Summary

The risk/reward profile of corporate bonds is less attractive now than when the coronavirus crisis began. Since then, bonds from higher-rated firms have been buoyed by central bank support. As the credit cycle turns, we suggest prioritising both issuer and security selection to seek outperformance – potentially with fallen angels and secured bonds.

Key takeaways

|

According to the Bank for International Settlements, 50% of firms globally may have insufficient cash flows to cover debt-related and operating expenses for 2020. This may push many credit investors higher up the rating spectrum as they seek to avoid potential distress in lower-quality credits. However, such an approach brings two main risks to performance.

- First, many of these higher-rated bonds are already back to trading close to par, or their full value. This means their prices are less likely to appreciate further, so investors may only get returns from the bonds’ coupon payments.

- Second, high-yield investors may run the risk of not earning the full yield-to-maturity because issuers can “call”, or redeem earlier, a large share of bonds to refinance the debt at lower rates.

One possible solution is to invest selectively in so-called “fallen angels” – issuers that have been downgraded to high yield, but which may go on to regain investment-grade status.

Seek out selective and defensive exposure to fallen angels

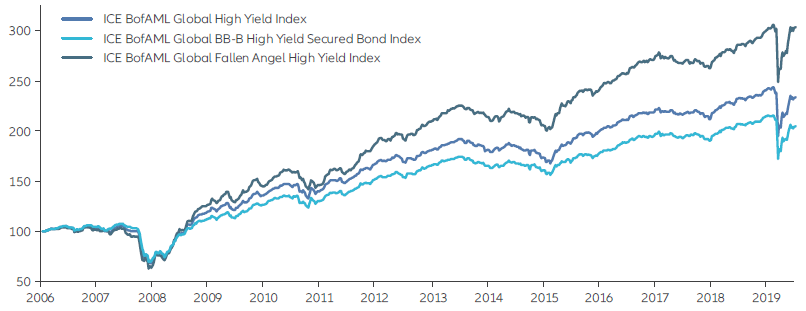

Fallen angels consist largely of non-callable bonds that may offer relative value, in the sense that they trade at deeper discounts than would be suggested by their credit fundamentals and peers. Historically, fallen angels have outperformed the broader high-yield market, as illustrated in Chart 1.

Chart 1: Over time, “fallen angels” have done better than high-yield bonds in general

High-yield bond total returns (in %; weekly data; rebased to 100, December 2006 to July 2020)

Source: Bloomberg, ICE BofAML indices, Allianz Global Investors. Data as at 10 July 2020. See disclosure for index definitions.

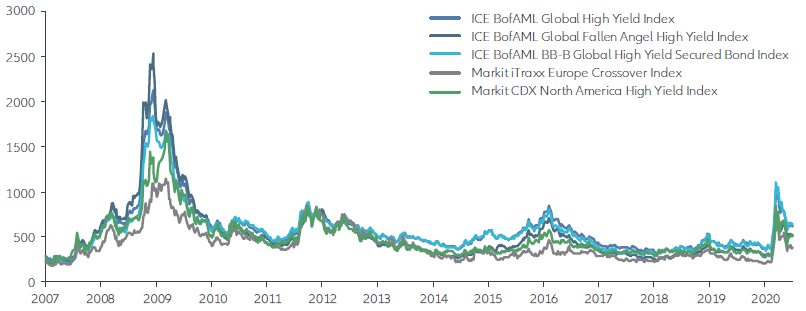

However, fallen angels in aggregate may not be offering quite as much value as they have in the past. As Chart 2 shows, fallen-angel credit spreads have not widened, or “cheapened”, as much in the current crisis as in 2008-2009, indicating that these issuers may offer less relative value than they did in the past. One possible factor behind this has been the unprecedented move by central banks to buy, or accept as collateral, bonds issued by fallen angels. By pushing up the prices of these bonds, this form of systemic stimulus can mask the remaining risks that are specific to each firm, and it can cap the potential for excess returns from fallen angels as a group. Research shows that only around one quarter of fallen angels make it back to investment grade, so it’s important to take a highly selective approach when investing in these securities.

Chart 2: Credit spreads have not widened as much as in the 2008-2009 crisis

High-yield bond & CDS spreads (basis points; weekly data; December 2006 to July 2020)

Source: Bloomberg, ICE BofAML and IHS Markit indices, Allianz Global Investors. Data as at 10 July 2020. Bond spreads are option-adjusted (eg, to account for the early redemption risk of callable bonds) and indicate the yield difference between corporate bonds and equivalent-maturity government bonds. CDS index spreads indicate the price investors pay to insure against any of the index constituents failing to pay their debt. See disclosure for index definitions.

