Active is: Thinking sustainably

Beyond climate: it's time for investors to protect biodiversity

Summary

Part one of the latest UN Biodiversity Conference ended with optimism that biodiversity can be put on a path to recovery by 2030. It has never been more important for investors to play a role in protecting and promoting the world’s natural capital.

Key takeaways:

- Biodiversity is falling fast due mainly to human activity, with little action being taken to tackle the crisis

- There are reasons for optimism regarding biodiversity, as it’s not too late to tackle the crisis and there is every chance of political consensus for action

- Investors can play an important part by integrating biodiversity factors into their investment processes and backing innovators

While the 2021 United Nations Climate Change Conference, known as COP26,1 needs no introduction, its “biodiversity” equivalent is less known. Yet the UN Biodiversity Conference that began in October 2021 (CBD COP-15)2 is equally important and set new goals for the natural world. At last, the biodiversity crisis is moving out of the shadow of climate change with which it is interlinked. It’s not a moment too soon, as the pressure on our ecosystems is increasing exponentially.

Can we imagine our Earth without biodiversity? Indeed, what will happen if we continue to underestimate all that nature provides us with?

We believe that climate change and biodiversity loss should be tackled together, and that sustainable finance can help to tackle both. They both classify as “planetary boundaries” – the nine boundaries that humanity must respect and protect to maintain life on Earth. This article addresses the importance of integrating biodiversity into investment strategies by defining the concept, the extent of biodiversity loss, the associated challenges and the role that investors can play.

What is biodiversity?

