The China Briefing

Returning to normal

Please find below our latest thoughts on China:

- It has been an encouraging start to the New Year for China equities, following through on the momentum from the end of 2022.

- Offshore equities have been particularly strong, up 10% already this year. China A-shares are up around 6% (USD, 11 January)1 .

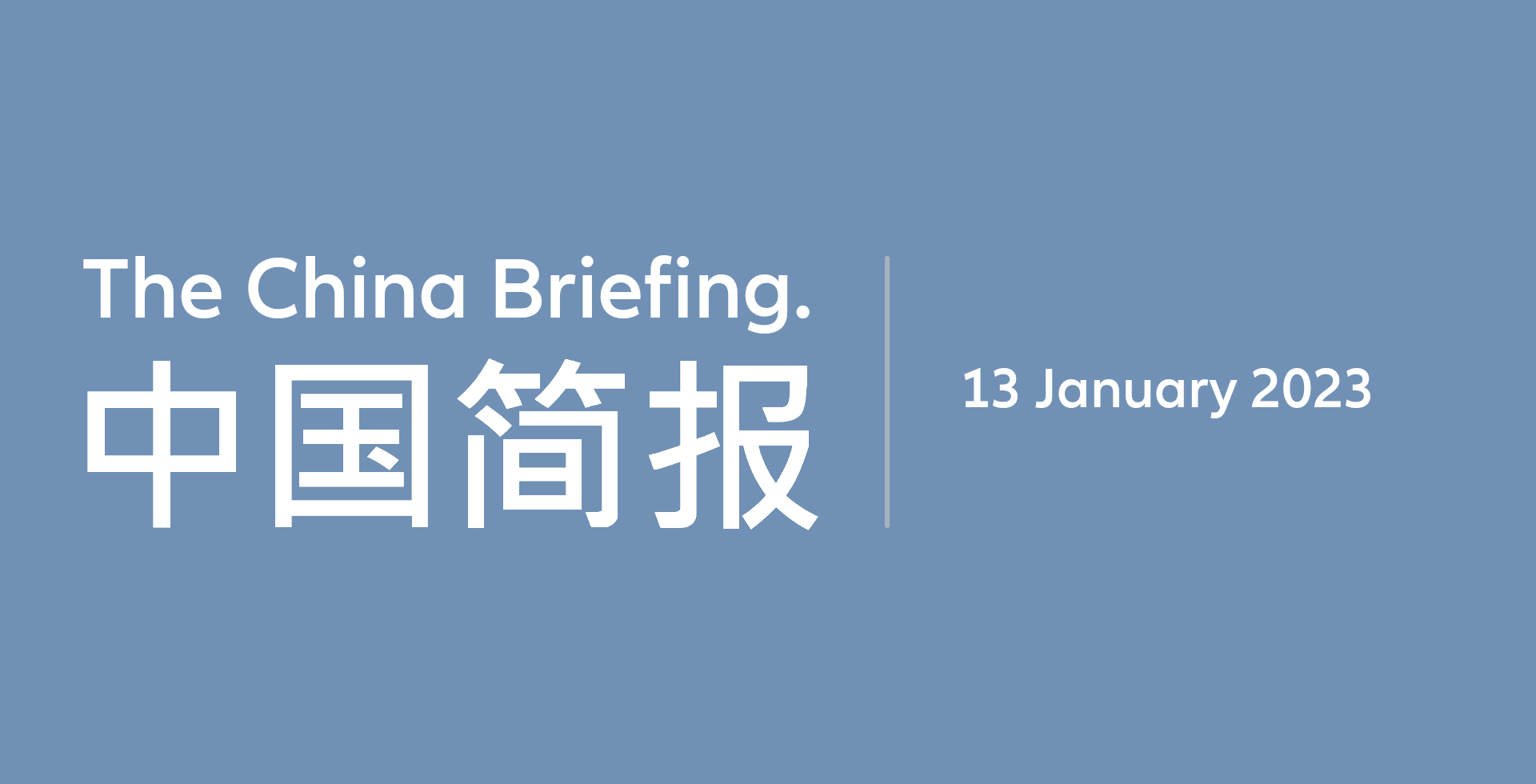

- The strength of the rally means that, since the beginning of last year, the total return from MSCI China is now ahead of the S&P 5002 (see Chart 1).

Chart 1: MSCI China, MSCI China A Onshore, S&P 500 Indexes - returns since beginning of 2022 (USD, rebased to 100)

Source: Bloomberg, Allianz Global Investors as at January 11, 2023

- The reason for offshore stocks performing so well is partly because they previously fell so much further. Hedge funds used the large and liquid internet names in particular as a proxy to short China. And it is these names which have also led the rebound.

- The abrupt change in Covid policy has been the primary catalyst for the market turnaround. Within a matter of weeks, China has dismantled large swathes of the zero-Covid apparatus.

- The result has been a huge surge in Covid cases, estimated at 250 million people in the first 20 days of December3.

- With many Chinese households worried about infection, the initial reaction was extreme caution. In the big cities there were days when major roads – usually jammed bumper to bumper – were eerily deserted.

- But just as the initial spread of Covid was chaotic, now there are signs of an equally rapid return to normality. It seems that most places, including rural areas, may already have passed their infection peaks.

