Transforming Infrastructure

Financing Growth with Infrastructure in Latin America

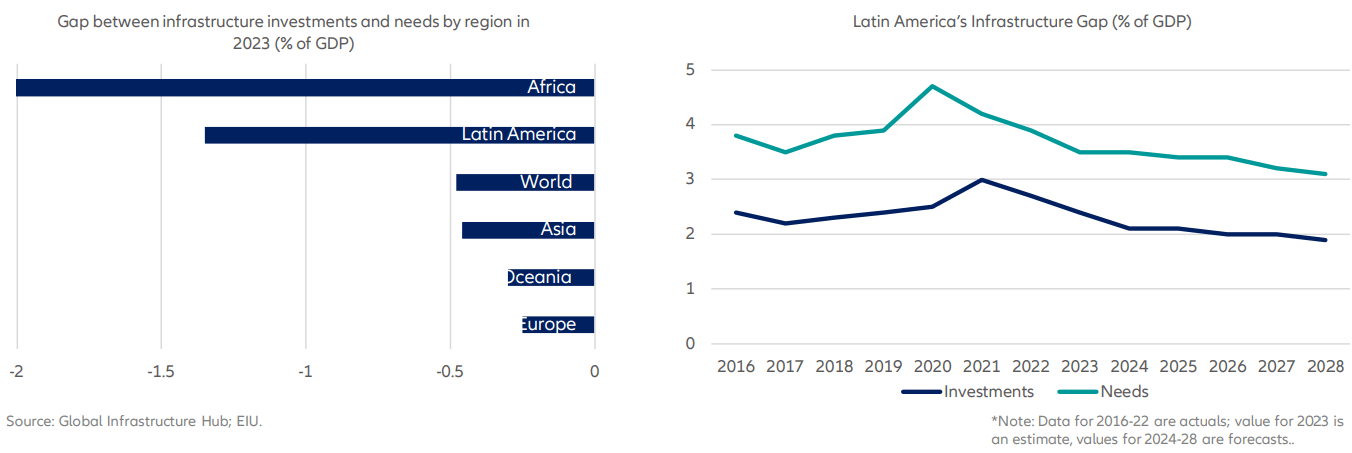

Over 650 million people live in the 33 countries of Latin America that largely differ in terms of their economic development. By 2030, Latin America and the Caribbean need to invest at least 3.12% of its GDP each year1 which amount to approximately $2.2 trillion to expand and maintain the necessary infrastructure in order to meet the Sustainable Development Goals (SDGs).

Infrastructure investments in sectors such as water, electricity, transportation, and communications are essential to Latin America's economic growth and for reaching the SDGs. Driven by rapid urbanization and rising economic activity (+2.2% regional GDP yoy2), the need for infrastructure is substantial. Latin America faces an important infrastructure gap, driven by diverse macroeconomic and political challenges per country, including high inflation (+14.41%) 3, regulatory and bureaucratic hurdles and persistent fiscal deficits that constrain government spending.

Historically, the public sector has funded most infrastructure investments in the region, with two out of every three dollars coming from public sources4. However, a significant increase in public spending on infrastructure is constrained by the region’s fiscal pressures and economic challenges. High levels of foreign debt and U.S. interest rates (Mexico), fiscal deficits (Brazil, Colombia)5, and weakening currencies, further limit Latin American governments’ ability to invest in capex intensive infrastructure projects.

Figure 1 - Latin America's infrastructure gap; Global Infrastructure Hub

The Major Role of Private Capital

With public funding falling short in closing the infrastructure gap, private capital has become a determining source of infrastructure financing in Latin America. Over the past two decades, Latin American governments have increasingly turned to Public-Private Partnerships (PPPs) and other financing models including tax exemptions frameworks to attract private investment.

A notable case is Colombia’s 4th Generation (4G) toll road program, launched in 2014 under the National Infrastructure Development Plan. This ambitious $24 billion initiative spans nearly a decade and involves up to 40 PPPs aimed at delivering a nationwide toll road network.

Revenues under the program are guaranteed by Colombia’s National Infrastructure Agency, enhancing investor confidence. Beyond the pipeline itself, 4G was designed to strengthen local bond markets, attract new financing partners, build domestic investment capacity, and establish greater predictability within Colombia’s PPP legal framework — a critical foundation for long-term private capital mobilization. AllianzGI has supported this framework through the investment in the construction and maintenance of two toll road projects: Pamplona-Cucuta Road (122.5 km) in 2023 and Conexión Norte Road (145.6 km) in 2024.