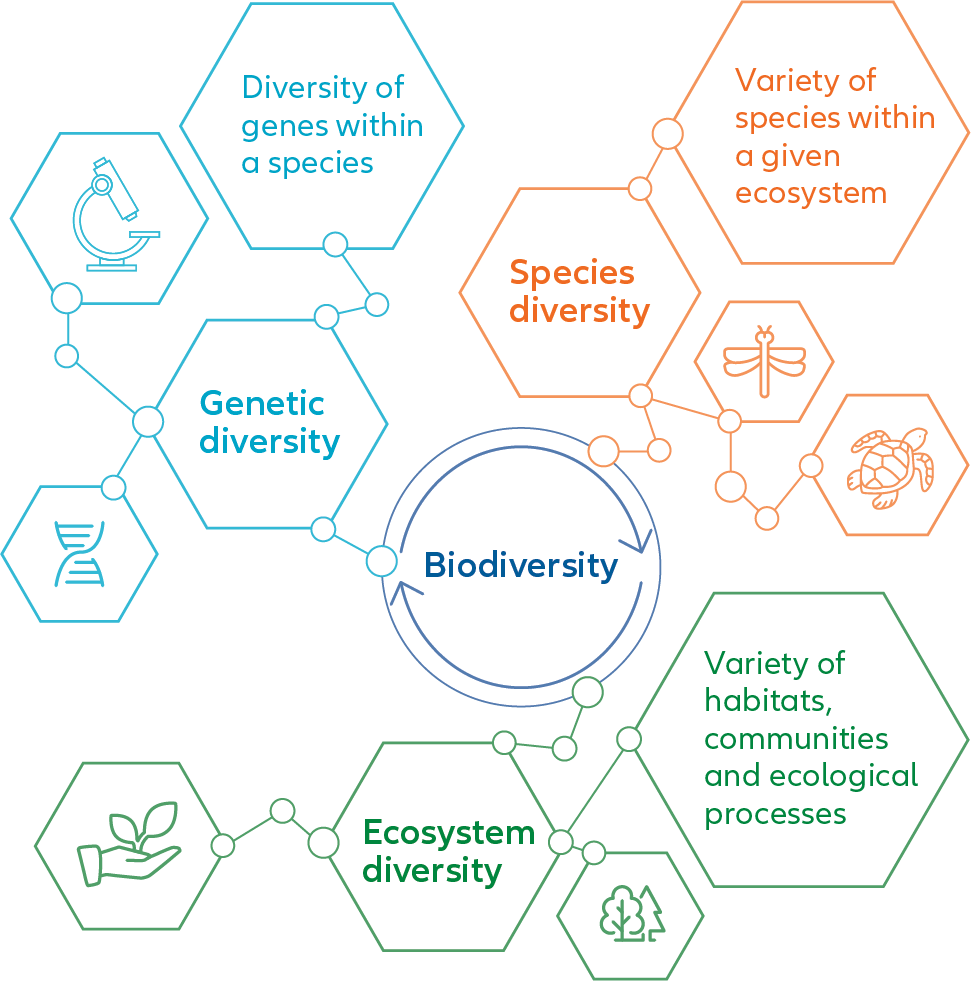

An extensive variety of plant and animal life in the world is considered vital for life as we know it – a concept that’s known as biodiversity.3 More specifically, this refers to the variety of life on Earth at three interdependent levels: diversity within species (genetic diversity), between species (species diversity) and between ecosystems (ecosystem diversity).

Why is biodiversity in crisis?

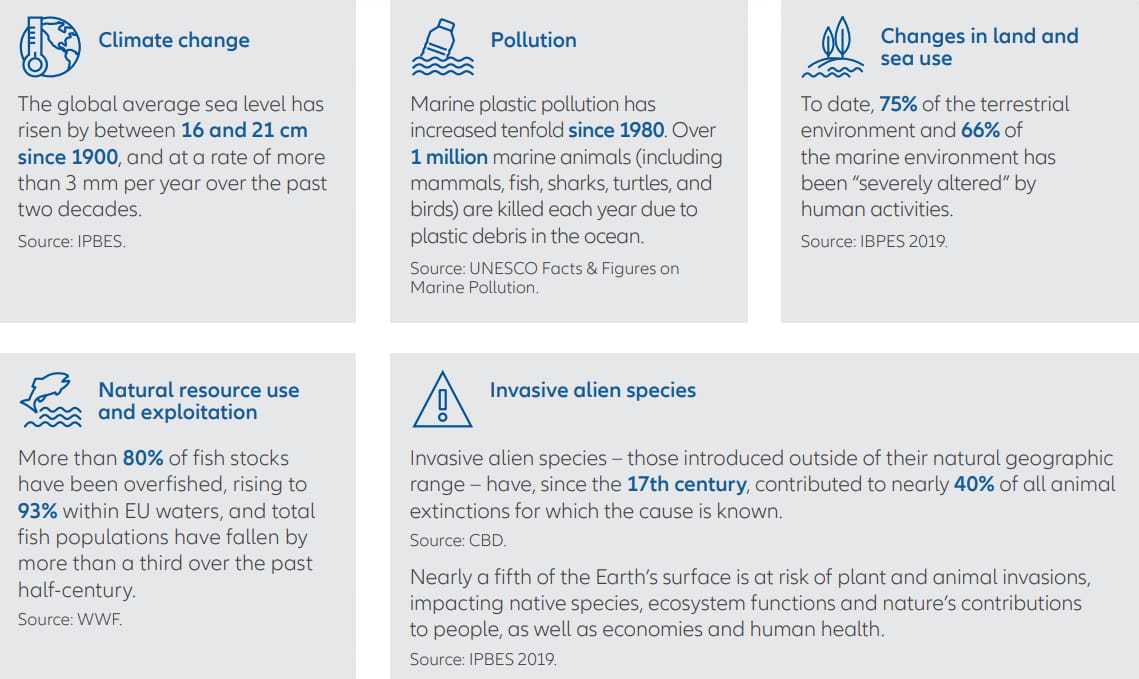

At this point in time, we are in an era of unprecedented biodiversity decline. More than one million species are under threat, plastic pollution threatens about 66% of the marine environment and plant species have declined by about 50%. Human activity is mostly to blame, with the main causes being changes in land and sea use, direct exploitation of organisms through activities such as fishing, widespread pollution, the introduction of invasive alien species and climate change, according to the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES).

We are exploiting Earth’s resources faster than it can replenish them. The good news, though, is that there is still time to reverse the trend for future generations.

