Summary

Brexit negotiations will be the biggest factor in whether the Bank of England changes its monetary policy – which means the BoE will likely be driven by politics for the next few months. Don’t expect a rate hike at the central bank’s November meeting, but inflation, the labour market and the UK budget could all affect the BoE’s future decisions.

Key takeaways

|

In the last few months, the market concluded that the Bank of England will raise rates by 25 basis points by August 2019, and this rate rise was fully priced in. But we believe it’s highly unlikely that it will happen at the BoE’s next meeting on 1 November.

The Brexit deal is the single most powerful determining factor for the Bank of England in whether or not it will change its monetary policy. Brexit may result in a boost to the UK economy if any pent-up investment demand resurfaces in 2019. However, a hard Brexit could prompt the BoE to cut interest rates and possibly even restart quantitative easing. Either way, the UK’s central bank appears likely to remain a hostage to politics over the next few months.

Inflation could be heading down

The market is always on the alert when the BoE is set to release its quarterly inflation report, and the next one is timed for publication on 1 November. Investors will be watching for any revisions to the bank’s inflation and growth outlook, but we don’t expect significant market movements.

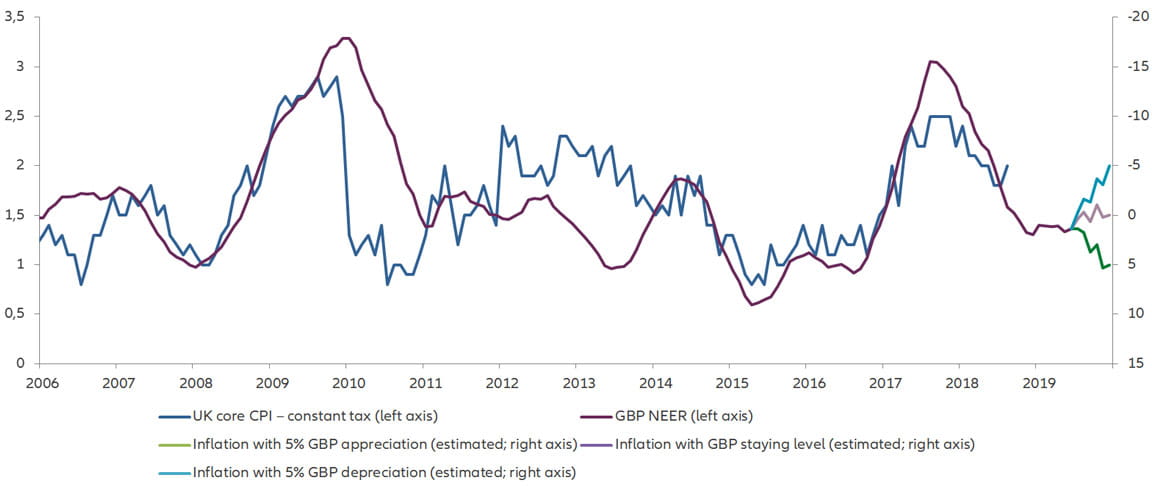

For the last 10 to 15 years, UK inflation has been almost entirely driven by the British pound sterling’s movements in the prior nine months. For example, inflation saw a huge jump in 2017 because sterling fell sharply after the June 2016 Brexit referendum. It takes a surprisingly long time for the inflationary effects of currency devaluation to come out of the year-on-year inflation numbers, but most of the 2016 declines in sterling have now disappeared from the inflation numbers.

However, the pound actually appreciated in the last year, which means that inflation is likely to move steadily downwards over the coming months. After that, where inflation goes will depend on what Brexit deal is reached.

Inflation should keep falling, although its future path depends upon sterling

Source: Bloomberg and AllianzGI calculations. Data as at 30 Sept 2018. GBP NEER = British pound sterling calculated at the nominal effective exchange rate, year-on-year change, 6-month moving average, 9-months advanced.

Watching the labour market

Other factors are at play in the UK economy: wage growth is picking up, but the unemployment rate hasn’t moved much lower. In addition, the Bank of England’s annual productivity study surprised the markets in February because it suggested there was even less spare capacity in the labour market than previously thought. This is an added complication and reason to believe that inflation may trend slightly higher. Yet any major revisions to the BoE’s outlook for the labour market will likely happen next February, rather than in November.

An October budget deadline

The UK’s annual budget will also be presented to Parliament at the end of October, but it is unlikely that there will be a major increase in the projected deficit – at least not under this government. In fact, the government is projected to be a few billion pounds ahead of the budget it set out for this fiscal year. So if we were to see a slight increase in borrowing, it would be warranted by the better-than-expected revenues this year.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG, licensed by FINMA (www.finma.ch) for distribution and by OAKBV (Oberaufsichtskommission berufliche Vorsorge) for asset management related to occupational pensions in Switzerland; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

643137

Volatile markets and politics won’t change the Fed’s path

Summary

The strong economic foundation in the US continues to validate the Fed’s trajectory, despite the increased risk-aversion recently seen in the markets. As a result, we expect the FOMC to stay on its path, free from political pressure, and continue monetary-policy normalisation.

Key takeaways

|