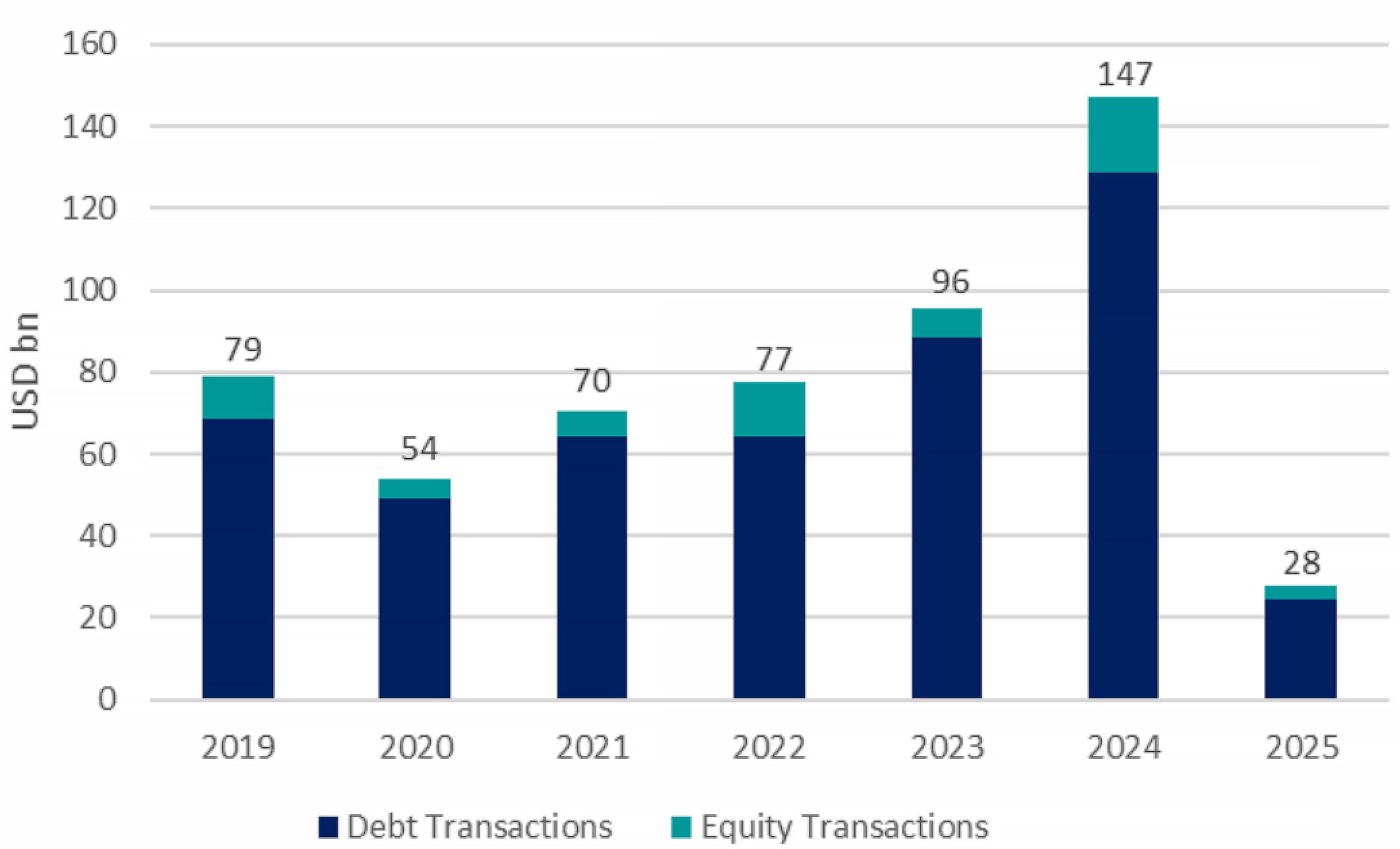

Private debt is a growing source of private funding7, as investors have a preference to be senior in the capital structure, secured by asset collateral and prioritized for repayment offering relatively lower risk. The region has attracted more than $760 billion private capital towards private infrastructure in the last 30 years8. This rising influx of private debt and equity transactions plays an important role in infrastructure development. Beyond providing essential financing, private capital brings expertise in design, risk management, and execution, enhancing the success and long-term sustainability of infrastructure developments across the region.

