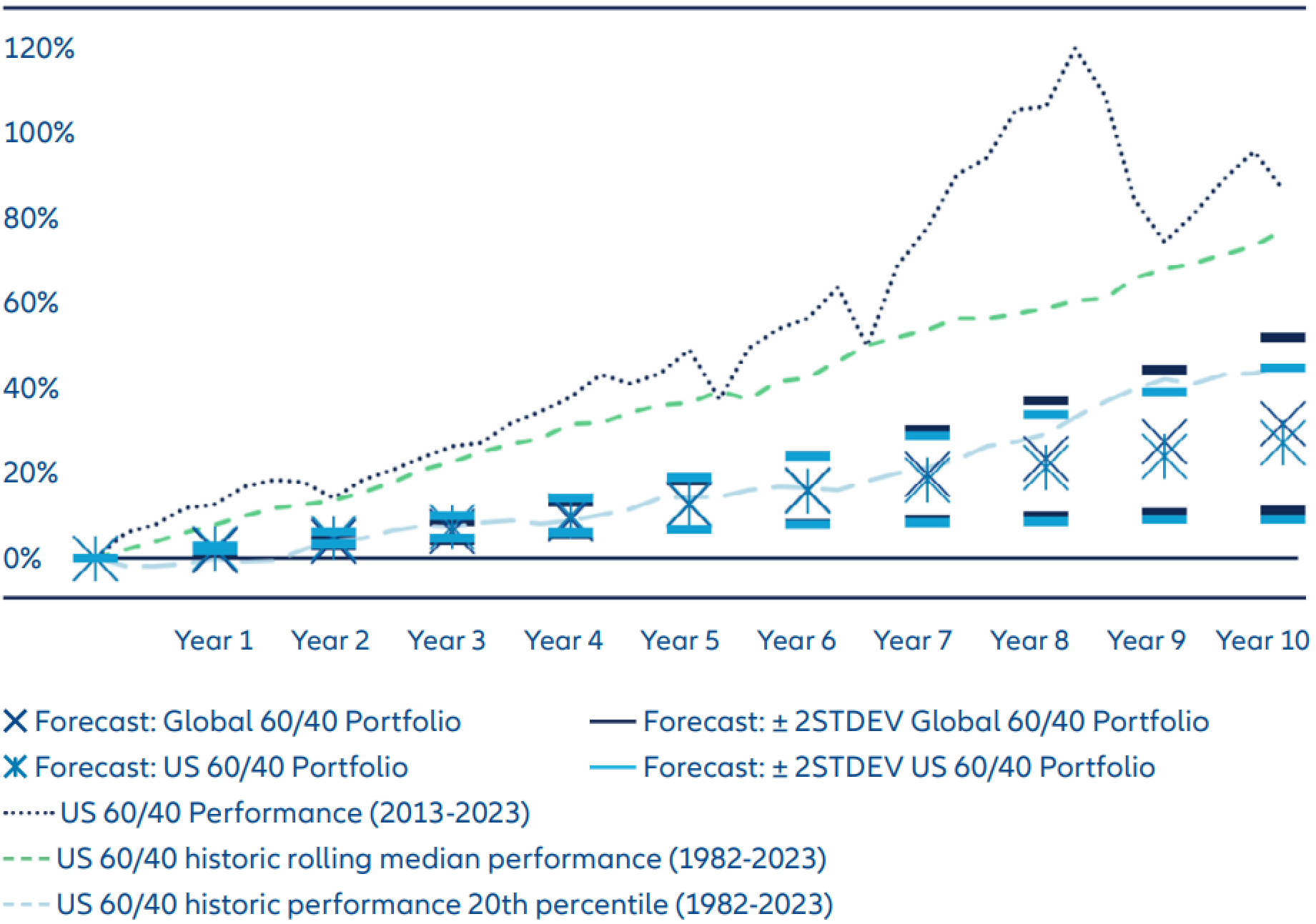

Using AllianzGI’s proprietary longterm forecasting framework, we simulated returns for a US-centric 60:40 portfolio and a global 60:40 portfolio more relevant for European investors.2 As Exhibit 4 shows, the results suggest very muted returns for the concept going forward.

