Navigating Rates

Four fixed income themes to watch

Many of the major central banks (excluding Japan) are beginning or set to begin interest rate-cutting cycles this year. Here are four fixed income themes we believe could present investors with opportunities during the remainder of 2024.

Key takeaways

- In anticipation of future rate cuts, we favour steepeners in the US and Germany, while monetary policy normalisation in Japan over the coming years favours a flattening yield curve expression.

- Following a high degree of correlation in the performance of developed bond markets, diverging economic outlooks will likely open up relative value opportunities across sovereign bond markets.

- Caution is warranted in corporate bonds – especially high yield – given rich valuations.

- As economic performance and monetary policy diverge, and the US dollar starts to face headwinds, active currency management is set to play an increased role in fixed income portfolios.

Favour yield curve relative opportunities

Favour yield curve relative opportunities

In the last decade, declining economic growth expectations, low inflation and quantitative easing saw government bond yield curves flatten in the major G4 (ex-Japan) markets; the yield on longer maturity bonds was little more than that on shorter maturity bonds.

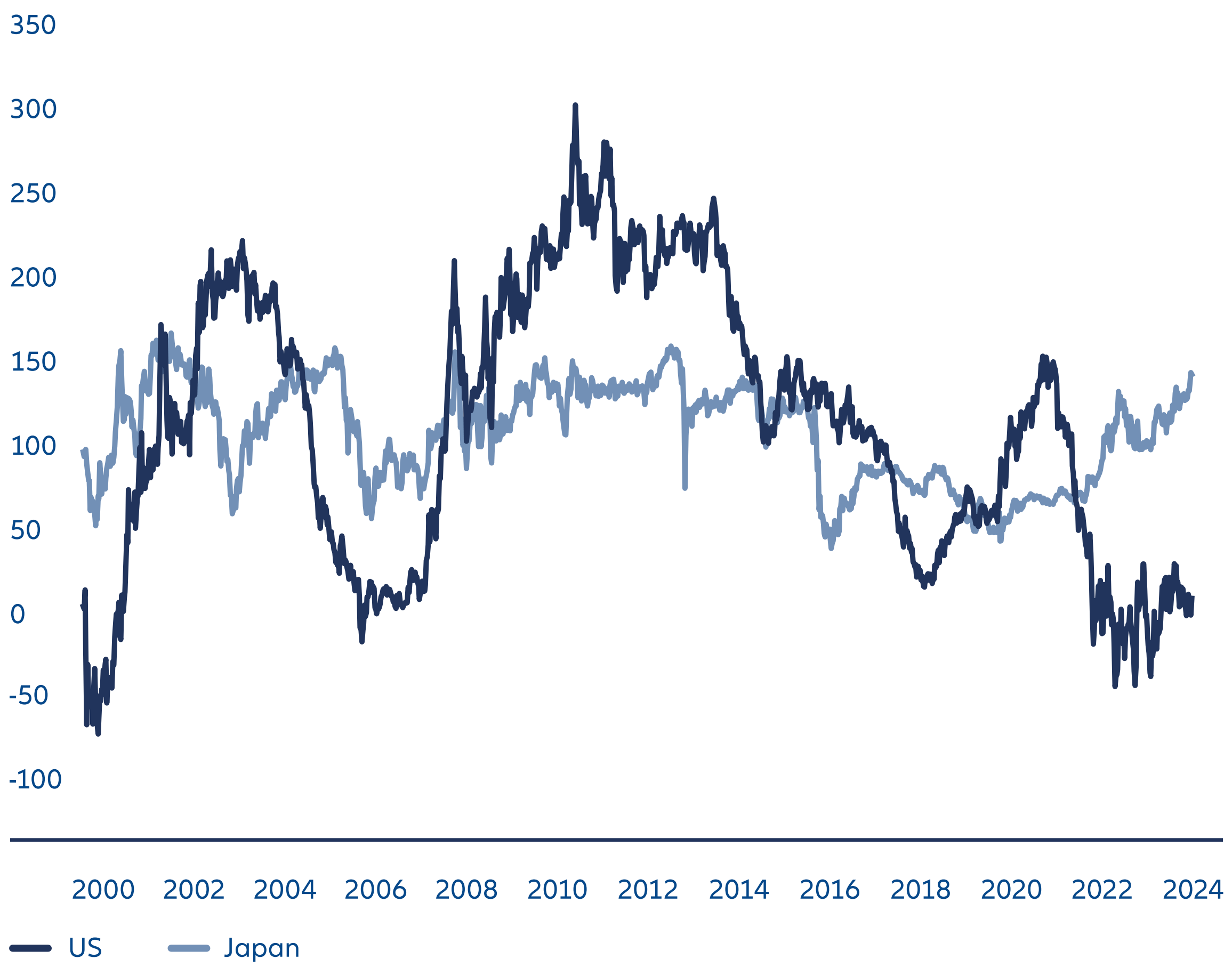

While the economic environment has shifted considerably in recent years, with rising inflation and sharply higher interest rates, the US Treasury curve (among others) remains remarkably flat relative to history (see Exhibit 1) as the persistent outperformance of the US economy has kept upward pressure on front-end yields.