Figure 2 - Private investment in infrastructure projects, Latin America9

Measuring Performance

Chance for investment premiums in Latin America

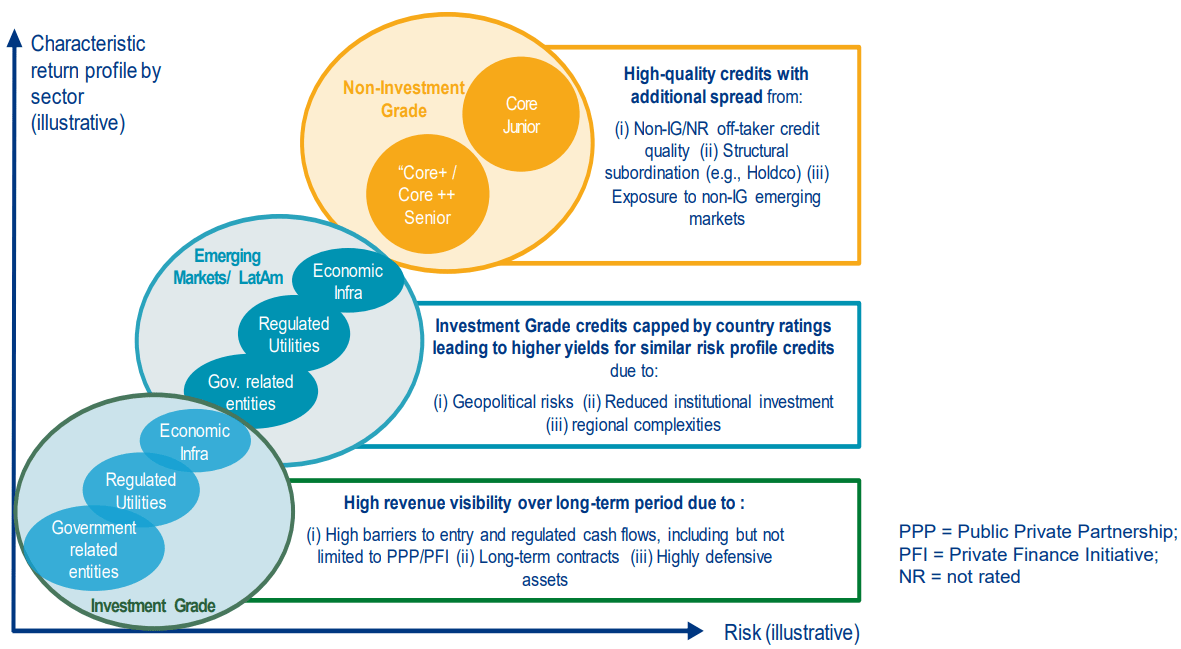

Infrastructure debt is a highly defensive asset class that can offer long-term, stable, and inflation-protected returns thanks to its essential nature, structural protections, and resilience to economic cycles. In Latin America, infrastructure debt presents a compelling opportunity for investors seeking attractive returns with an investment premium. The region’s combination of high sovereign bond rates, constrained liquidity, and structural market complexities contribute to this premium, offering higher yields than similar assets in developed markets10.

The investment premiums in Latin America are driven by several key factors, including geopolitical risks, currency volatility, and regulatory challenges. These risks yielding to higher returns are often mitigated by carefully structured financing arrangements, guarantees, and government or development finance backed initiatives aimed at attracting investor capital. Inflation-protected contracts and regulated revenue streams further shield investors from inflationary pressures, while currency risk can be managed through hedging mechanisms or local currency financing options.

Diversification across risk/return profiles

Latin American infrastructure debt provides a wide spectrum of risk-return profiles, catering to both conservative and high-yield investment strategies. Many Latin American countries, such as Chile (A/A2)11 and Uruguay (BBB+/Baa1), maintain investment-grade ratings with projects featuring risk profiles comparable to those in developed markets but with higher yields, enhancing the asset class’s appeal.