The US-centric portfolio is expected to deliver an annualised total return of around 6.5% over the next 10 years, with the global portfolio slightly better at 6.8%.

Assuming an average US interest rate of 4.1% over that period, that would leave 60:40 with limited excess returns over cash, nowhere near what investors have enjoyed in the last 10 years (the blue dotted line) or the median rolling 10-year performance over the past three decades (the orange dashed line). In fact, the returns we project for the next 10 years are roughly in the bottom 20% of 60:40 outcomes over the past 20 years.

Exhibit 4: Simulation excess returns over USD cash for US centric and global 60:40 portfolios

Source: AllianzGI, risklab, January 2024. Global 60:40 portfolio denominated in USD with fixed income allocations FX hedged. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

Medium-term 60:40 outlook calls for active management

Given the subdued outlook for a passive 60:40 asset allocation, we believe active multi asset strategies are better placed to achieve meaningful excess returns in the medium-term. We think other allocations (such as 30:70 in favour of bonds) and the addition of less traditional asset classes (such as commodities and private markets) could be more appropriate for the current environment.

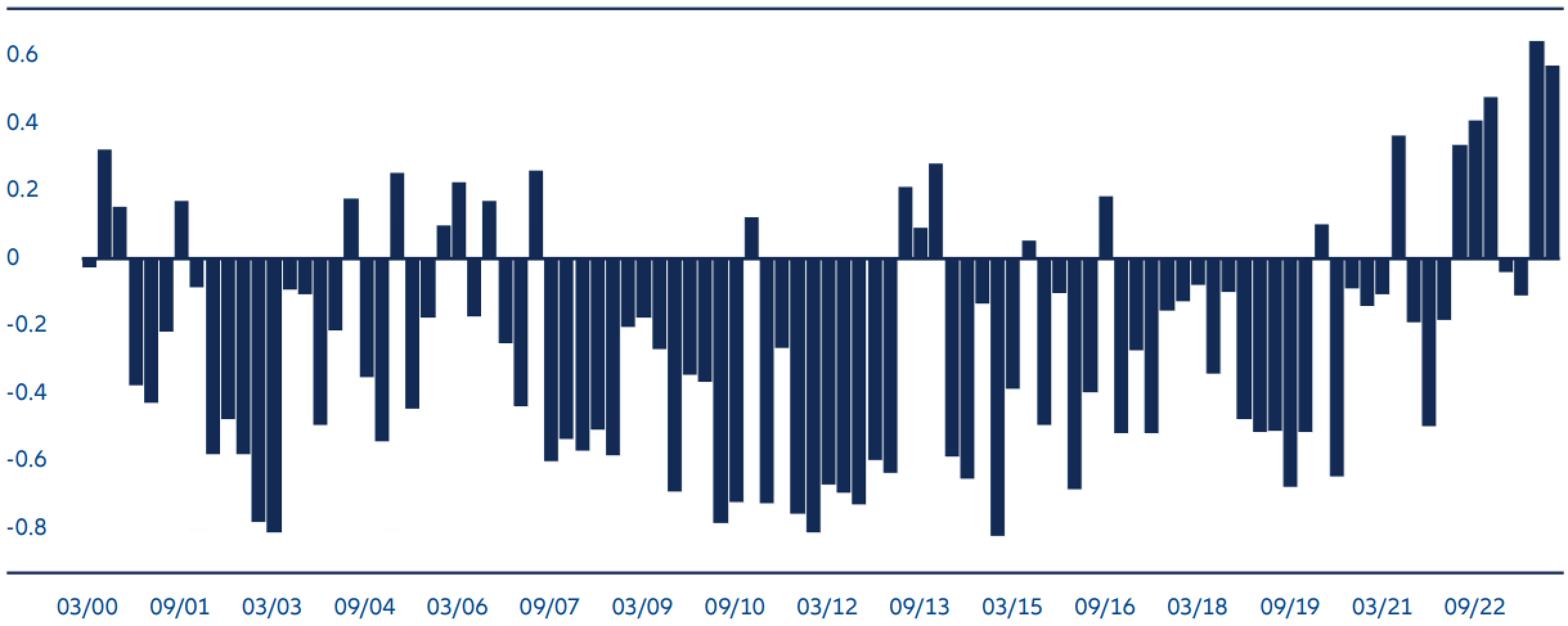

As Exhibit 5 shows, since 2000 the vast majority of quarters have seen negatively correlated returns between bonds and equities, which delivered great diversification benefits for multi asset portfolios (much like they did for 60:40). But the bull markets of 2021 and the sharp market corrections of 2022 featured strong positive correlations, which made finding opportunities for absolute returns a major challenge even for very active and flexible multi asset investors.

Exhibit 5: Quarterly correlations of US equity and bond returns

Source: Bloomberg, AllianzGI, 31 December 2023; Past performance, or any prediction, projection or forecast, is not indicative of future performance. Stocks represented by S&P 500 index, bonds by 10-year US Treasury future. Correlation calculated using the daily returns occurring in each quarter.

Naturally, multi asset investors have been buoyed by the recent return of negative correlations. But while the reset in bonds bodes well for diversification benefits currently, it is hard to predict how correlations will behave going forward. Historically there have been many instances where equity-bond correlations have gyrated wildly, and there have also been periods when correlations have remained positive for far longer than a few quarters, such as the 1970s and 1990s.

However, there is another recent development that in our view strongly favours active multi asset strategies. As we argued in a recent paper, the performance of major global economies is beginning to diverge meaningfully for the first time in many years.3 As business cycles in different regions become more desynchronised, we expect to see increased performance dispersion between asset classes and sectors.

