Summary

Inflation has made a forceful comeback recently, and we believe it will last longer than the financial markets and many investors currently anticipate. In part one of a two-part paper, we look at the factors that may cause a more persistent rise in consumer price inflation – and why it matters to investors.

Key takeaways:

- The recent inflation spike has been amplified by several extraordinary and temporary factors – including the post-Covid rebound and base effects

- But there are other reasons why consumer price inflation may turn out to be “sticky” – including continued accommodation from central banks, less globalisation and an aging population

- We also expect the fight against climate change and economic inequality to contribute to upward inflationary pressure

The inflation spike is real – and it may last for some time

After years of subdued price pressure and a brief disinflationary bout early in the Covid-19 pandemic, global inflation has made a forceful comeback. Consumer prices in OECD countries rose by 4.3% from August 2020 to August 2021 – the fastest pace in 13 years.1

But contrary to the market consensus, we believe that only part of the inflation spike is transitory. To be sure, some of the recent rise in inflation is a byproduct of the sharp post-Covid economic recovery, powered by unprecedented monetary and fiscal stimulus, lingering pent-up demand and surging commodity prices. The inflation spike has also been amplified by several extraordinary and temporary factors – including base effects, tax effects and supply-side bottlenecks.

Yet in our view, there are cyclical and structural forces at work that could lead to a more persistent rise in goods and service inflation in the years ahead. Importantly, we believe this increase could be notably more than what the financial markets and many investors currently anticipate. We expect inflation to regularly reach and at least temporarily overshoot central banks’ targets over time. That makes it worthwhile to take a deeper look at the factors that are driving inflation higher.

Eight factors driving inflation higher

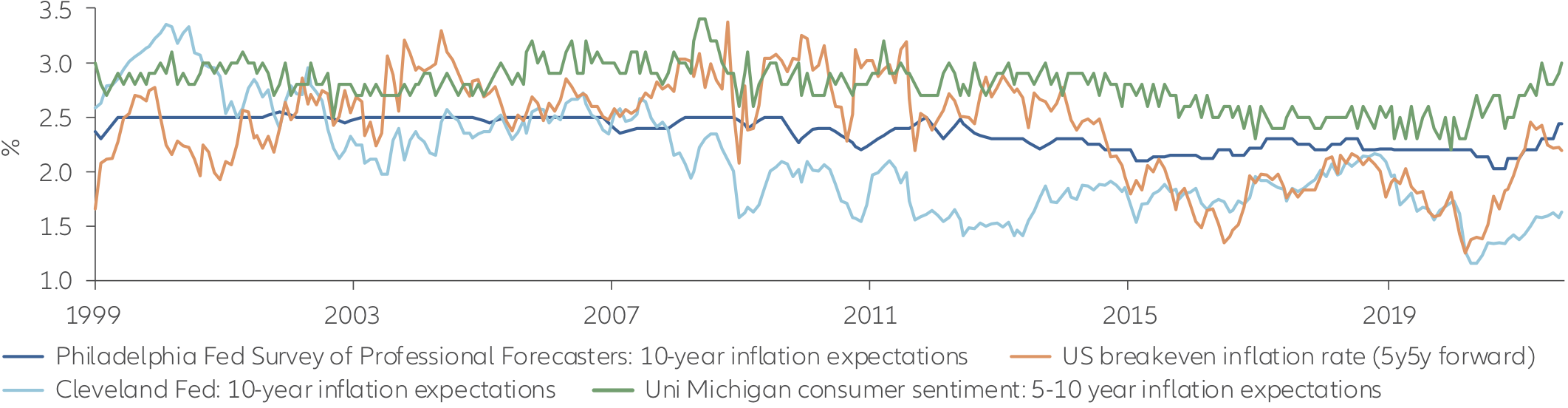

After the global financial crisis of 2007-2008, long-term inflation expectations regularly dropped below central banks’ target levels due to a sluggish reflation process. Their efforts at sparking higher levels of inflation were held back by factors such as the shallow global economic recovery and after-effects from the multi decade rise in globalization. In order to address the risk of a “de-anchoring” of inflation expectations to the downside2 (see Exhibit 1), many central banks made adjustments to their monetary policy approach and related reaction functions – some clearly signalled and others more implicit. Some of their more reactive strategies have new names, such as the “flexible average inflation targeting” by the Federal Reserve or the “symmetric 2% inflation target” by the European Central Bank.