For instance, Chile’s renewable energy sector has attracted significant investment due to its regulatory stability and economic resilience, while Uruguay’s infrastructure benefits from a solid legal framework and steady economic performance. AllianzGI financed a renewables project in Chacao in Chile in 2019 which is upon completion the largest renewables project of the country and contributes significantly to the decarbonization of Chile.

The region also offers higher-yielding opportunities in countries like Colombia (BB+/Baa2), Mexico (BBB/Baa2) and Peru (BBB-/Baa1), where investors can achieve substantial returns with investment grade credits however capped by country ratings. Latin America’s infrastructure needs also span a diverse array of asset types, from traditional concessions to corporate project development, offering flexible, higher-risk and growth opportunities. This variety across risk levels, sectors and technology enables investors to build a well-rounded portfolio across the broad risk-return credit spectrum infrastructure debt offers.

Infrastructure makes real impact

Infrastructure investment inherently has a significant impact, as it brings substantial economic, social, and environmental benefits to the region. These projects improve connectivity, productivity, and quality of life while helping governments meet sustainability goals and supporting corporate development strategies. By creating jobs, enabling businesses to operate more efficiently, and reducing logistical costs, infrastructure investment fosters economic growth in Latin America.

Additionally, these projects create lasting employment opportunities, both in construction and operations, helping to reduce high unemployment (6.1% in the region)2 and stimulate local economies. According to the IDB, each dollar invested in infrastructure can boost GDP by 1.5 times over five years and create 36,000 jobs per $1 million invested in the region13.

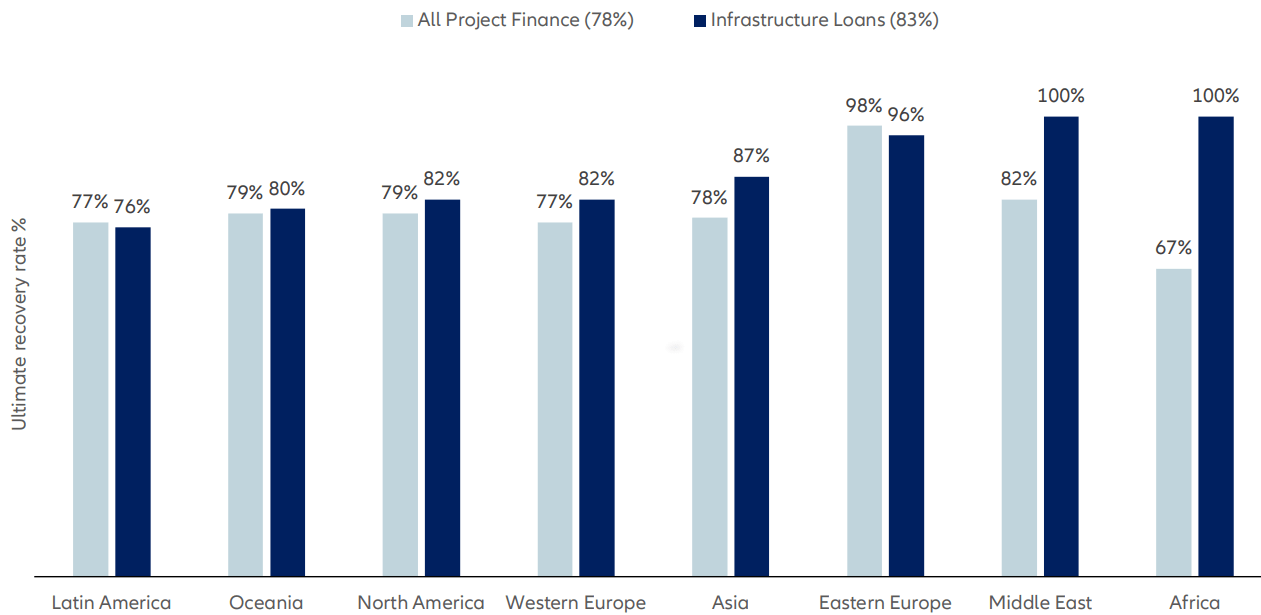

Growing asset class resilience

Infrastructure investment in Latin America faces unique challenges for project finance debt compared to other regions. The region’s reliance on global commodity prices creates economic volatility, affecting government revenue and the stability of infrastructure financial support. Political instability and frequent regulatory shifts increase the likelihood of contract renegotiations and project delays, while lengthy and complex permitting processes often stall progress. Currency volatility further strains projects financed by international debt, as fluctuating exchange rates raise debt servicing costs and reduce revenues. Legal system weaknesses also hinder contract enforcement and extend recovery timelines, complicating debt recovery efforts.