Essential services for human society

Biodiversity is about more than just the species we consider rare or threatened: it encompasses the food we eat, the oxygen we breathe, the medicinal plants that heal us and the clean water we drink. In fact, the continuing loss of biodiversity directly threatens human health and increases the risk of future infectious diseases emerging. We owe everything to nature.

More broadly, biodiversity loss is slowing progress towards the United Nations Sustainable Development Goals (SDGs), according to the IPBES Global Assessment Report on Biodiversity and Ecosystem Services.4 Thirty-five out of 44 SDG sub-targets are impacted by biodiversity loss, including those related to poverty, hunger, health, water, cities, climate, oceans and land. Biodiversity is, therefore, not a pure ecological issue – it has significant social, security and economic implications.

The threat to drug discovery

Did you know that medicines like aspirin, morphine and penicillin come from wild plants? According to the World Health Organization, about 60% the world’s population depends on traditional medicines and 85% of that medicine originates in plants.5 Indeed, plants have been used to successfully treat human disease for many years, and have yet more potential that has not yet been exploited. So, biodiversity loss directly threatens new drug and treatment discovery.

Contributing to climate change mitigation

Indeed, the challenges of climate change and biodiversity are intertwined. “We can’t be net zero unless we are nature positive,” explains David Craig, co-chair of the Taskforce on Nature-related Financial Disclosures (TNFD), which was launched in June 2021. Healthy ecosystems help to mitigate climate change and limit global warming by delivering carbon storage benefits, soaking up greenhouse gas emissions and considerably reducing natural disasters. For example, oceans that cover about 70% of the Earth’s surface make our atmosphere breathable and mitigate global warming by capturing approximately 30% of CO2, absorbing over 90% of excess heat and absorbing up to 50 times more CO2 than our atmosphere.6

The financial cost of less biodiversity

Turning to the economy, more than half of the world’s USD 44 trillion GDP depends on nature, according to the World Economic Forum. Consequently, a decline in so-called natural capital risks significant damage to the global economy.

From medicines to raw materials, food to tourism – businesses across all sectors depend directly or indirectly on nature and ecosystem services, as the ravages of the Covid-19 crisis have shown. The increasing pressure on nature directly threatens the continuity of businesses and their value chains, especially for agriculture, forestry, tourism and fishing. Rethinking their role of these sectors, and increasing their resilience, has become essential.

By exceeding planetary limits, we are disrupting the functioning of ecosystems, limiting our access to its vital natural services and magnifying our vulnerability to natural disasters. Despite growing awareness of this, the actions taken so far seem out of step with the reality. Progress remains limited. This is partly because people are disconnected from nature and do not recognise its value.

Scientists have sounded the alarm for decades, but the biodiversity crisis remains largely underestimated. Biodiversity is a complex concept; many people do not understand how human activities directly impact our natural capital and, therefore, are not concerned by the extent of its loss.

A key challenge: measuring ecosystem services

As the saying goes: you treasure what you can measure. But the measurement of “ecosystem services” provided by biodiversity is challenging. While there are many proposed indicators and variables, there’s a lack of consensus about how to put a “price label” on nature’s services and the cost of biodiversity loss. Agreement is important, however, as it would help corporates to make biodiversity commitments and inform investors in their decision-making.

The TNFD’s launch in the summer of 2021 marks an important milestone, as it establishes an international reporting framework that will allow investors to better understand nature-related risks, impacts and opportunities. Through its framework, the TNFD is expected to replicate the success of the Taskforce on Climate-related Financial Disclosures (TCFD), which has successfully promoted the issue of climate-related risks in finance.

Expecting a coordinated policy response

Despite all international initiatives and accumulated scientific knowledge, the world community has failed to address the biodiversity crisis. Simply put, the topic has not captured the same political attention as climate. Yet this is changing as awareness grows, especially following the failure to meet the 2010 Aichi targets.7 As a result, a coordinated policy response is expected. We think policy makers should present a clear roadmap with achievable targets. It is, therefore, essential to support an ambitious political agreement at COP-15 for biodiversity, where the draft of the post-2020 global biodiversity framework8 should be adopted. The framework proposes four goals to achieve a 2050 shared vision of “living in harmony with nature” and is expected to provide the level of ambition needed to halt biodiversity’s decline.