But the shift to these new reactive strategies raises the risk of a monetary policy error, particularly when it gets late in the economic cycle. If central banks are too late in addressing the risks that may de-anchor long-term inflation expectations to the upside, they could be forced into a more aggressive and disruptive tightening of monetary policy. This could upend parts of the global economy and make inflation more volatile. It would likely also affect financial markets. Rising long-term inflation uncertainty means investors would expect to be compensated accordingly, which would lead to higher inflation risk premia.

Exhibit 1: inflation expectations are on the rise

US inflation expectations/compensations (since 1999)

Source: Bloomberg, Philadelphia Fed, Cleveland Fed. Data as at 30 September 2021.

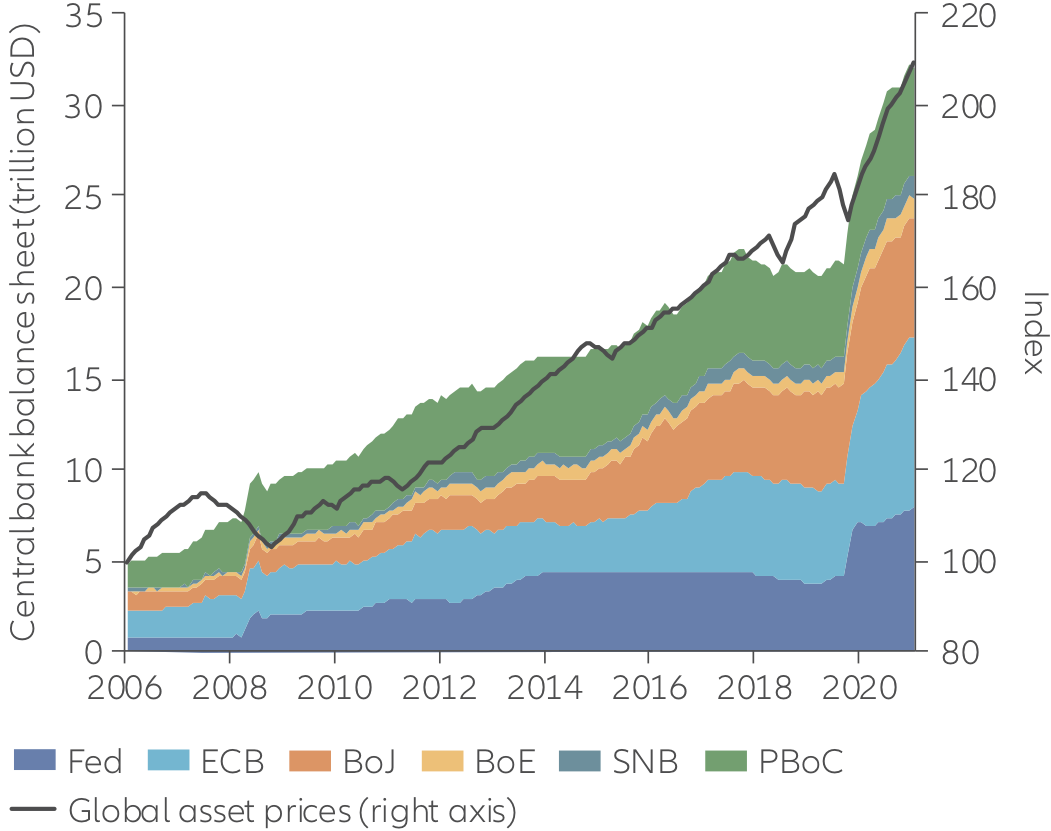

During the Covid-19 crisis, central banks around the world stepped up their unconventional stimulus measures, buying sovereign bonds at an unprecedented pace. This massive injection of central bank liquidity led to an unparalleled surge in global money supply (see Exhibit 2) that could fan consumer price inflation over time, in particular against the backdrop of rapidly shrinking output gaps3.

