The China Briefing

China’s 2025 risk / reward outlook

Notwithstanding the uncertainty of what the Trump presidency will bring, it's to be more optimistic on the outlook for China equities

Please find below our latest thoughts on China:

- Recent weeks have seen China equities consolidating after the very strong rally at the end of September/early October, which was spurred by a significant change in government policy focused on stabilising the economy as well as financial markets.

- As a result of this rally, China equities have been one of the better performing global asset classes year to date, delivering double-digit gains in US dollar terms in both onshore and offshore markets.1

- A key market concern since the US elections has been to what extent higher US tariffs, which weighed heavily on sentiment in China equities in 2018, will again become a major risk.

- Our view is that the “shock factor” of a Donald Trump presidency will be somewhat less the second time around, and that China authorities will react with further domestically focused stimulus measures in the event of a major hike in tariffs.

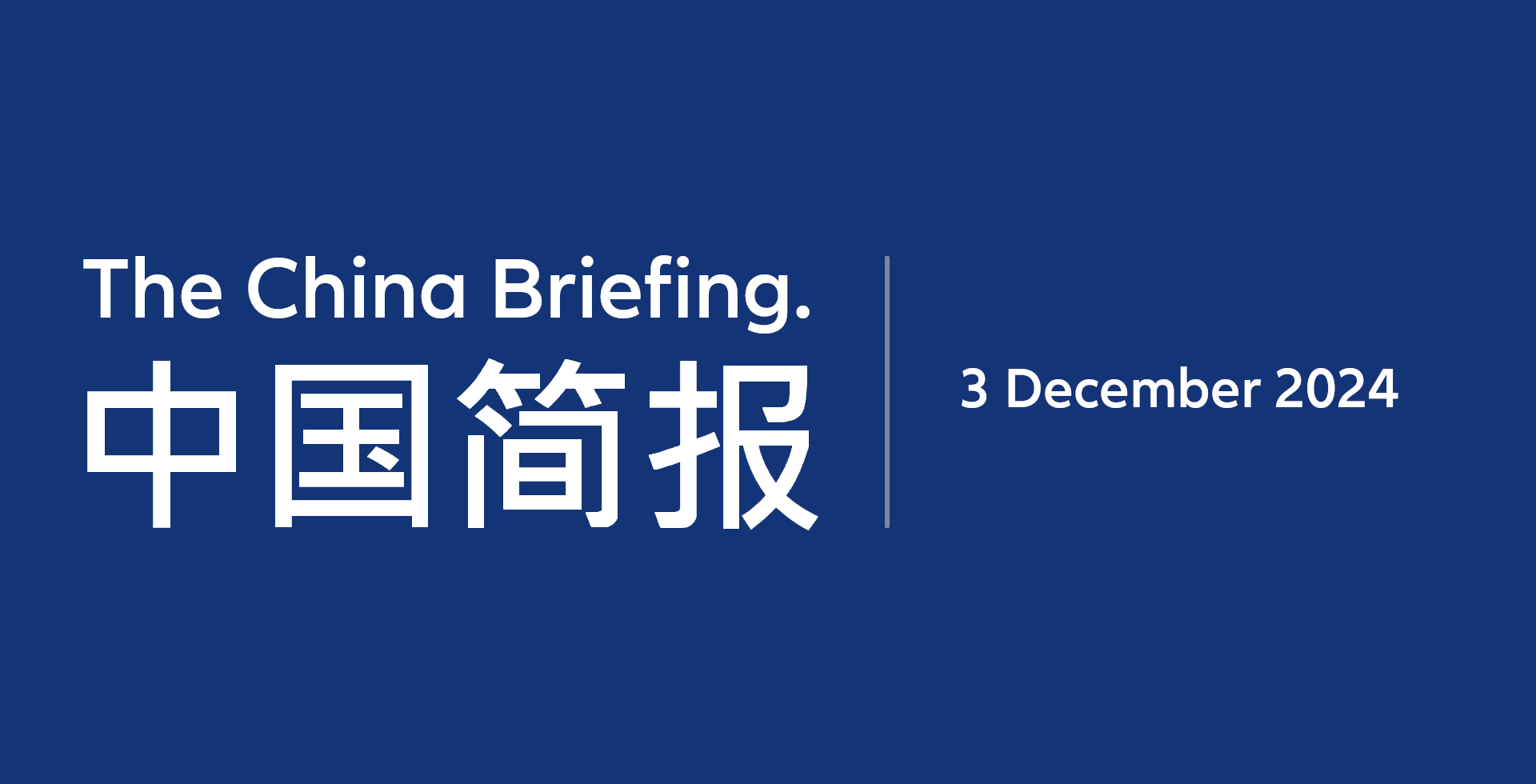

Chart 1: Citibank China Economic Surprise Index

Source: Bloomberg, Allianz Global Investors, as at 2 December 2024.

