Active is: Challenging convention

Brexit done, Covid continues: what’s next for the UK?

Summary

The UK market has been deeply out of favour for some time now. The agreement of a UK-EU trade deal marks an essential step towards making the UK “investable” again but several other factors – not least the ongoing Covid-19 pandemic – will continue to weigh on sentiment.

Key takeaways

|

The trade deal with the European Union removes some of the uncertainty facing the UK, even though the agreement is relatively “skeletal” and includes little to address the service sector. It closely resembles what was once considered a “hard Brexit”. Moreover, the ongoing Covid-19 crisis and a third national lockdown will continue to depress the UK economy.

However, following a year in which the UK’s FTSE 100 index fell more than 14% – its worst performance since the financial crisis – the agreement with the EU removes one source of uncertainty that has weighed on the UK market since the Brexit referendum in 2016. While the deal is unlikely to transform sentiment towards the UK overnight, investors may begin to see buying opportunities in an equity market that is widely undervalued. Moreover, the prospect of mass vaccination against Covid-19 allows investors to look beyond the pandemic, and we expect the UK economy to return to growth in the second half of 2021:

- Sectors that were hit hard by the pandemic – such as hotels, food service, transport, leisure and arts – will likely see improved annual growth rates after the first quarter of 2021, particularly relative to how they performed in 2020.

- The logistics sector is expected to expand forcefully, driven by the acceleration of e-commerce as people stayed at home during the pandemic.

- The construction sector should profit from fiscal measures to boost infrastructure investment as the UK government puts a “green recovery” at the heart of its post-Covid vision.

Beyond the ongoing pandemic, the UK stockmarket has structural issues to deal with – specifically the sector mix of its industries. This is a market with fewer technology- and growth-centred firms and more “old economy” and structurally challenged sectors, such as energy and banking. This limits the upside, but even allowing for this, the UK appears very cheap.

The other factor to consider is that the UK equity market is different from the UK economy. Many of the largest UK corporations are really multinationals that just happen to be listed in the UK – they get a large percentage of their sales and profits from overseas. This means they benefit when sterling is weaker because their overseas revenues are worth more.

While sterling enjoyed a rally in the immediate aftermath of the Brexit deal’s announcement, we do not expect it to strengthen significantly from here. And, with the worsening Covid-19 situation in the UK, we expect the Bank of England to continue to pursue quantitative easing – likely by buying UK gilts – and dip into negative interest rate territory only as a last resort.

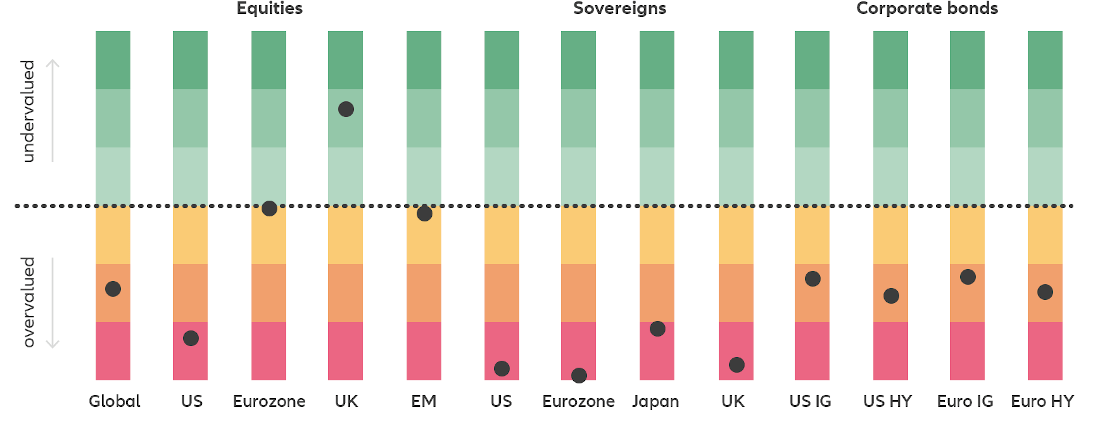

UK equities appear undervalued – unlike almost all other major asset classes

Source: Allianz Global Investors, Bloomberg, Datastream. Data as at November 2020. Valuation score = current score relative to historical distribution of scores. Equity valuation based on Shiller-PE, price/book, 12-month forward PE. Sovereign valuation based on 10-year real interest rate and term premium. Corporate-bond valuation based on implicit default probability and respective sovereign valuation.

How Allianz Global Investors is prepared

Given the UK’s challenges, we expect higher short-term volatility. It will be critical to be more selective to take advantage of the right opportunities. As an active manager, we will continue to seek to help our clients by taking an active investment approach in UK bonds as well as UK equities.

The future shape of the regulatory environment in the UK isn’t yet clear, as the new trade agreement has little to say on financial services. While there will undoubtably be some divergence between the UK and the EU, it’s unlikely there will be a “bonfire of regulations”.

1451528

Active is: Investing with conviction

Expect US market momentum to continue – but watch for inflation

Summary

Investors can start the year with a positive outlook for the markets thanks to three drivers: higher spending from the new Biden administration, wider uptake of vaccines and continued Fed support. Consider layering in exposure to value and cyclical stocks, small cap and international assets – but keep an eye on rising inflation.

Key takeaways

|

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).