Critically, we don’t expect this situation to reverse anytime soon. There has been a steady rise in private and public indebtedness around the world, and ultra-accommodative monetary policy has kept the financial system afloat. But the system has also come to rely on this support, leading to what has been termed “fiscal and financial dominance” – an environment where central banks essentially do the bidding of their governments4. To be fair, higher coordination between the monetary policy of central banks and the fiscal policy of governments was necessary to contain the immediate economic fallout of the Covid-19 crisis. But maintaining this close link for too long would effectively prevent central banks from being independent. It could also introduce some form of modern monetary theory (MMT) – which broadly describes an environment where governments would end the era of independent monetary policy by taking back full control over the printing of their fiat currency to fund spending. In either case, the rising risk of MMT and fiscal/financial dominance should be reflected in higher long-term inflation expectations and rising inflation risk premia.

Exhibit 2: massive stimulus from central banks has pushed up asset prices

Central bank balance sheets vs global asset prices (since 2006)

Source: Bloomberg, Bank for International Settlement (BIS). Data as at 30 June 2021. Fed = Federal Reserve; ECB = European Central Bank; BoJ = Bank of Japan; BoE = Bank of England; SNB = Swiss National Bank; PBoC = People’s Bank of China. Global asset prices based on IMF Global House Price Index, BIS Property Price Statistics, FTSE World Broach Investment-Grade Bond Index and MSCI All Countries Equity Index (real estate, equities, bonds each 1/3 weight).

Globalisation had been a powerful disinflationary force in the two decades before the eruption of the financial crisis (see Exhibit 3), but it is now in retreat – an environment that some call “slowbalisation”. Growth in the volume of international trade has slowed and protectionism is on the rise. Reduced international access to cheap labour is putting upward pressure on wages, and eventually on prices. In addition, severe disruptions in global supply chains since the outbreak of the pandemic have triggered a wave of “re-shoring” activities in the corporate sector5. There have also been supply shortages in the UK as a consequence of Brexit. These examples illustrate how the longer-term trend of re-regionalisation and slowbalisation are structural issues that weigh on global economic growth while pushing consumer price inflation higher.

Exhibit 3: globalisation’s second wave seems to be ebbing

Global merchandise exports and global exports of goods and services (as a share of world GDP; 1827-2019)

Source: JH Fouquin, J Hugot (2016): "Two Centuries of Bilateral Trade and Gravity Data: 1827-2014", Ourworldindata, World Bank. Data as at December 2019.