Given the risks outlined above, careful project selection is essential for investors. Transactions require closer scrutiny, and frequent waivers and consents are often part of the process. However, this disciplined approach has proven effective, AllianzGI Infrastructure debt portfolio in Latin America has not experienced a single payment default to date. This underscores the growing resilience of the asset class in the region when key risk parameters are well understood and actively managed.

Figure 3 - Asset Class Risk-Return Credit Spectrum (illustrative), 2025

Case Study – Sea Water Pipeline in Chile, Sustainable Impacts (investment made in June 2024)

AllianzGI is committed to invest in sustainable assets that support the energy transition and help mitigate climate change risk:

- Severe Water Scarcity: Chile has faced its worst drought in a decade, with rainfall dropping 20–40% while having economic activities straining freshwater reserves. The World Resources Institute predicts Chile will experience high water stress by 204014. To fight the latest, Chile aims to cut the mining sector’s continental water use to 10% by 2025 and 5% by 2040 and promote sustainable mining practices15.

- Critical Infrastructure for Sustainability: Seawater desalination plants and pipelines are essential for Chile’s mining industry, reducing reliance on freshwater, supporting sustainable mining, and strengthening the country’s economy.

- Essential Mineral for Energy Transition: Copper is critical for global decarbonization and digitalization targets, key for clean energy and enabling the transition to a low-carbon economy through electrification and renewable technologies.

- Economic Growth and Job Creation: Chile is the largest copper producer globally, supporting the latest industry bolsters the country’s economy by creating jobs, developing infrastructure, and stimulating local communities and related sectors like transportation, manufacturing, and services.

*For illustrative purposes only (no reference to any real strategy, portfolio or product data)

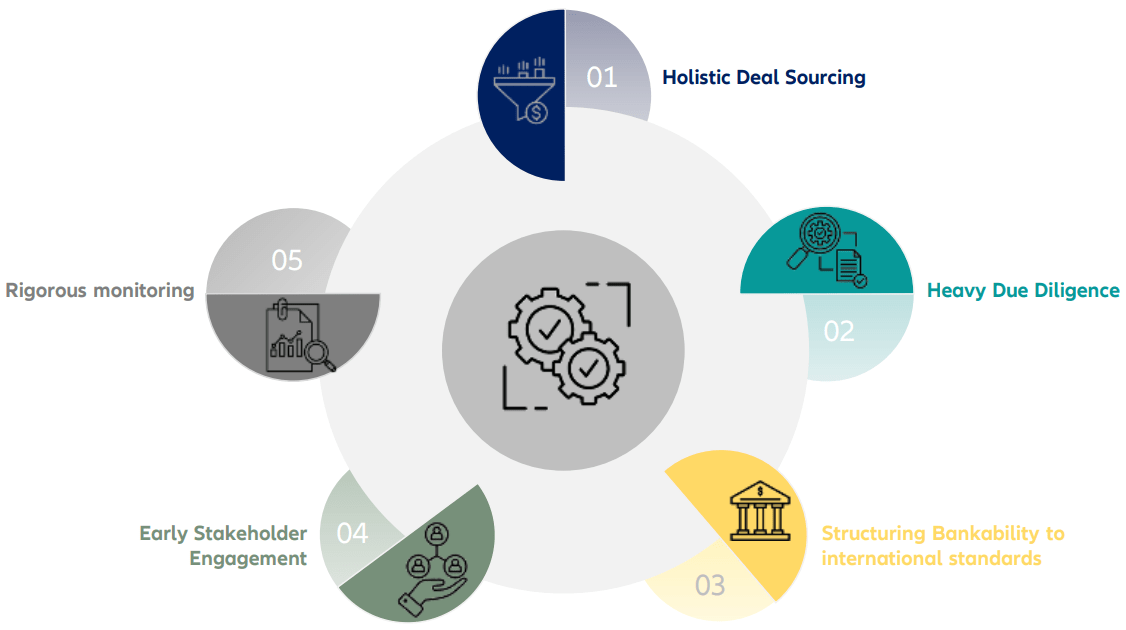

Five Levers for Successful Infrastructure Investments

Successful infrastructure investments in Latin America require a strategic, multi-dimensional approach that aligns with the region's specific economic and regulatory context.

