Achieving Sustainability

COP 29 Review - is COP burnt out?

COP 29 closed amid comparisons with an equally acrimonious COP 15 in 2009. The tripling of climate finance commitments merely masks heightened tensions between developed and developing nations, evident ambition gaps, and ongoing absence of detail. In short, the COP format appears increasingly unable to match the 2015 Paris Agreement ambitions.

Key takeaways from COP 29:

- Increased climate finance lacks ambition and detail. The new USD 300 billion target of climate finance for developing countries by 2035 represents a tripling of the previous goal. However, USD 300 billion falls significantly short of the needs and expectations of developing countries, and lacks detail on the “wide variety of sources” of this financing.1

- Incoming US administration was used to barter. The possibility of another US exit from the Paris Agreement next year cast a shadow, and was an active lever in moderating the demands of the developing nations. Amid this uncertainty some form of deal, however inadequate, was favoured over no deal.

- Will climate transition move East? China remains classified as a developing country by the UN, and therefore falls outside the expectations of developed economies on climate. As both the world’s largest greenhouse gas emitter and largest investor in clean energy, China’s reach into both the Global North and Global South could be influential for climate in coming years. Despite its low profile at the conference China could quietly drive progress amid fractures in the Global North’s approach to climate, especially if it is “elevating” ties with Brazil – the host country of COP 30.2

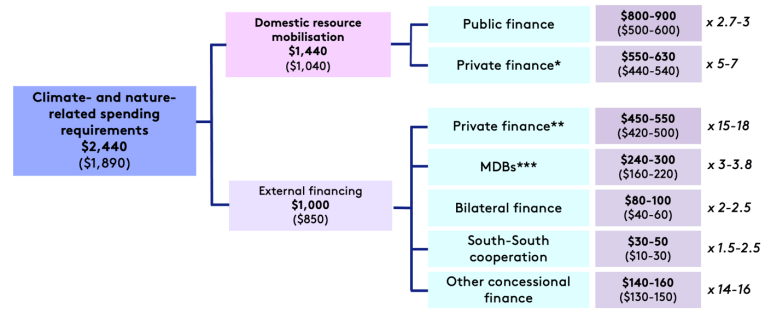

- Private finance expected to step up. The conference concluded with the aim of raising USD 1.3 trillion of total annual climate finance “from all actors” by 2035. We await more detail next year, but it is evident that a sizeable onus will lie on the private sector (see Exhibit 1). At both conferences, the private sector appeared much more engaged to lead the transition, and is the more likely source of innovative finance and solutions. The Digitalisation Day at COP 29 highlighted ways to bridge climate gaps with private financing.

- A boost for carbon markets, but many questions remain. On the private finance theme, a rare positive development came with an agreement for carbon market standards. The announcement of new standards set the rules to develop a robust, transparent, and reliable voluntary carbon trading market, with an estimated USD 250 billion saving for global climate plans. However, there is much work to be done on strengthening governance on standards, assurance, and transparency.

- The health of the transition. The climate impact on human health and the need to integrate this into commitments were recognised, with the creation of a new Continuity Coalition for Climate and Health. The conference’s reach into social topics is welcome, ranging from education to adapt and upskill for the transition, and a strong focus on gender, children, and local community rights.

- The fading relevance of COP. The combination of the underwhelming biodiversity and climate conferences this year has fuelled the view that COP is “no longer fit for purpose”3. COP 30 is scheduled for November 2025, while COP 17 is scheduled for July 2026. However, as outlined in the open letter signed by multiple signatories, without major reform both these and future events are likely to be beset by perennial headwinds. The heat is already on for Brazil to deliver a different outcome

The failure of another COP meeting to achieve an ambitious climate agenda may well galvanise private finance, and possibly China, to more proactively take on climate leadership. In spite of political noise, there is recognition from private finance and from China in particular, that innovative climate and financing solutions and genuine engagement on physical risks, planetary and social topics can simply be good business.

Exhibit 1 – Mobilising financing for emerging markets and developing countries (EMDCs) ex China by 2030

(USD billion per year by 2030*)

* Increment from current figure in parentheses

Source: Grantham Research Institute on Climate Change and the Environment, 2024

1 UNCC, New collective quantified goal on climate finance, Draft decision -/CMA.6. Proposal by the President, page 2, 8a, 24 November 2024

2 The National Committee, of the Chinese People’s Political Consultative Conference, China, Brazil decide to elevate ties in Xi, Lula meeting, 21 November 2024

3 Club of Rome, Open letter on COP reform to All States that are Parties to the Convention, 15 November 2024