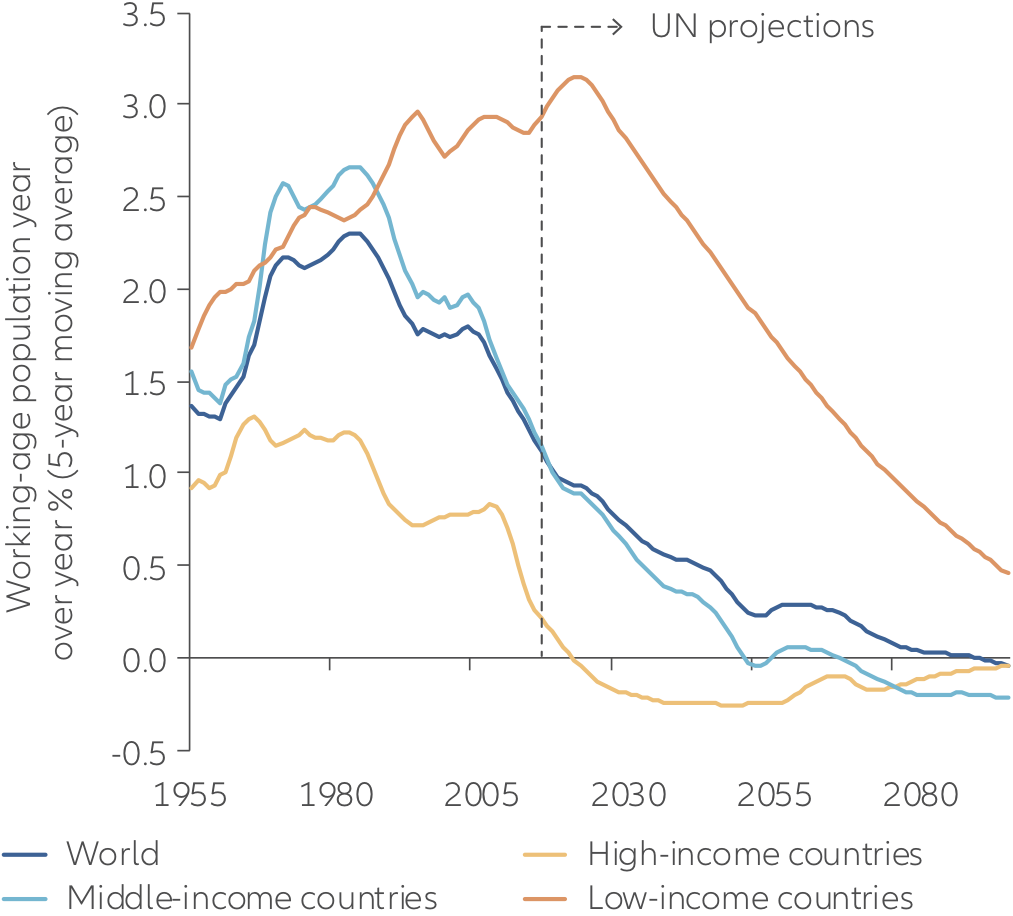

For 30-plus years, the global workforce has been growing, reinforced by globalisation and access to cheap labour. Together, these forces provided a powerful tailwind that drove output up and inflation down, but this environment is coming to an end. A progressive ageing of the world population (see Exhibit 4), rising dependency ratios (where the working-age population is shrinking as a proportion of the total population) and slower growth in labour supply in the emerging world (particularly in China) may contribute to a return of inflation in the years ahead6. The interplay between these factors is complex, but consider that as the world grows older, there will be an increase in the “consuming” part of the population relative to the “productive” part of the population. All else equal, prices for goods and services would rise as demand outstrips supply.

Exhibit 4: demographic trends point to fewer workers, which could push up wages

Working-age population (1955-2100)

Source: United Nations. Data as at 2019.

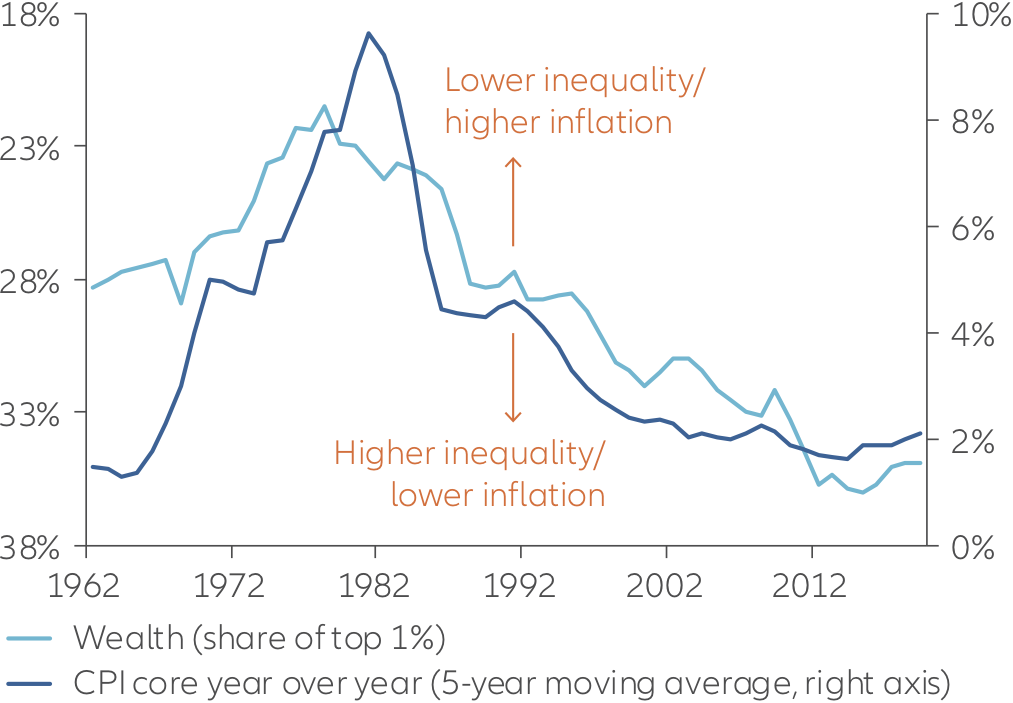

In the last 40 years, there has been a persistent rise in wealth and income inequality around the world, contributing to a structural slowdown in consumer price inflation7. Fortunately, many governments are now making a concerted effort to reduce inequality. This could bring economic benefits and invite higher inflation – as seen in these examples:

- The shift towards “bigger government” in the United States and large parts of the industrialised world may lead to rising fiscal deficits, which could foster an inflationary environment of fiscal dominance.

