Land-based Aquaculture: The Answer to Fish- Farming’s Existential Crisis?

Summary

Rising demand for healthy, high-end protein is fuelling a surge in fish consumption. While farmed fish can meet this demand and one day potentially offset the need to catch wild fish from the oceans, salmon farming, still has a number of major sustainability challenges like parasites and organic waste that threaten entire ecosystems. Find out how land-based aquaculture can present an opportunity to meet rising demand, and resolve environmental problems.

Summary

- Rising demand for healthy, high-end protein is fuelling a surge in fish consumption

- Farmed fish can meet this demand and one day potentially offset the need to catch wild fish from the oceans

- But salmon farming, in particular, still has a number of major sustainability challenges like parasites and organic waste that threaten entire ecosystems

- Land-based aquaculture presents an opportunity to meet rising demand, and resolve environmental problems

Eating fish often feels like we are making a better choice. Typically, fish has less saturated fat than meat, and a wider range of beneficial compounds like omega 3 oils, said to reduce cardiovascular disease. In a restaurant, we might console ourselves that the higher price tag means we are tucking into a dish freshly caught and prepared locally. The more sustainability-minded among us might also consider the fish’s favourable carbon footprint compared to a similar portion of beef, pork or chicken.

On the face of it, fish is indeed superior to meat from a sustainability perspective. In the wild, herbivorous fish consume algae, and are in turn eaten by their carnivorous counterparts. The process requires no deforestation for grazing, no otherwise productive land is given over to producing feedstock, and no chemical interventions are required in order to grow or maintain supply. However, harvesting fish at an industrial scale has clear environmental consequences. These range from overfishing, to ecosystem destruction and of course, plastic pollution from fishing equipment. According to Greenpeace, socalled ‘Ghost Gear’ accounts for 10% of all plastic ocean pollution.1

How fish farming addresses the shortcomings of industrial fisheries

Fish farming or ‘aquaculture’ presents solutions to some of these problems. The most commonly farmed fish are carp and tilapia, both grown in fresh water, inland. Salmon, the most valuable aquaculture species, are farmed in coastal marine waters. As with wild fish, no forests have been lost. And, while grain is fed to farmed fish, the conversion of those grains into proteins is more than 5X more efficient than beef.2 This superior ‘Feed Conversion Ratio’ means far fewer resources are used in the production of fish vs. beef. Consequently, the advantages are economic as well as environmental.

The consumption of fish has accordingly skyrocketed. Partly, this is due to a surging global population, with the world expected to reach 9 billion inhabitants by 2050. However, according to the United Nations Food and Agriculture Organisation (FAO), the global consumption of fish has increased at twice the rate of population growth since 1961, at 3.1%3 p.a. Absolute demand for protein has thus been reinforced by rising average incomes, with perceptions of health and status meaning that fish consumption has outpaced the growth of all other animal protein foods.4