However, we expect the US and German yield curves to re-steepen over the remainder of 2024. Despite volatile macro data making the timing of rate cuts more uncertain, we still expect central banks to deliver cuts in 2024 and this could be a catalyst for a re-pricing of front-end yields. In addition, the world is transitioning from a disinflationary macro landscape, with very loose monetary policy and fiscal restraint to one with greater inflation risks, more conventional monetary policy and greater fiscal activism in response to climate change, ageing populations and rising geopolitical risks. As a consequence, we expect the “term premium”– the extra yield investors demand for holding longer maturity bonds over shorter ones – to rise, weighing on ultra-long maturity bonds.

US and German yield curve steepening trades should benefit in this environment. In particular, we look for a steepening between 7-year and 30-year US Treasuries, coupled with a steepening in German Bunds between 5-year and 30-year and 10-year and 30-year maturities.

In Japan, however, we expect policy interest rates to be normalised over the coming years in the face of rising inflation expectations. The Bank of Japan’s balance sheet is amongst the largest of the G10 markets and the bank owns a larger share of its government bond market relative to its peers, with its Japanese government bond (JGB) holdings concentrated in sub-10 year maturities. Any adjustment of its balance sheet has important implications for the JGB market. Japan currently has the steepest 7s30s curve among the G4 markets and eventual policy normalisation should drive a flattening in the JGB curve.

Exhibit 1: Yield curve opportunities: flat vs steep curves.