- When lower-income households get a boost in discretionary income, they’re more likely to spend it – and this additional boost in spending can push up goods and services prices. (In contrast, middle- and higher-income households already have more discretionary income and are more likely to save, rather than spend, additional cash.) As a result, economic policies that help “redistribute” wealth and income could be inflationary (see Exhibit 5a).

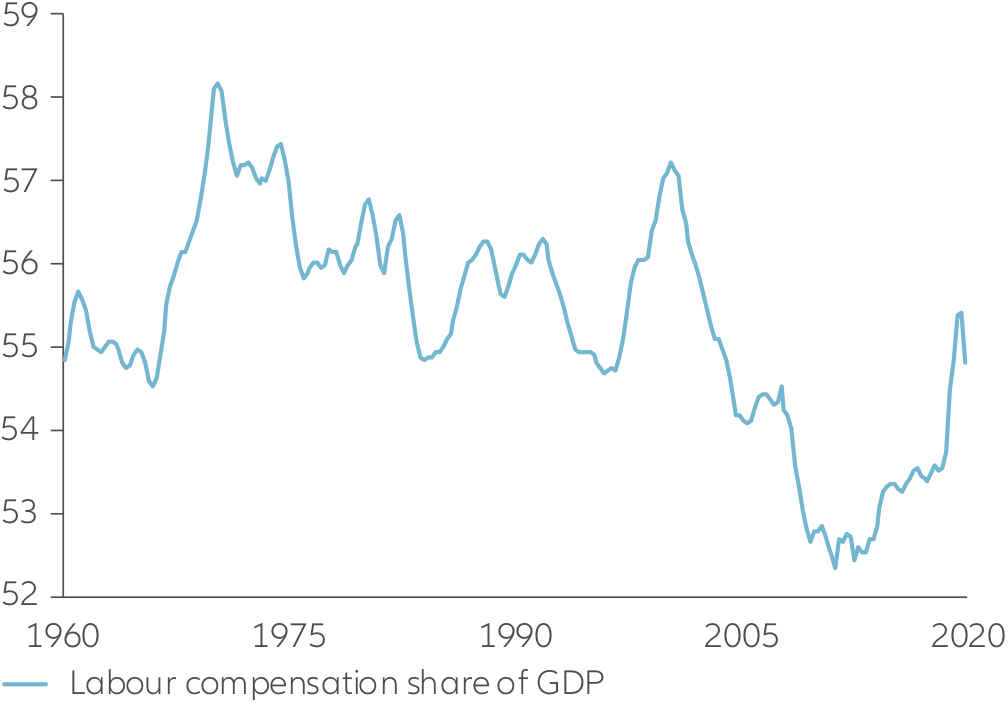

- The combined effects of changing demographics and efforts to reduce inequality may already be showing up in a rising share of labour compensation (wages plus benefits) relative to GDP (see Exhibit 5b).

- In addition, we are observing voluntary increases of minimum wages by companies in order to attract staff.

Exhibit 5a: redistributionist policies are reducing economic inequality but could drive inflation higher

US wealth inequality vs consumer inflation (1962-2019)

Source: World Inequality Database, Bloomberg. Data as at 2019.

Exhibit 5b: labour share is rising

US labour compensation share (since 1960)

Source: Refinitiv Datastream, Allianz Global Investors. Data as at 4 October 2021.