- An estimate by search engine Baidu, based on the frequency of keyword searches for terms like “fever”, suggests that almost all Chinese cities had seen the peak of infections by the end of December4.

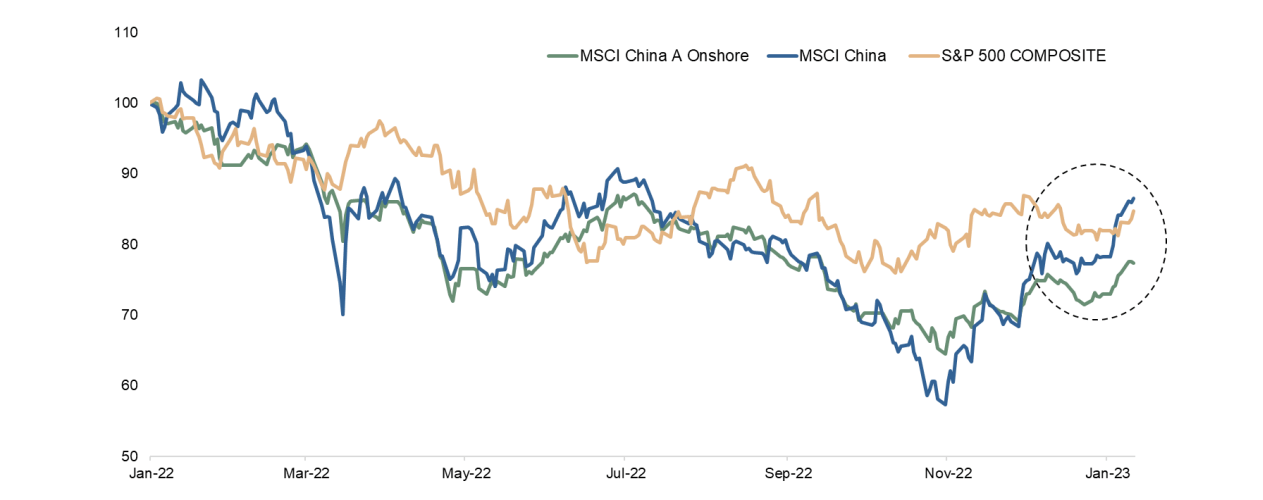

- High-frequency data, such as daily road traffic volume, has also recovered (see Chart 2). Within a few months, Chinese tourists are likely to be back on the streets of Paris, Milan and London.

Chart 2: Daily road congestion indexes of key cities in China

Source: Wind, Allianz Global Investors, as of January 10, 2023. Using 2019 data as baseline (1.0)

- Our take is that China’s economic recovery may well start to pick up steam more quickly than some have expected, probably after the end of the upcoming Lunar New Year holiday.

- This economic rebound is also aided by government policy that is now firmly focused on supporting growth. There is a good chance that GDP will expand by 5% or more in 2023.

- One of the biggest factors driving the recovery will be the property sector. Rhetorically, the regulatory stance on property had already shifted to a more supportive position back in late 2021.

- But throughout most of last year, regulators had been reluctant to match their rhetoric with material support, due to worries about excessive leverage and moral hazard.

- This finally changed in November. In response to the worsening credit crunch, a series of policy measures clearly demonstrated that regulators wanted a step change in support for both property developers and property buyers.

- Most recently there is talk of relaxing restrictions on developer borrowing, which effectively dials back the stringent “three red lines” policy. There have already been announcements on the extension of debt repayment periods, additional bank lending, resumption of equity market financing, and the expansion of government bond guarantees.

- With the average mortgage rate in China at a historical low level (4.34%) and consumer confidence set to recover from the lifting of lockdowns, the stage is set for a rebound in property activity5.

- One further change to government policy recently has been the vote of confidence for private enterprise.

- A day after the closely-watched Central Economic Work Conference (CEWC) in December, the People’s Daily – the official newspaper of the Communist Party – ran a front page article titled, “The key is to boost confidence”.

- A quote in the article was from President Xi: “I am a consistent supporter of private companies and had worked through places with relatively developed private economies.”

- It is early days, but recent actions have been encouraging. As well as support for property developers, there have notably been other announcements relating to internet platforms.

- These include the first approvals for new foreign online games to be released in China since June 2021. And Ant Group has been given approval for a RMB 10.5 billion (USD 1.5 billion) capital raise. Taken as a sign that the regulatory crackdown is over, this has also contributed to the strong recovery in offshore markets.

- Of course, there are still challenges to navigate – there is a tricky policy balance between providing support while not further inflating the national debt or risking the sort of inflationary surge seen elsewhere.

- But for the time being, it looks like the economic and profit cycle in China is set to turn up. Combined with reasonable valuations (MSCI China A Onshore forward PE 12.2x, MSCI China 11.5x), we see encouraging signs that the headwinds for China equities are starting to clear6.

- Finally, a reminder that with the upcoming Chinese New Year holiday, the Shanghai and Shenzhen stock exchanges will be closed from Monday 23 to Friday 27 January. The Hong Kong market is closed from Monday 23 to Wednesday 25 January.

1 Bloomberg, 11 January 2023

2 Bloomberg, 11 January 2023

3 Bloomberg, 23 January 2023

4 Gavekal, 6 January 2023

5 Gavekal, 10 January 2023

6 Bloomberg, 11 January 2023