US 5s30s and Japan 7s30s yield curves, basis points

Source: AllianzGI, Bloomberg, 31 May 2024

Diverging economies suggest relative value opportunities

Diverging economies suggest relative value opportunities

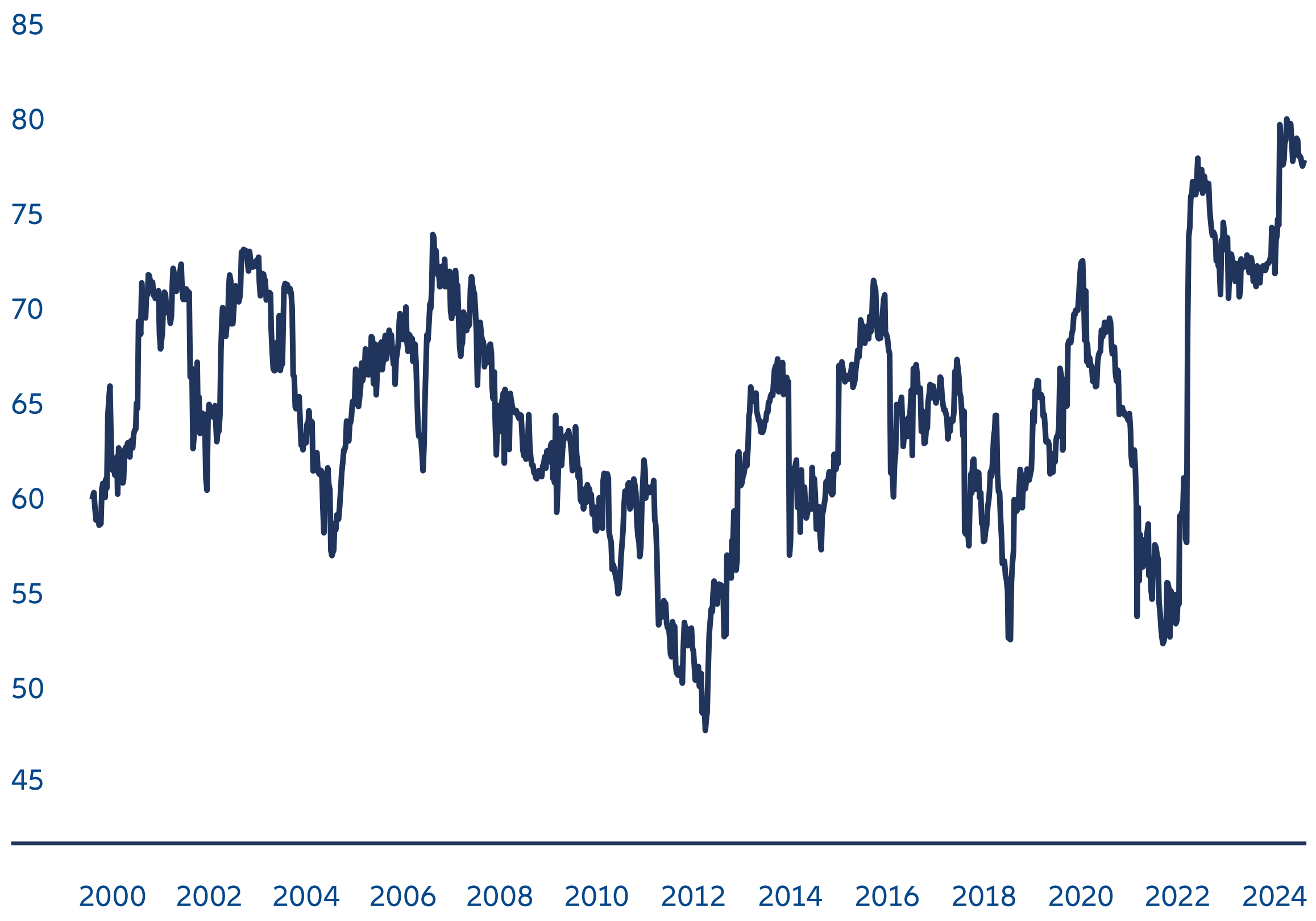

As Exhibit 2 shows, major developed government bond markets have behaved virtually in lockstep in recent years.

However, opportunities now abound as economic trajectories are set to diverge thanks to growing differences across countries and regions in terms of debt fundamentals, the transmission of monetary policy and the ability of governments to boost their economies with fiscal support.

This could mean attractive returns from relative value positions going forward. As an example, the strength of US economic data has led to a dramatic shift in expectations for 2024 rate cuts, with markets now pricing in just over one rate cut this year versus six back in January.1 By contrast, UK macro fundamentals (sub-trend growth and fiscal restraint) and an attractive valuation backdrop given restrictive real rates, favours an allocation to UK Gilts on a cross-market basis.

Exhibit 2: High correlation between major government bond markets

Mean 1-year rolling correlation of major developed market government bond markets vs US Treasuries