- Indeed, it was noticeable how China equities reacted positively in the final week of November to an announcement by President-elect Trump that he would impose an additional 10% tariff on China goods on top of all existing levies. This would suggest that, to some extent, the expectation of higher tariffs is already discounted in share prices.

- Looking ahead to next year, a further key issue will be whether there are concrete signs that China’s policy package is working, which would then potentially outweigh tariff concerns. While high-frequency economic data has certainly improved so far in the fourth quarter, there are still questions as to the sustainability of this improved economic momentum.

- In particular, China’s export momentum – a key driver of growth this year – will likely fade in 2025. An improvement in domestic demand will therefore be needed to achieve the expected GDP growth target of 4.5- 5.0%.

- Unlike in other global economies, Chinese consumers have been in “saving” rather than “spending” mode since the end of Covid. Cash levels are close to record high levels – household deposits in banks, for example, have reached the equivalent of two times the entire market capitalisation of China A-shares.2

- Much of the reason for the higher savings rate, in our view, is related to fears of future income prospects and the erosion of wealth as house prices have fallen. As such, stabilising the property market will be key to start rebuilding confidence and ultimately reversing this cycle.

- While recent government initiatives such as reducing mortgage rates and downpayment ratios, and improving access to funding for cash-strapped developers, have undoubtedly been a step in the right direction and mitigated previous tail risk concerns, more stimulus will likely be needed.

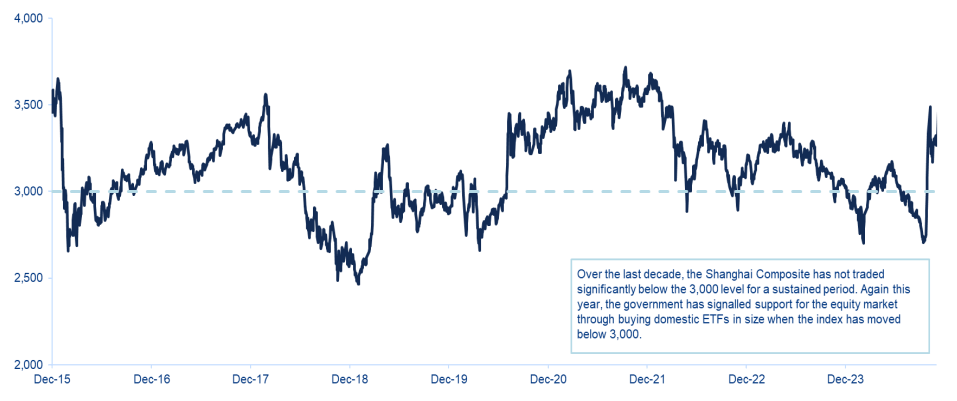

Chart 2: Shanghai Composite Index, 10 years

Source: Wind, Allianz Global Investors as at 2 December 2024.

- And while the government’s words are certainly encouraging, it is important these words continue to be backed up by action.

- Finance Minister Lan Foan recently commented that “the central government still has significant room for increasing debt and expanding the deficit”. This is a strong indication that there will be a meaningful step up in budgets and spending, and that policy priorities have shifted in a more growth-friendly direction.

- We are therefore likely to see more measures in the coming months. There may be some indication at the upcoming Central Economic Work Conference (CEWC).

- An annual meeting held each December, this is one of the most important economic events of the year, which brings together many of the most senior officials and will be closely scrutinised for signs of more pro-growth measures.

- Looking ahead, and notwithstanding the uncertainly regarding what the Trump presidency will bring, overall our view is to be more optimistic on the outlook for China equities particularly in the context of risk/reward outcomes.

- The government has sent strong signals that it will step in to support the China A market if needed, which should help to limit downside risks.

- Based on “national team” buying of ETFs this year, and the timing of other support measures provided historically, a key market level for the closely-followed Shanghai Composite index is 3,000.

- Over the last decade, the index has not traded significantly below this level for a sustained period. The current level of the Shanghai Composite is around 3,350.3

- And while we do not expect a massive fiscal boost in coming months, there is also now a significantly higher probability that a more expansionary approach benefits the real economy, and helps to support corporate earnings, which have been the main drag on China equity markets this year.

- In summary, with the likelihood of more supportive government measures to come, and with valuations still reasonable, our view – and the way we have been managing portfolios – is to use any periods of market weakness to “buy the dips”.

1 Source: Bloomberg as at 2 December 2024

2 Source: Wind as at 30 September 2024

3 Source: Bloomberg as at 2 December 2024