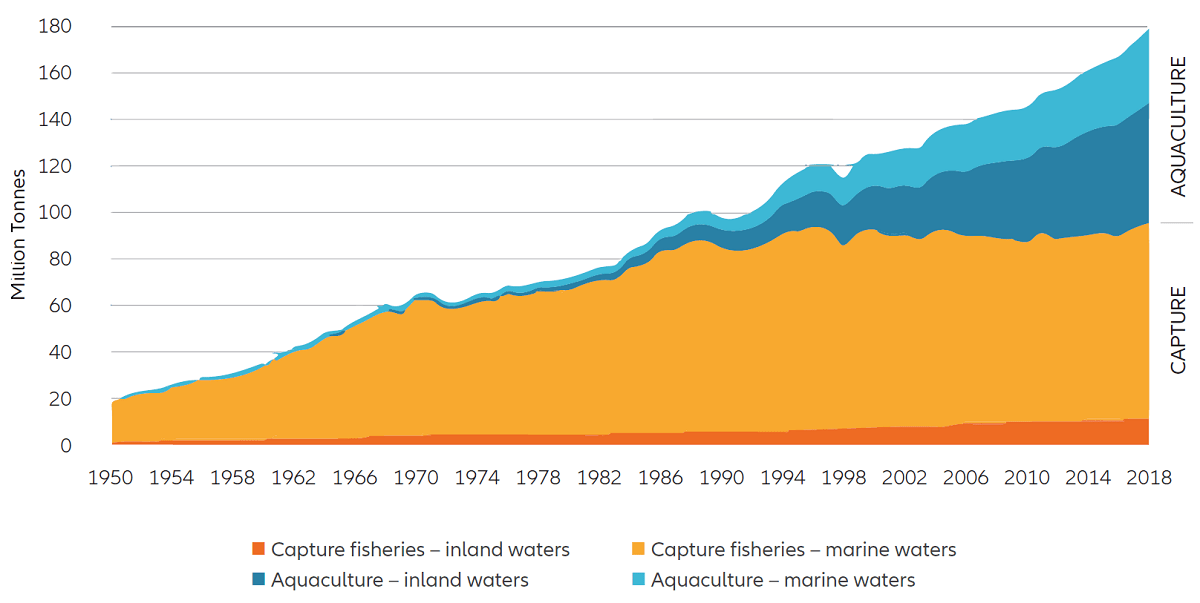

Aquaculture has stepped in to meet this demand. As the FAO chart below shows, the volume of fish caught by traditional methods has flatlined since the mid-1990s, while fish farms have boomed. Yet despite its advantages compared to both catching wild fish and meat farming, aquaculture is not without its issues.

Salmon makes up around 5% of all farmed fish consumed globally, equivalent to 2.4 million tonnes each year.5 By revenue, salmon and related species, account for almost 20% of the entire global fish trade.6 The sheer scale of this particular subsector has therefore made it impossible to ignore.

The major challenges that salmon farming faces

Farming salmon creates three main problems. Chief among these are parasitic sea lice. These crustaceans are transferred from wild fish onto healthy salmon, feeding on their skin and blood. As with lice in human populations, high density fish farms make for rampant infestations, and in extreme cases mass mortality.7

In trying to solve this however, farms have created a new setback: treating sea lice requires the use of harsh chemicals. Over time, the lice have evolved to build up a resistance, necessitating the use of ever harsher treatments. These chemicals are then combined with antibiotics to treat other diseases, impacting the health of both the farmed salmon and – as they wash out to sea – the surrounding ecology.

This relationship between density and surroundings is also at the heart of issue number three: effluent. Like cows, sheep or any farmed animal, salmon generate excrement. Without proper disposal, the organic matter can build up to levels which destabilise local ecosystems – a process known as eutrophication. As nutrient-rich effluent collects, algae build up and decompose, acidifying seawater and ultimately lowering oxygen content. The result is an acidic, low oxygen environment unsuitable for marine life.

A tightening regulatory framework

These consequences have attracted the attention of national and international regulators:

- Norway, as one of the earliest countries to develop salmon farming at an industrial scale, introduced a dedicated Aquaculture Act in 2005, specifically designed to promote the sector’s “sustainable development”.8

- The United Nations has since developed clear regulatory frameworks for the management of environmental issues in aquaculture.9 And, in December 2020, Canada’s Fisheries Minister chose not to renew the licenses of 19 salmon farms, explicitly citing their harmful impact on local species.