Moreover, a defensive way to add to or to hedge fallen-angel exposure is through “long” or “short” positions in corporate credit-default swap (CDS) indices. Long positions on these exchange-traded derivatives gain in value when there is an improvement in credit quality in the underlying unsecured bonds (which are insured against default by CDS contracts). CDS indices are relevant because fallen-angel and crossover securities tend to dominate CDS markets more than lower- or higher-rated securities. Also, CDS indices are usually more liquid than cash bonds, which can help CDS outperform as credit conditions improve.

There is value within the secured bonds universe

Secured bonds offer an alternative way to add relative value to credit portfolios, even if the segment may not look that attractive at first glance. Chart 1 shows that secured bonds have underperformed the fallen-angel universe and broader high-yield bond market – which are made up of approximately 5% and 20% of secured debt, respectively.

Intuitively this makes sense. Secured bonds offer greater loss protection, so they should command a lower risk premium. They have seniority over unsecured bonds and are collateralised with company assets and other guarantees – which has historically given them much higher recovery rates (more than 65%) in the event of default. For example, when an issuer is downgraded from a BB to a B rating, its secured bonds can trade at credit (risk) spreads as much as 200 basis points lower than their unsecured counterparts. Moreover, secured bonds have shorter duration on average, which can help smooth the impact of longer-term volatility in interest rates and spreads.

We think it’s particularly worthwhile to look at secured bonds now because major credit downturns usually prompt companies to pledge various forms of collateral in order to attract financing, potentially making their secured bonds even more attractive. For instance, in 2009, following the global financial crisis, the proportion of new corporate debt accounted for by secured bonds rose by several multiples year-on-year. This credit-cycle downturn has been similar, with April marking a record high so far in the volume of secured bonds issued globally each month.

However, unlike in 2009, credit spreads today more closely resemble those of the broader high-yield market. This means that on a loss- or recovery-adjusted basis, there will likely be bargains to be found within the secured bonds universe. This may be because many investors remain cautious, perceiving the increased issuance of secured debt as predominantly a sign of distress. But in a crisis as deep as the current one, healthier issuers are just as likely to issue secured debt as those that go on to default. Experienced credit managers with large research teams can often buy high-quality secured bonds at much higher-than-usual yields, especially in the primary market.

Since March this year, we have seen at least two examples of new secured bond issues that subsequently paid off on a relative value basis.

- One firm with a B rating was under pressure to fund cash needs and refinance bank loans, so it issued new secured bonds at double-digit yields more typical of CCC rated debt.

- Another high-yield issuer needed to pay down existing unsecured bonds that carried higher coupons, so it tapped the primary market with secured bonds that were rated investment-grade but actually yielded more than comparable securities.

Both issuers had at least one common characteristic: they did not issue as much secured debt in good times, leaving unencumbered assets at hand to pledge as collateral in bad times. A healthy loan-to-value ratio – ie, a relatively low level of debt compared to a company’s secured assets – became an important metric to consider when future earnings visibility vanished as economies went into lockdown.

Whether or not the credit rally continues, focus on relatively undervalued assets

Looking ahead, the risk-reward balance in corporate credit remains attractive, even if less so than in the first quarter of 2020. Higher-quality high-yield credit may be more skewed to income than capital gains for now, but we still see significant upside and lower downside in select fallen angels and secured bonds. Focusing on relatively undervalued assets may be more likely to deliver outperformance, whether or not the credit rally continues.

If credit spreads tighten further, identifying value relative to equivalent securities could help enhance returns for investors who feel they have missed out. Alternatively, if a “V-shaped” recovery does not materialise, repeated spread widening should push investors to prioritise liquidity and loss mitigation. Multi-sector and high-yield strategies – with a selective and defensive profile – have the potential to outperform in both scenarios.

1252414

Active is: Sharing insights

3 ideas for investors seeking diversification and growth potential

Summary

After months of strong outperformance, US markets may face new challenges, including a resurgent coronavirus and political uncertainty. Our US Investment Strategist has three ideas for investors seeking diversification and growth potential: sustainable investing, private-market debt, and securities in Asia and Europe.

Key takeaways

|

-

Investing involves risk. Duration is a measure of the sensitivity of the price of a bond to a change in interest rates. ICE BofAML Global High Yield Index tracks the performance of USD, CAD, GBP and EUR denominated below investment grade corporate debt publicly issued in the major domestic or eurobond markets. ICE BofAML Global Fallen Angel High Yield Index is a subset of ICE BofAML Global High Yield Index including securities that were rated investment grade at the point of issuance. ICE BofAML BB-B Global High Yield Secured Bond Index is a subset of ICE BofAML Global High Yield Index including all secured securities rated BB1 through B3, inclusive. The Markit iTraxx Europe Crossover Index comprises 75 equally weighted credit default swaps on the most liquid sub-investment grade European corporate entities. The Markit CDX North America High Yield Index is composed of 100 non-investment grade entities, distributed among 2 sub-indices: B, BB. All entities are domiciled in North America. It is not possible to invest directly in an index.

The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.