Aligning climate and biodiversity ambitions through investment

How investors can engage with companies to influence change…

Investors have an opportunity to lead the transition towards a nature-positive system. As risks associated with biodiversity degradation can directly reduce financial returns, we believe that it is key to consider biodiversity-related aspects in the investment process. This can be done by ensuring that companies formalise commitments to protecting biodiversity and apply them consistently in their operations.

We consider it important to apply exclusion criteria early in the investment process for severe controversies, using the United Nations Global Compact (UNGC) framework,9 and to engage with investee companies when necessary.

Responsible investors can require more disclosure from companies about their impact on natural resources. Although it is still difficult to get information, doing so is essential for raising companies’ awareness of the need to protect ecosystems. With planetary boundaries as one of our core sustainability themes, Allianz Global Investors is committed to increasing our engagement on biodiversity in parallel with the ongoing developments related to data availability.

…and how they can invest for impact

There is also an opportunity to back the innovative companies protecting biodiversity. This includes solutions for carbon sequestration, the circular economy or regenerative agriculture. The UN Convention on Biological Diversity, in the new global biodiversity framework, has highlighted that “adequate financial resources to implement the framework are available and deployed, progressively closing the financing gap up to at least USD 700 billion per year by 2030.”

Additionally, impact investing10 has an important role to play in investing to protect biodiversity, not least as financial flows are redirected away from harmful hydrocarbon and agriculture subsidies, estimated at USD 500 billion per year.11

Urgent rallying cry

Awareness of biodiversity's crisis is finally growing. As scientists have warned for many years, the challenges of climate change and biodiversity are interlinked. Both represent threats to the wellbeing of human society that must be tackled urgently.

As investors everywhere consider the question of how to invest sustainably, biodiversity has an important part to play in the answer. Protecting and nurturing the Earth's natural resources is clearly essential for the environment and society. It will also help manage portfolio risks and create investment opportunities that drive real change

Footnotes:

1The 26th session of the Conference of the Parties (COP26).

2The 15th session of the Convention on Biological Diversity (CBD COP-15).

3Biodiversity, or biological diversity, is defined by the Convention on Biological Diversity (CBD) as “the variability among living organisms from all sources including, inter alia, terrestrial, marine and other aquatic ecosystems and the ecological complexes of which they are part; this includes diversity within species, between species, and of ecosystems.”

4ipbes_global_assessment_report_summary_for_policymakers.pdf

5World Health Organization https://www.who.int/news-room/fact-sheets/detail/biodiversity-and-health Farnsworth et al. 1985

6Source: IPCC

7In 2010, Parties signatory to the Convention on Biological Diversity adopted the “Aichi targets”, a set of 20 global targets under the Strategic Plan for Biodiversity 2011-2020.

8The UN Convention on Biological Diversity (CBD) released in July 2021 the draft of the post-2020 framework that will be adopted in the 2nd part of the COP-15, to define targets and pathways to preserve and protect nature and its essential services for the next decade and beyond.

9Biodiversity is considered in principles 7, 8 and 9 of the UNGC.

10Impact investing: the third dimension (Matt Christensen) Impact investing | Allianz Global Investors (allianzgi.com)

11OECD, based on fossil-fuel subsidies and government support to agriculture that is potentially environmentally harmful https://www.oecd.org/environment/resources/biodiversity/Executive-Summary-and-Synthesis-Biodiversity-Finance-and-the-Economic-and-Business-Case-for-Action.pdf

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

Summary

Engagement with portfolio companies is a central tenet of our active investment approach. A new series – Stewardship Principles – will outline the way we work with the companies we invest in to promote best corporate governance practice and collectively work towards environmental and social transformation.

Key takeaways

|