“Market conditions have become more conducive to tactical and relative-value positioning, seeking to profit incrementally from cross-country and cross-asset spread moves across the yield-curve spectrum.

Once inflation and core rates stabilise, we see spread assets following soon after.“

Franck Dixmier

Global CIO Fixed Income

Fixed-income strategy: time to re-engage with markets in 2023?

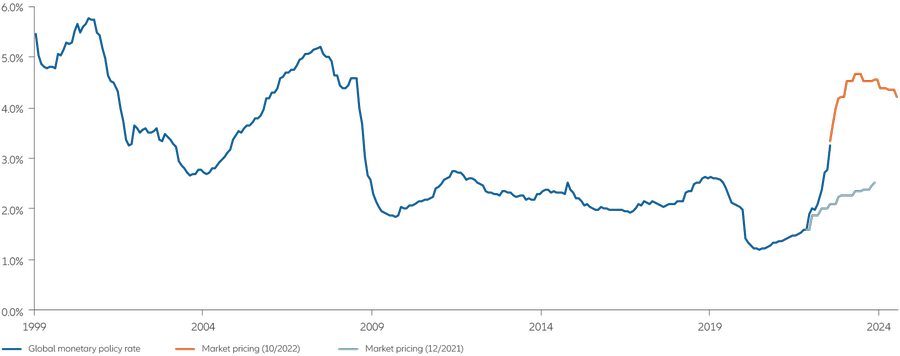

After such a historic reset in global bond markets, a key question in investors’ minds is how to re-engage with fixed income going into 2023. The macro picture remains challenging. Core inflation may prove to be stickier than previously anticipated, although as economies slow down, the headline inflationary uptrend is likely to ease somewhat. But tail risks still lurk. Markets may have misjudged monetary policy on two fronts: first, the level at which rates will have to rise, and stay for some time, to stabilise and bring down inflation; and second, the extent to which quantitative easing through asset purchases will have to be wound down.

Going forward, we expect central banks will be hard-pressed to shake off any market perception of their role as “bond market-makers” or “fiscal-policy underwriters” of last resort. As expectations around liquidity and “fiscal dominance” come to an end, expect bouts of market volatility to be the dominant feature of the months ahead.

Our proprietary leading indicators forecast that global growth continues to run below its trend rate over the coming months. A global recession is increasingly likely, given headwinds from tightening financial conditions and the squeeze in household real incomes. For emerging-market economies, where inflation is showing early signs of moderating and many central banks are close to the end of their tightening cycles, the sharp appreciation of the US dollar and a squeeze in global dollar liquidity are unhelpful.