Source: AllianzGI, Bloomberg, 31 May 2024

Keep a cautious credit stance, particularly in high yield

Keep a cautious credit stance, particularly in high yield

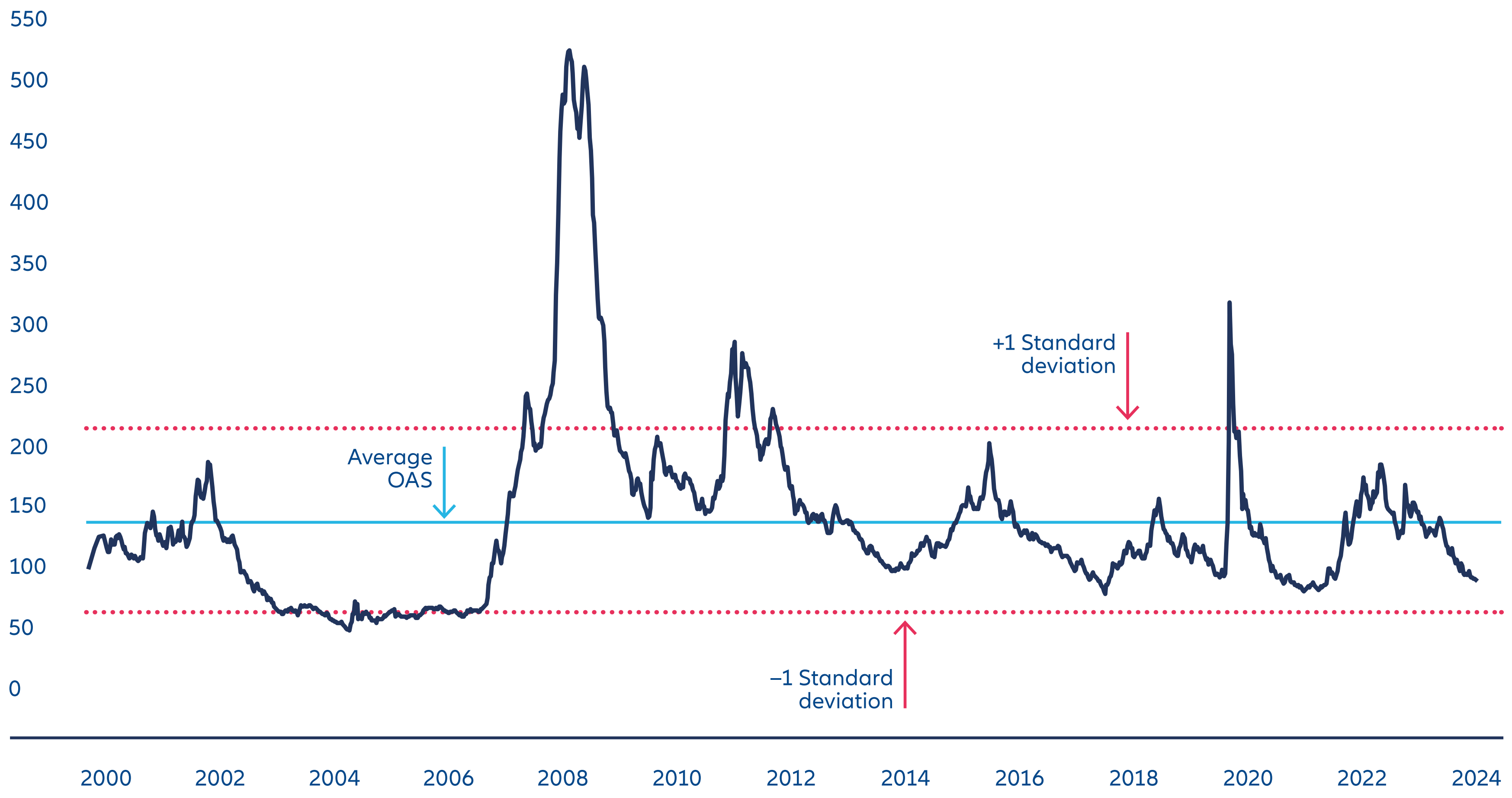

Credit spreads – the risk premium offered by corporate bonds over sovereigns – are looking increasingly expensive versus long-term ranges (see Exhibit 3).

From a macro perspective, hopes of multiple rate cuts in 2024 from the US Federal Reserve and other central banks have faded, even as inflation worries have receded somewhat; consequently, real interest rates have risen and are beginning to put corporate fundamentals under more pressure, especially for high yield issuers.

In addition, there are early signs that corporate pricing power is beginning to weaken as some key engines of US consumer spending lose steam. This makes us wary about adding exposure to credit at this time.

Nonetheless, we are cognisant that history shows that credit spreads may not materially cheapen for some time in the absence of a negative catalyst, such as renewed Fed rate hikes or much weaker US growth prospects.

In the short term, therefore, we see a case for staying invested in investment grade corporate bonds for the attractive “carry” – the income gains made from holding bonds over time – favouring relative value opportunities in financials over industrials. Greater caution, however, is warranted for high yield bonds. When we do see a material widening in credit spreads, this could present an opportunity to add back credit exposure.

Exhibit 3: Corporate bond spreads close to recent lows

Bloomberg Global Agg Corporate Index option-adjusted spread (in basis points)

Source: AllianzGI, Bloomberg, 31 May 2024

Active currency management to play increasing role

Active currency management to play increasing role

One longer-term dynamic we believe fixed income investors need to watch is the potential for active currency management.