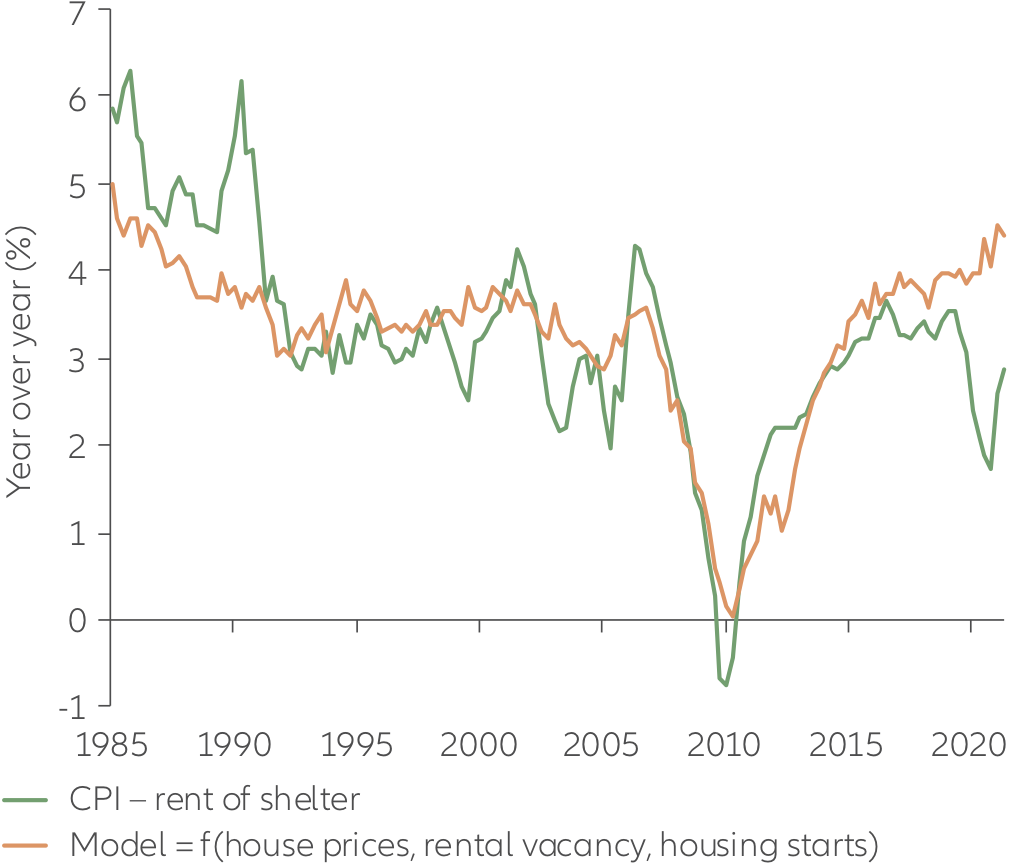

While central banks in general exclude asset prices from their inflation mandate, real estate represents a grey zone. Owners’ occupied housing costs (as part of the “rent of shelter” component) affect consumer price inflation in several countries – including the United States, where rent of shelter accounts for 33% of the overall CPI basket and 42% of the core index (excluding food and energy). Within the next few quarters, the surging housing market (see Exhibit 6) is expected to drive up goods and services price inflation. (Higher home prices usually take around 12 to 18 months to spill over into consumer prices.) In this way, there is at least an indirect link to the spillover of monetary policy into asset markets.

Exhibit 6: surging housing prices aren’t yet been reflected in consumer price inflation

CPI – rent of shelter vs model (year-over-year change, 1985 – 2021)

Source: Bloomberg, Allianz Global Investors. Data as at 30 September 2021.