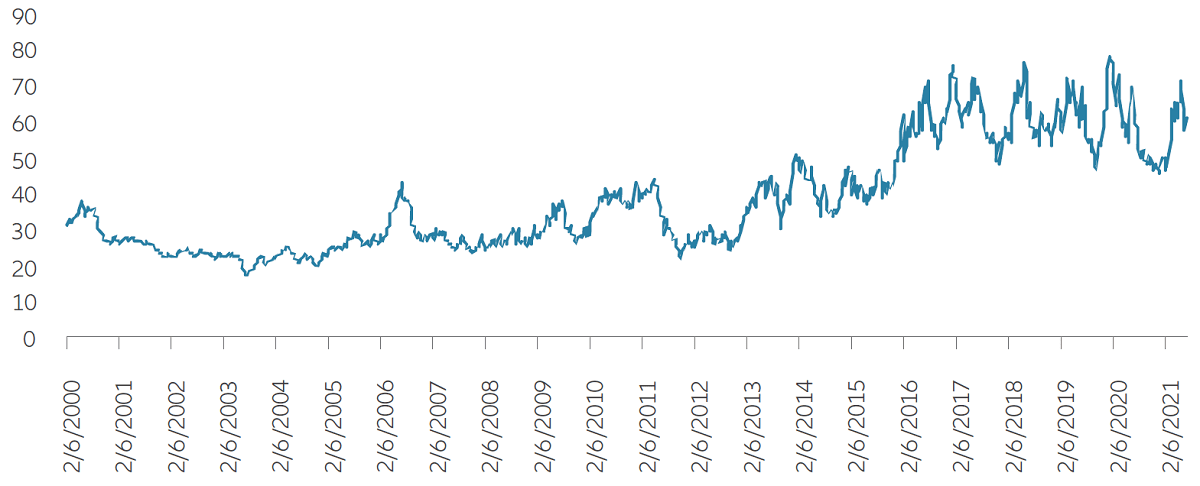

A combination of adverse environmental impact and ever-tighter regulation is thus helping to create an existential crisis for the industry. On the one hand, surging sea lice infestations are leading to fewer fish successfully making it out of each farm. At the same time, operators face tighter restrictions and increased costs as a result. Even as global demand for salmon surges, supply is being constrained by the industry’s very existence. The result has been a steady rise in global salmon prices since 2004, with particular volatility over the last five years.

Norway Salmon Exports Fresh Price (NOK/kg)

An innovative solution: land-based salmon farming

Land-based salmon farming offers a potential resolution. Adult salmon are cold water, marine fish, typically found in Scottish lochs or Norwegian fjords. As such, salmon farms have historically needed to be in locations as similar as possible to the fishes’ natural habitat, with all the associated fallout. Once caught, the fish must be frozen and transported, often by air so as to prevent spoilage, to their eventual destination for consumption. An innovative technology known as Recirculating Aquaculture Systems (RAS) means this is no longer the case.