Holistic deal sourcing is essential; successful, long-term investors focus on projects that capitalize on the region’s competitive advantages and support the global energy transition, such as renewable energy and commodities. Sourcing projects that align with short-term policy interests while emphasizing long-term, critical infrastructure is key to creating lasting value.

A thorough understanding of each country’s rule of law and regulatory predictability is crucial for effective sourcing, ensuring that investments remain viable amid political and economic shifts.

Heavy due diligence is important to mitigate risks and align with investor strategies. In Latin America, managers operate within a funnel framework, evaluating many transactions but closing the few that pass rigorous scrutiny. This process emphasizes identifying long-term risks, often requiring local expertise and partnerships with reputable contractors, legal advisors, and other project finance stakeholders. Careful assessment of political, regulatory, and financial risks helps investors anticipate shifts that could impact project lifecycles, ensuring a comprehensive risk management approach.

Figure 4 - Infrastructure defaults by region, S&P, 2024

Figure 5 - Infrastructure and other project finance debt by region, Moody’s (10-year cumulative investment 2020), 2020

Structuring bankable deals with robust international standards allows project viability in Latin America. Deals typically include comprehensive covenant packages addressing contractor terms, technology standards, insurance coverage, and strong termination clauses to protect investors in adverse scenarios. Enhanced guarantees, robust security package, and step-in rights offer additional protection during financial or operational disruptions. Partnerships with development finance institutions further enhance projects’ stability and credibility, improving credit ratings and facilitating financing.

Proactive engagement with stakeholders, from regulators to community leaders, significantly reduces approval and permitting timelines and builds critical support and alignment of interest among counterparties. Proactive engagement with local communities is especially important in areas with environmental or social sensitivities, as gaining their endorsement also prevents delays from opposition or protests.

Finally, rigorous monitoring during construction and maintenance ensures asset performance, controls costs, and keeps the project’s permitting process on track, allowing for early detection and resolution of potential issues. Engaging qualified contractors during maintenance sustains asset quality over time. Consistent quality control throughout both phases ensures compliance with technical and environmental standards, supporting long-term success and reliable returns.

Conclusion

Infrastructure debt investment in Latin America hence can offer a compelling combination of attractive financial returns, diversification strategies, and meaningful social and economic impact. Private investment, particularly through debt financing, has been essential in bridging the region’s infrastructure gap, enabling critical development in sectors like transportation, energy, and water. Navigating the region’s unique challenges requires a disciplined approach, including thorough due diligence, robust risk management, and strategic engagement with local stakeholders. With the right strategies, investors can capture substantial returns while contributing to long-term, sustainable growth in the region.

1 Latin America & the Caribbean Infrastructure investment: closing gaps

2 Including Caribbean, World Bank 2022-2023.

3 Including Caribbean, Inflation rate compared to previous year, Statista 2024.

4 Infralatam, 2019

5 Regional combined fiscal deficit of 4.7% of GDP 2024e, Fiscal Monitor Report, IMF 2024.

6 gih_infrastructuremonitor_2023_private_investment.pdf

7 Most Active Private Credit Investors in LATAM, Cascade 2023; Challenges to infrastructure financing in Latin America, IDB 2024.

8 Including Caribbean - IDB “New Report Highlights Advances in Public-Private Partnerships in Infrastructure in Latin America and

the Caribbean”, October 2024.

9 Including project and corporate finance deals, excluding beyond infra sector; IJ Global Database, 2019-2025

10 Experience AllianzGI’s investment team gained on investments from 2013-2024.

11 S&P and Moody’s respectively.

12 International Labor Organization Report, 2024

13 Sustainable-and-Digital-Infrastructure-for-the-Post-COVID-19-Economic-Recovery-of-Latin-America-and-the-Caribbean-ARoadmap-to-More-Jobs-Integration-and-Growth.pdf

14 Ranking the World’s Most Water-Stressed Countries in 2040 | World Resources Institute

15 2050 National Mining Policy