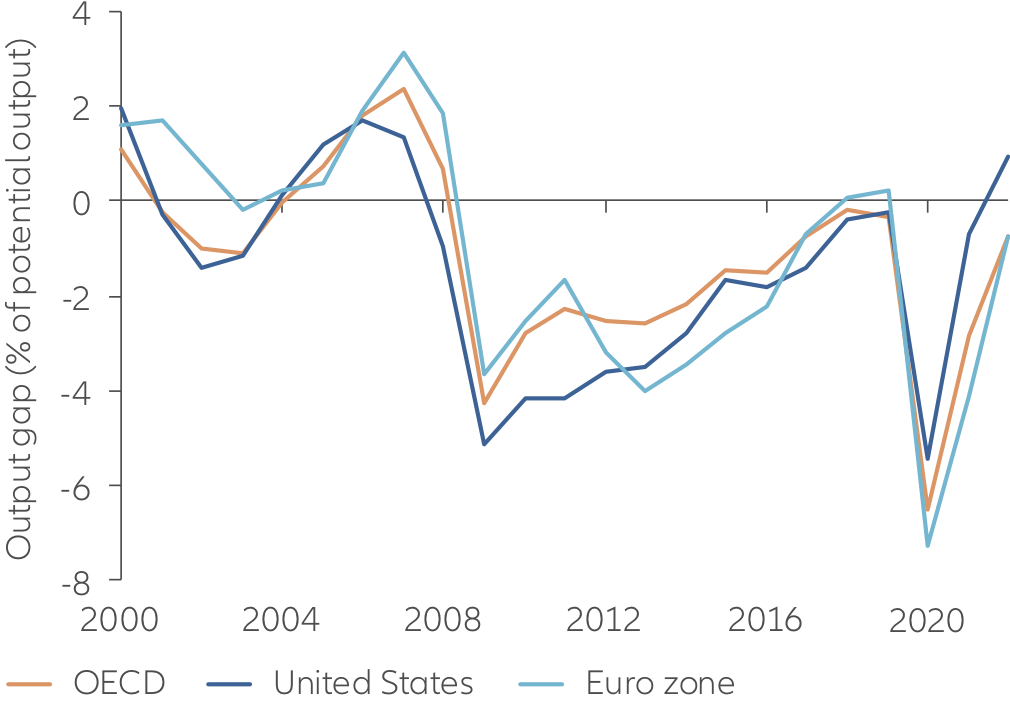

The continued rapid closure of output gaps (the difference between an economy’s actual and potential output; see Exhibit 7) means the global economy has rebounded well and unemployment should continue to fall. This is where the “Phillips curve” relationship comes into play, which states that along with lower unemployment comes higher prices. While the curve has flattened over the past 20 years, it still shows a link between low unemployment and higher services price inflation. Goods price inflation has behaved differently in recent decades, thanks to international forces helping to keep prices down. But goods prices may soon also begin to rise in a more sustainable way in light of “slowbalisation”, rising protectionism and the re-shoring of production – all of which are inflationary.

Exhibit 7: narrowing output gaps point to higher inflation

Output gaps in major developed economies (since 2000)

Source: OECD. Data as at May 2021.

