Summary

During periods of disruptively high inflation, investors may want to rethink their allocations to certain equity sectors and investment styles. For example, the energy and consumer discretionary sectors have historically fared better than consumer staples and utilities during inflationary periods. The value, momentum and quality styles have also done well, on average.

Key takeaways

|

With inflation near its highest levels in a generation, many investors want to know how a prolonged period of inflation might affect the financial markets – and their portfolios. Looking back at market performance over time, we can see that when inflation is high, some sectors (such as energy) have historically fared much better than others (such as utilities). This is often linked to the fact that some companies set prices while some “take” prices. There is also solid research showing that certain investment “styles” (including value and momentum investing) have also tended to outperform in inflationary periods. That’s why it may make sense for investors to form their inflation-fighting strategies by differentiating not only between traditional sectors, but investment styles as well.

With inflation set to remain high, where can investors turn?

Although periods of high inflation are not unusual to the economic cycle, there are aspects of this particular inflation cycle that are very different. The global pandemic has disrupted global supply chains in an unprecedented manner. And the invasion of Ukraine by Russian armed forces has disrupted the supply of energy, fertiliser and grain. These factors have conspired to increase prices at the highest rate seen in decades. On top of that, the pandemic has also profoundly changed the labour market. This has led wage inflation and made inflation more persistent.

So how can investors form a defense against inflation? Equities have historically performed relatively well in times of economic expansion and modest inflation. Although equities may suffer a short-term downturn when inflationary expectations increase, they are generally viewed as a good “hedge” against inflation in the long-term. But equities are not all the same, and it is worthwhile to drill down and see how different sectors are affected by inflation cycles.

Different sectors have responded differently to inflation

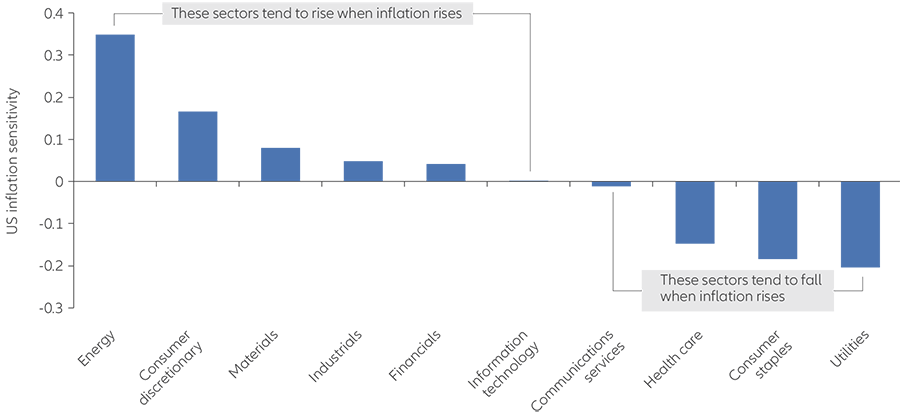

Let’s start with an industry-level view of the US economy – which is where we find the most robust inflation data. Exhibit 1 shows US sector sensitivities to inflation (as measured by changes in the US Consumer Price Index) for US stocks as a whole (as measured by the MSCI USA Index). Of note:

- Companies in certain sectors (such as energy and materials) tend to own or control physical assets; they may also sell commodity-based products. Since the value of their assets and the prices of their products increase with inflation, their stock prices are positively correlated with inflation. That means that typically, their stock prices move higher when inflation moves higher.

- Conversely, companies in sectors such as consumer staples and utilities have negative correlations with inflation. That’s in large part because these companies consume commodities, which increases their input prices. On average, this has adversely affected their profit margins and stock prices.

Exhibit 1: identifying sectors with positive (or negative) correlations to inflation

Sector sensitivities to changes in US CPI (MSCI US Index, April 2022)

Source: Allianz Global Investors. Data as at March 2022.

Drilling a little deeper, one might ask if some companies within an industry are more affected by inflation than others. Now, we’re entering the realm of active portfolio managers and their ability to seek to identify the winners. Consider that some companies can increase prices and pass their increased costs on to consumers. Active investors can aim to identify such companies by closely following changes in sales and profit margins – looking for high-quality companies with large and stable profit margins since they tend to do better in times of high or increasing inflation.