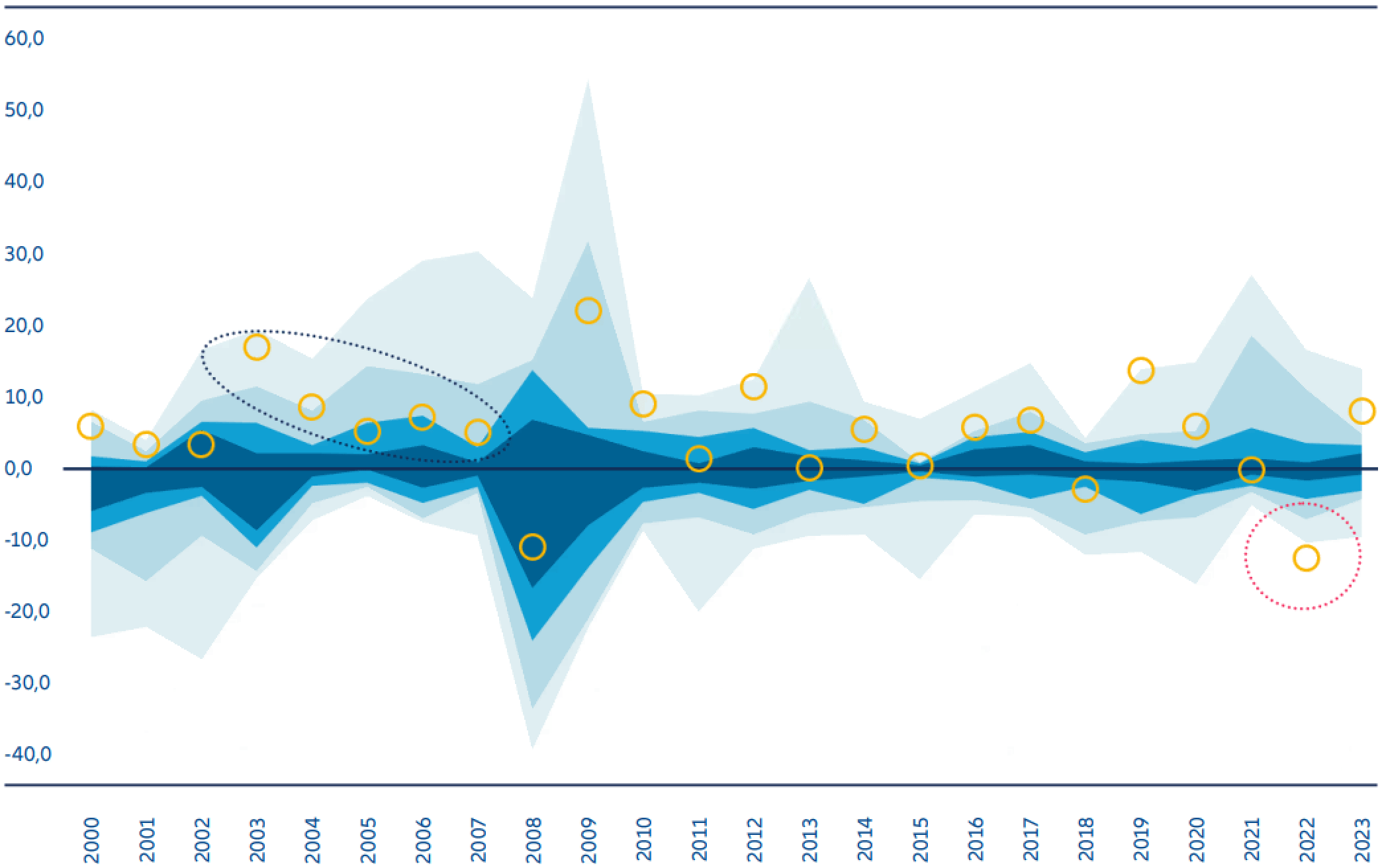

As Exhibit 6 shows, asset performance dispersion (the blue envelopes) is widening again having narrowed significantly during the “Great Moderation” in the wake of the global financial crisis. This creates more potential opportunities for generating alpha from active asset allocation. Indeed, if markets were to enter another period of sustained positive equity-bond correlation, active multi asset strategies would have to rely solely on asset class dispersion as a driver of returns.

Exhibit 6: Dispersion in asset class returns over time

Source: Bloomberg, Datastream, AllianzGI, 31 December 2023. Local returns; Asset Classes: US EQU, EMU EQU, JAP EQU, UK EQU, EM EQU, CHI EQU, US SOV, EMU SO, JAP SOV, GER SO, US IG, US HY, EMU IG, EMU HY, REITS, COMM, GOLD, US I/L, EM HC, EM LOC, US CASH, EMU CASH, UK SOV, EM IG, EM HY. Annual return observations for various asset classes were transferred into percentiles whereby the average return was rebased to zero to be able to highlight the range and how it changes over time. The orange circles show the average return across all assets in every given year. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

Active allocation can target greater upside

Overall, we think it is too simplistic to say that the 60:40 portfolio is outdated or “dead”. Rather, with the outlook for a static 60:40 portfolio looking challenging, we believe the active management multi asset strategies can add around that baseline will be important in delivering excess returns for investors in the medium-term.

Bond valuations look more favourable for 60:40 today, but equity valuations (at least in the US) may be too stretched to drive meaningful excess returns from here – in other words, the downside is limited but so is the upside.

With growing economic divergence likely to bring growing asset performance dispersion and more opportunities for alpha, active multi asset strategies can help target those opportunities.

1 The hypothetical performance and simulations shown are for illustrative purposes only and do not represent actual performance; they do not predict future returns. Please see important information regarding back-testings and hypothetical or simulated performance data at the end of the article. Please refer to the disclaimer at the end of the article.

2 The hypothetical performance and simulations shown are for illustrative purposes only and do not represent actual performance; they do not predict future returns. Please see important information regarding back-testings and hypothetical or simulated performance data at the end of the article. Please refer to the disclaimer at the end of the article.

3 Divergence is back. Time for multi asset? | Allianz Global Investors (allianzgi.com)