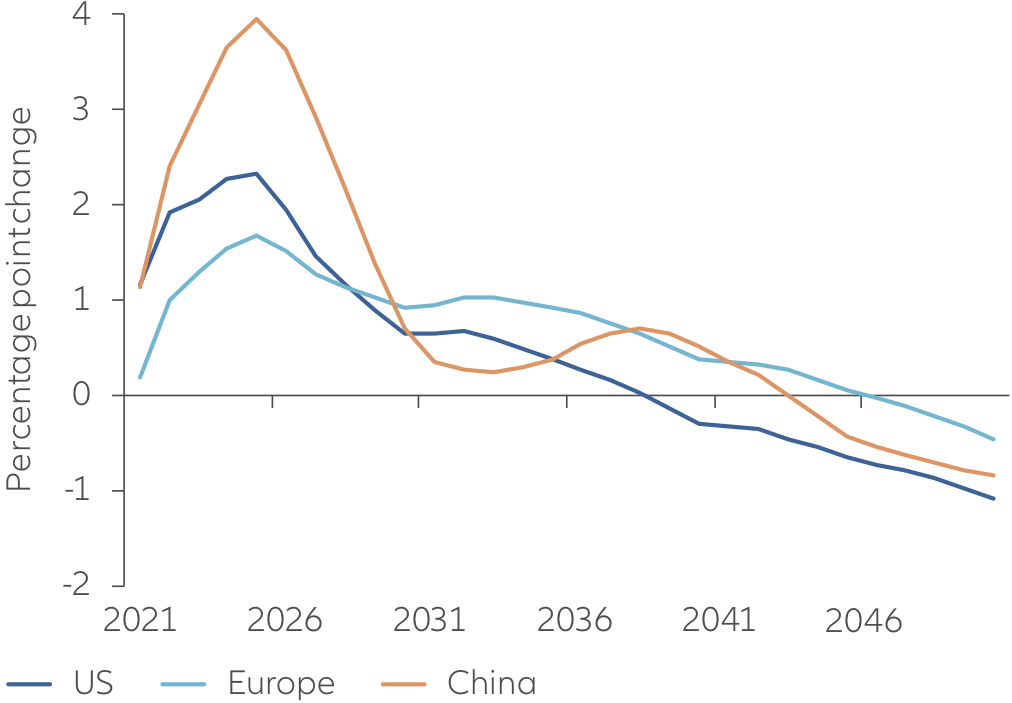

Decarbonising the world economy to limit global warming and address climate change has become the preeminent challenge of our time. The importance of this task is undisputable, and “green growth” and similar investments may lead to higher economic output and lower inflation in the long run. Before we reach this point, however, the necessary transformation of the global economy may go hand in hand with less access to “cheap” energy, an increase in environment-related regulations, the obsolescence of “cheap” but dirty production processes and high volumes of stranded assets that are subject to write-downs. All of this means that the energy transition will likely be an inflationary one (see Exhibit 8). Yet it is also important to note that this inflationary pressure is a byproduct of internalising costs (at the product level) that have until recently been borne by other stakeholders.

For an example of how policy efforts to achieve long-term climate goals have an impact on inflation, consider two recent developments. The sharp rise in gas prices globally in 2021 to some extent reflect the increased demand for energy from gas-fired power plants, which emit fewer greenhouse gases than coal-powered ones8. In addition, local governments in China recently restricted coal-fired power generation to meet climate targets set by the central government. But this also caused disruptions in many industries, thereby exacerbating global supply-side constraints and adding to inflationary pressures.

Exhibit 8: the energy transition will likely push up near-term inflation

US, EU, China: change in inflation vs baseline for “net zero 2050” scenario

Source: Network for Greening the Financial System. Data as at 28 June 2021.

Learn more about the implications for investors

Taken together, these eight factors make a compelling argument as to why consumer price inflation may turn out to be more sticky than what the market currently anticipates. As a consequence, it may be a good idea to hedge against the risk of a persistent rise in inflation. In part two of this two-part paper, we share the results of our proprietary analysis into the asset classes that may provide an optimal inflation hedge.

1 Source: OECD as at August 2021. OECD is the Organisation for Economic Co-operation and Development.

2 When consumers, corporations and other parties expect inflation to remain steady, their “anchored” inflation expectations help central banks maintain price stability. If inflation expectations are de-anchored to the downside, the markets think inflation will be lower than the central banks’ target level.

3 In the US, the multi-year growth in broad money supply now exceeds the multi-year growth in real GDP by a wide margin. Historically, this measure of excess liquidity has also coincided with a rise in consumer-price inflation.

4 They do this by pegging interest rates at artificially low levels to reduce the costs of servicing sovereign and private debt.

5 This also has the added political aim of helping countries ensure the domestic supply of critical products, which increases their strategic self-sufficiency.

6 For a deeper discussion of the demographic impact on inflation see, for example, Goodhart, C., Pradhan, M. (2020): “The Great Demographic Reversal” and Juselius, M. and Takáts, E. (2018): “The enduring link between demography and inflation”

7 The precise mechanism linking high inequality and low inflation remains unclear, but one driver is that lower-income households tend to consume more. Higher consumer spending tends to push up inflation, all else equal.

8 Other factors pushing up gas prices include supply-side constraints and a generally higher demand for energy.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Equities have tended to be volatile, and do not offer a fixed rate of return. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Credit risk reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. Emerging markets may be more volatile, less liquid, less transparent, and subject to less oversight, and values may fluctuate with currency exchange rates. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

1868719 | COMM-432

Summary

How can investors reposition their portfolios in the face of a persistent rise in consumer price inflation? In part two of a two-part paper, we share the results of our proprietary analysis into the asset classes that may provide an optimal inflation hedge.

Key takeaways:

- Given our view that inflation is set to last longer than many market watchers expect, we conducted our own analysis into how different asset classes performed in a range of inflation environments

- Our research found that with moderate inflation (2%-4%), equities were the top-performing asset class, and sovereign and corporate bonds both generated decent positive annual real returns

- Perhaps surprisingly to those who consider gold to be the ultimate hedge against inflation, gold’s returns were mixed across different inflationary environments

- Commodities consistently generated solid positive returns in times of high and rising inflation, but their longer-term outlook may be obscured by the transition away from fossil fuels