Welcome to our Sustainability Report 2020

The year brought an inflection point for sustainable investing. Investor interest in sustainability turned into significant inflows, even as the Covid-19 pandemic caused turbulence in the markets and upended ways of working and living.

Indeed, the pandemic didn’t detract attention from sustainability – rather, it highlighted real-world issues that only sustainable investments can help solve.

Demand looks set to continue as governments worldwide lead meaningful coordinated action to “build back better”. Asset managers will have a role to play, not just in identifying opportunities for investors, but also helping to create them.

Sustainable investing is essential to who we are

(all data as of 31 December 2020)

Highlights from our Sustainability Report 2020

OUR STRATEGY

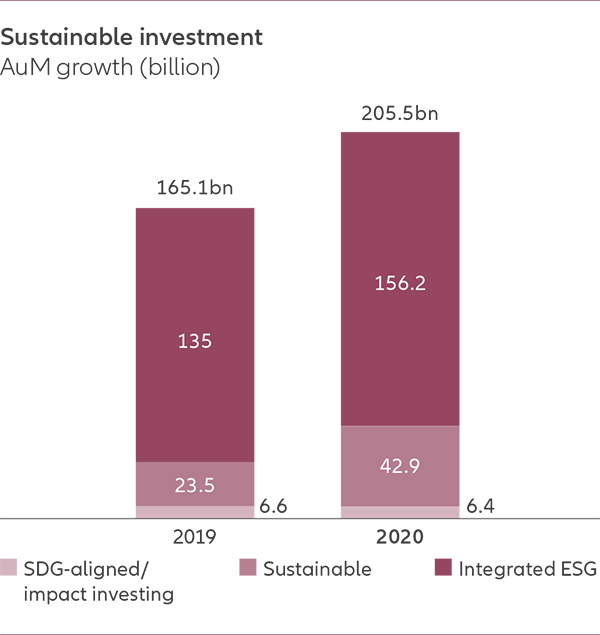

Our track record and commitment to ESG dates back two decades. Our conviction today is that ESG factors matter in all investment decisions. Reflecting on the diverse needs of our clients, we offer a range of sustainable investing approaches that support clients in managing risk, addressing real-world problems and generating returns from investments.

Recognising our clients’ needs, we offer a range of sustainable investing approaches

With sustainable investing no longer seen as a trend but as an essential consideration in portfolio management, the investment industry is at a tipping point. Sustainable investing approaches can deliver significant positive outcomes, and active engagement with the companies in which we invest offers huge potential benefits.

OUR PURPOSE

Our purpose is not only to help secure the future for our clients and ensure financial returns to our shareholders – we also seek to make a positive contribution to society as a whole. To focus our sustainability approach, we identified the most important issues for our stakeholders and our business. This helps us target our efforts and reporting to ensure we are doing as much as we can to exert a positive influence where we can make the biggest difference.

CONTRIBUTING TO THE UN SUSTAINABILITY DEVELOPMENT GOALS (SDGs)

The UN SDGs have come to represent a global call to action for stakeholders to address the challenges facing society. Business has a clear role to play and the goals have become an important tool for shaping and assessing impact.

We have the opportunity to make a positive, measurable contribution to the SDGs through our core business and targeted investments. We support the delivery of the SDGs as an employer and as an active, engaged investor with an expanded range of SDG-aligned funds and Impact offerings.

ACTIVE STEWARDSHIP

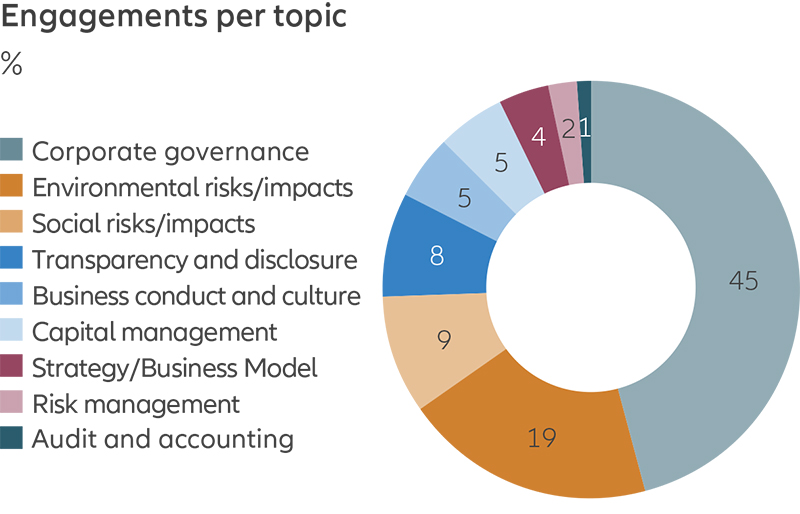

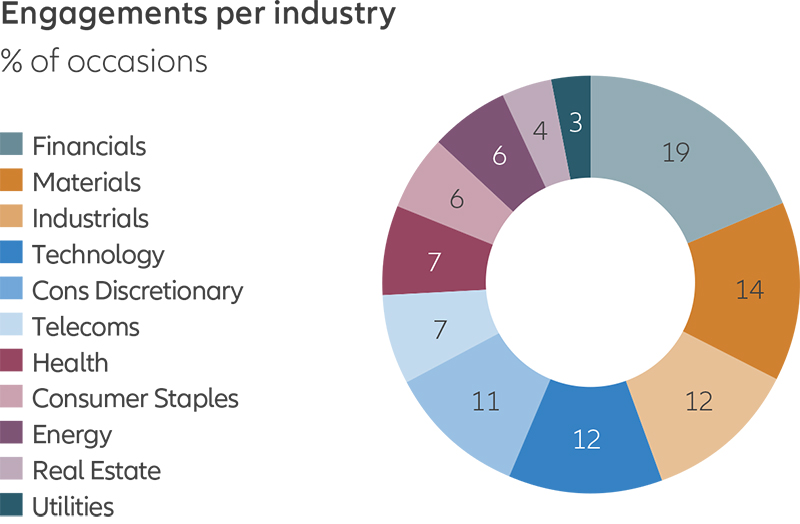

Our active stewardship approach aims to steer investee companies towards sustainable business success and impact through corporate dialogue and proxy voting. It is a critical part of our capabilities as an active asset manager.

Consistent with our investment philosophy and approach, we routinely engage in dialogue with investee companies and seek proactively to present a viewpoint, effect positive change and monitor the results of engagement.

We are recognising the importance of climate change, and the power of engagement to drive real-world impact, with the launch of a dedicated climate engagement approach.

Download our Stewardship Report 2020 for full details.

OPERATING AS A SUSTAINABLE BUSINESS

Our investment activities are only one part of what makes us sustainable. We believe we have a responsibility to lead by example by demonstrating – across our business – the standards and commitments we expect of the companies we invest in.

This translates into a focus on sustainability across our span of operations – from our commitment to client service to our work in building an inclusive and diverse workforce; from our data security safeguards and environmental management practices to our work with the communities in which we operate.

Our rankings in the 2020 Greenwich Report underscore our commitment to staying focused on clients’ changing needs:

- Ninth consecutive year as Greenwich Quality Leader in institutional investment management in Germany, and third consecutive year in Europe.

- Second consecutive year as Greenwich Quality Leader in overall European intermediary distribution quality.

- Greenwich Quality Leader in both institutional and intermediary services in Asia.

- Leading ESG Investment Manager for Institutional Clients in Continental Europe in 2020.

|

Document

|

Date

|

Actions

|

|---|---|---|

|

11/05/2021

|

|

|

|

30/04/2021

|

|

|

|

30/04/2021

|

|

1597292