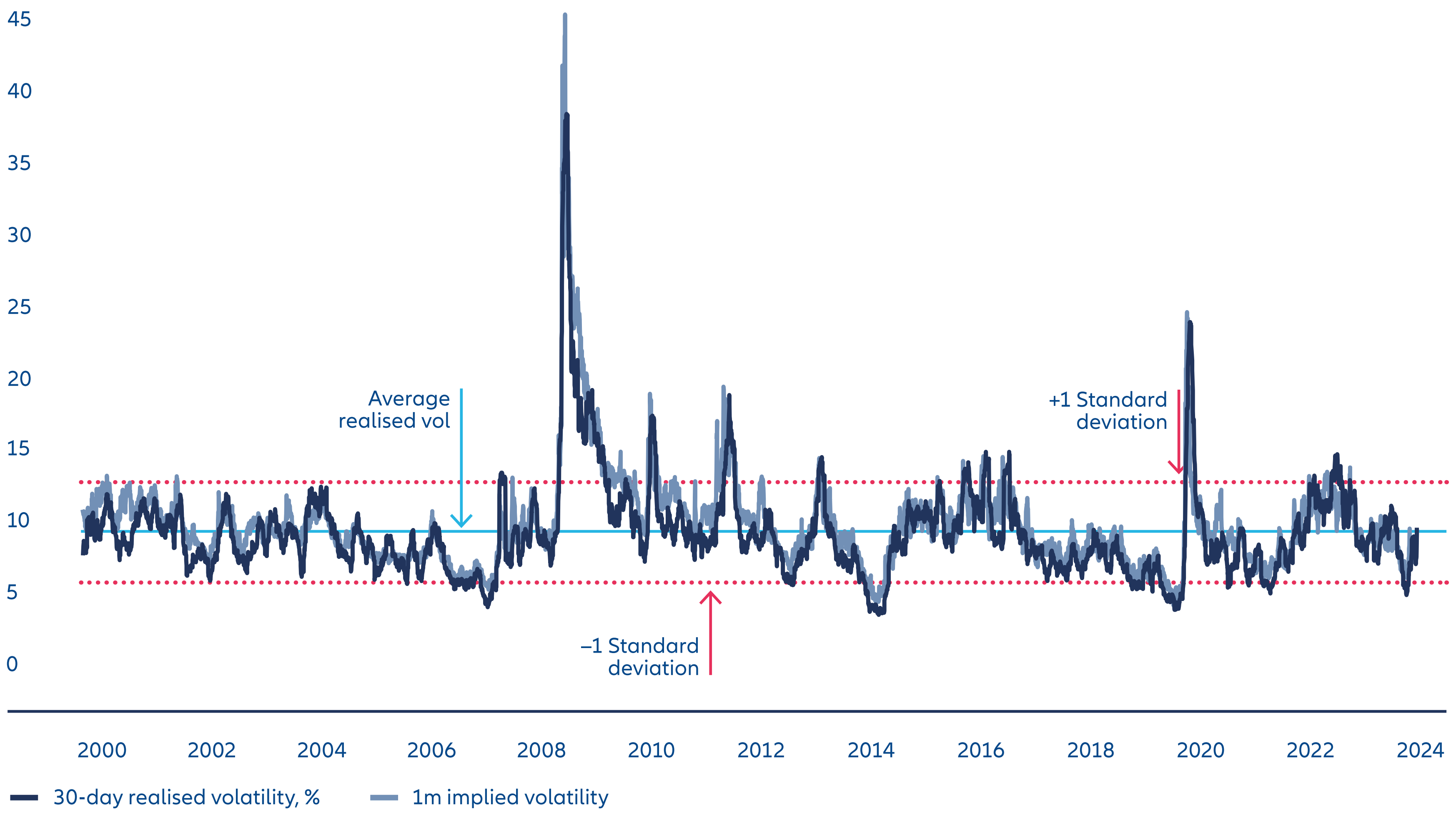

As Exhibit 4 shows, FX markets are currently experiencing a period of relative calm. We expect this to change as economic performance and monetary policy diverge across the major economies.

One of the biggest reasons we haven’t seen this play out yet is the US dollar which, thanks to relative US economic strength and its role in the global monetary system, continues to hover around four-decade highs in real trade-weighted terms. Going forward, we believe that cyclical and structural factors should begin to weigh on the performance of the US dollar. This is the case both over the near term, as US growth outperformance fades versus other major markets, and over the medium term, as US industrial and trade policy objectives erode the “strong US dollar” policy.

We therefore expect active currency management to begin making a larger contribution to returns for fixed income portfolios, especially in the coming months if volatility rises on the back of policy uncertainty as we head towards the US elections in November.

Exhibit 4: Currency calm should subside

Basket of EURUSD, USDJPY, AUDUSD and USDMXN volatilities

Source: AllianzGI, Bloomberg, 4 June 2024