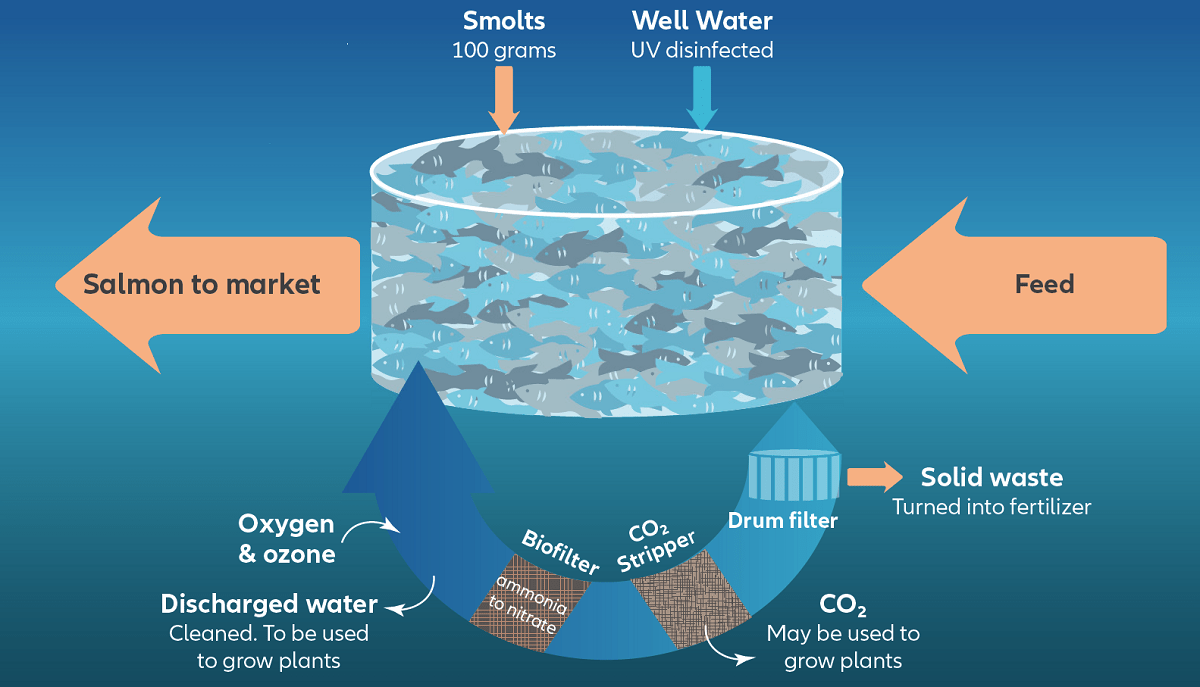

RAS allows salmon to be kept in large indoor tanks, with every element monitored and controlled. This ranges from temperature, to lighting, waste products and even artificial currents. From an environmental perspective, the closed-loop system means effluent can be removed, treated, and disposed of safely, while also eliminating any exposure to seaborne parasites or disease. Lastly, the water itself is purified and reused. While the technology itself isn’t new, it is only the combination of rising prices and industry pressures which have conspired to make it commercially viable.

Key enablers for sustainable land-based salmon farming solutions

We look for companies that are providing long-term, sustainable solutions to the planet’s ever-growing demand for nutrition. For example, a Norwegian company has indoor farms in two of the world’s largest salmon markets. Sites in Denmark and Florida not only address the industry’s environmental challenges directly, but also bring products closer to the point of consumption. This means products are fresher, while transportation costs and associated emissions are lower.

These environmental benefits go hand in hand with financial advantages. The RAS closed loop naturally lowers the incidence of parasites and disease, in turn reducing fish wastage and the need for costly chemical treatments. At the same time, retaining effluent within the RAS creates a smaller environmental footprint, minimising the likelihood of costly remediation at the hands of regulators. Indeed, far from a potential cost, effluent can become a new revenue stream. Properly treated, fish excrement can be used as a fertiliser, producing income and further improving agriculture’s contribution to the environment.

Firms focusing on the concerns of environmentally conscious consumers

Looking forward, the economics of salmon supply and demand are expected to continue as global populations and average incomes rise. And while the upfront costs and technical challenges of land-based farming may be higher, the daily operational expenses are lower thanks to automation and lower mortality rates from disease. Consequently, demand should be further bolstered by increasingly environmentally conscious consumers. A Florida-based facility currently produces 9,500 tonnes of salmon each year, and plans to deliver 23 times that amount by 2031, equal to 41% of current US annual salmon consumption.

An attractive business model thus demonstrates how addressing a sustainability challenge directly can present meaningful commercial opportunities. More broadly, it encapsulates how an industry upon which we are increasingly reliant, is being forced to innovate for its longer-term survival. As investors, we are uniquely placed to help shape these transitions for the benefit of our clients and society as a whole.

1 https://www.greenpeace.de/sites/www.greenpeace.de/files/publications/20190611-greenpeace-report-ghost-fishing-ghost-gear-deutsch.pdf

2 https://web.archive.org/web/20160616072736/http://lib.dr.iastate.edu/cgi/viewcontent.cgi?article=1027&context=driftlessconference

3 The State of World Fisheries & Aquaculture 2020, UN Food & Agriculture Organisation http://www.fao.org/3/ca9229en/ca9229en.pdf p.3

4 Ibid p.3

5 Ibid p.46

6 Ibid p.100

7 https://www.nhm.ac.uk/discover/the-problem-of-sea-lice-in-salmon-farms.html

8 http://www.fao.org/fishery/legalframework/nalo_norway/en

9 http://www.fao.org/3/bb124e/bb124e.pdf

1722226

Summary

With low rates to the left of them, inflation concerns to the right, investors may feel stuck in the middle as they seek to protect and enhance their savings. How should they rethink portfolios to keep pace?

Key takeaways

|

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).