Different styles have also reacted differently to inflation

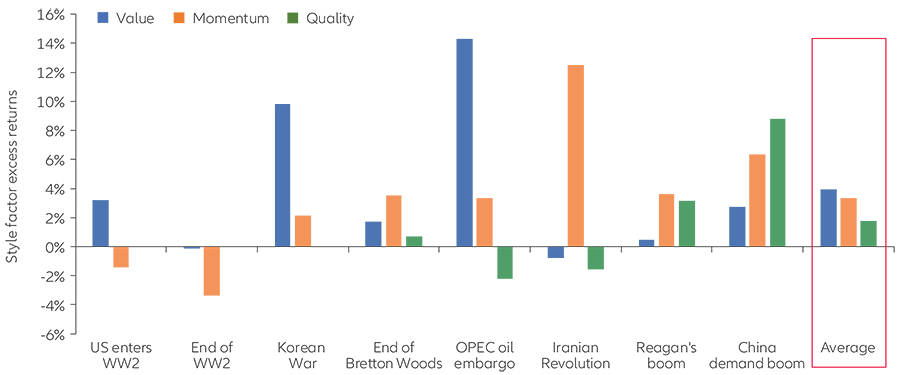

Many investors employ style investing in an attempt to achieve higher returns than the broad market on average. How does style investing do in times of high inflation? Researchers in the Systematic Equity team at Allianz Global Investors examined the performance of several well-known equity style factors during eight periods of high inflation in the United States since 1940. Exhibit 2 plots the average returns in excess of a capitalisation-weighted market benchmark for three equity styles: value, momentum and quality.

- Attractively valued stocks (known as value stocks) outperformed the benchmark in six of eight periods.

- Stocks selected based on their performance during the previous 12 months (known as momentum stocks) on average continued their streak, and also outperformed the benchmark in six of eight periods. These stocks had higher average excess returns in inflationary times than in normal times.

- More profitable companies or those with a better balance sheet (known as quality stocks) outperformed the benchmark in four of the six periods for which data was available.

Exhibit 2: value, momentum and quality have outperformed, on average, when inflation is high

Equity style factor performance vs market in inflationary periods

Source: Allianz Global Investors; K French; H Neville, T Draaisma, B Funnell, C Harvey and O Van Hemert. Key dates: US enters WW2 (Apr 1941-May 1942); end of WW2 (Mar 1946-Mar 1947); Korean War (Aug 1950-Feb 1951); end of Bretton Woods (Feb 1966-Jan 1970); OPEC oil embargo (Jul 1972-Dec 1974); Iranian Revolution (Feb 1977-Mar 1980); Reagan’s boom (Feb 1987-Nov 1990); China demand boom (Sep 2007-Jul 2008).

What it means for investors

Here are four takeaways that investors may want to keep in mind:

- Although equities may suffer a short-term downturn when inflationary expectations increase, they are generally viewed as a good “hedge” against inflation in the long-term.

- Companies in the energy and materials sectors have historically had a positive correlation with inflation, which means the value of their assets and the prices of their products tend to increase as inflation rises.

- Within sectors, some companies are in a better position to increase prices and pass their increased costs on to consumers – and active asset managers can seek to identify these companies by closely following changes in sales and profit margins.

- Historically, the value, momentum and quality investment styles have tended to outperform in inflationary periods.

1 Source for inflationary periods: Henry Neville, Teun Draaisma, Ben Funnell, Campbell R. Harvey and Otto Van Hemert, 2021, “The Best Strategies for Inflationary Times.” https://ssrn.com/abstract=3813202.

2 Source for style factor data: Ken French, https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. Factor definitions are as follows: value (BIG HiBM – Mkt); momentum (BIG HiPRIOR – Mkt); quality (BIG HiOP – MKT).

The MSCI USA Index is an unmanaged index designed to measure the performance of the large- and mid-cap segments of the US market. Investors cannot invest directly in an index.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Equities have tended to be volatile, and do not offer a fixed rate of return. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Credit risk reflects the issuer’s ability to make timely payments of interest or principal – the lower the rating, the higher the risk of default. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed, and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction, or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; ; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).

2206405

Summary

Armed conflict, financial woes and inflation shocks have contributed to a tricky 2022 so far for emerging markets. But a broader, systemic crisis is not anticipated for emerging-market debt, and there might be reasons for optimism about a recovery.

Key takeaways

|