Consider investments aimed at minimising rate, spread and currency volatility

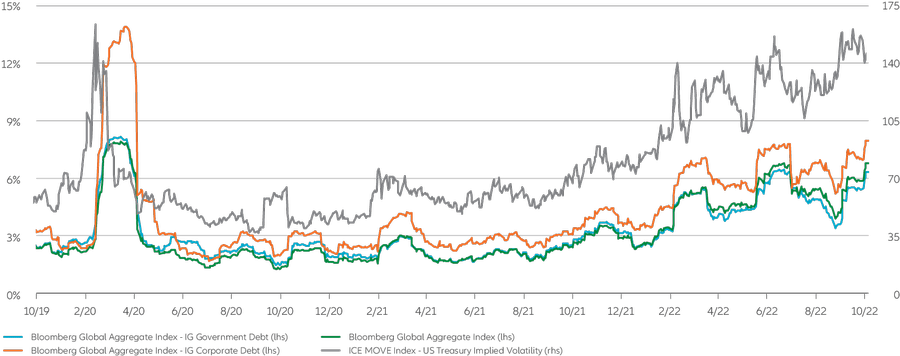

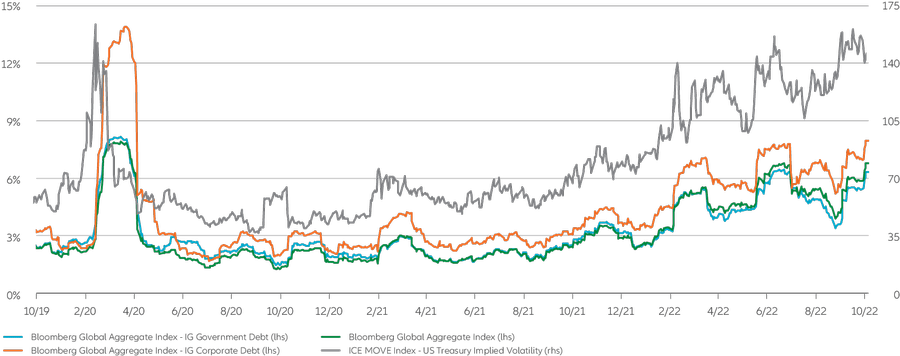

While the outsized sell-off in UK government debt in October 2022 was highly idiosyncratic in some respects, it meant investors could add “financial stability” to a list of tail risks that already includes “sticky inflation” and “deep recession”. The outlook for bonds has got messier – measures of implied and realised bond volatility remain too high and highly unstable for taking much outright, one-directional risk in portfolios (see Exhibit 2). Ideas to think about:

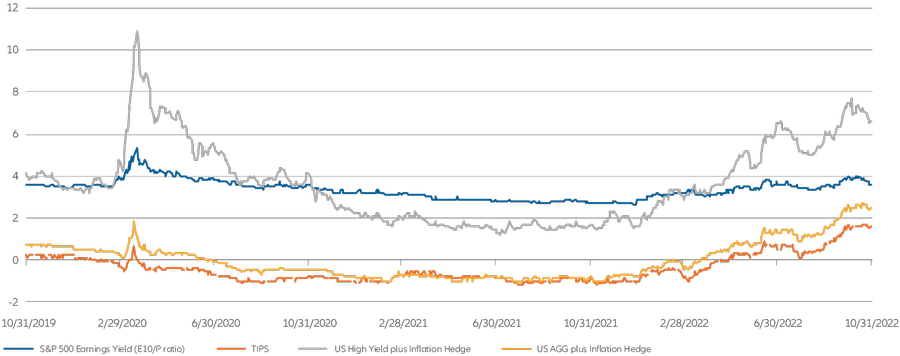

- Considering the inherent macro uncertainty at this point of the rates and credit cycle, it may be the wrong time to aggressively increase outright duration or credit risk.

- Many government bond yield curves are flattish to inverted, so buying short-maturity bonds could lock in yield income as high as – or even higher than – that offered by long-maturity debt. But short-maturity bonds may not help much to dampen portfolio volatility as the front-end of yield curves remains vulnerable to further shocks from the repricing of terminal short-term rates.

- We think investors should consider combining short-maturity cash bonds with derivatives-based overlay strategies that can help minimise rate, spread and currency volatility. It’s important to note that there can be cash outlay and performance costs associated with these hedging strategies.

- Floating-rate notes are another way to add exposure to short-duration corporate debt with less interest rate risk. Keep in mind that floater yields tend to be lower than fixed-rate corporate bond yields – it would take several consecutive rate hikes for floater yields to begin to catch up.

Exhibit 2: measures of expected and realised bond volatility have come down from their recent peaks, but are still high

Realised volatility (30 days trailing) of global investment-grade bonds and option-implied volatility (30 days ahead) of US Treasury bonds

Source: Bloomberg and ICE BofA indices. Allianz Global Investors. Data as at 31 October 2022. Index returns in USD (hedged). Realised volatility (30 days trailing) is annualised. IG= bonds rated Investment Grade. lhs=left-hand-side axis. rhs=right-hand-side axis. The rhs axis represents the value of the MOVE. which is a yield curve-weighted index of the normalised implied volatility on 1-month Treasury options on the 2, 5, 10 and 30-year contracts over the next 30 days. A higher MOVE value means higher option prices. Past performance does not predict future returns. See the disclosure at the end of the document for the underlying index proxies and important risk considerations. Investors cannot invest directly in an index. Index returns are presented as net returns, which reflect both price performance and income from dividend payments, if any, but do not reflect fees, brokerage commissions or other expenses of investing.

Opportunities of a flight to safety

The shift to an inflation-led regime (as opposed to a growth-led regime) is beginning to enrich the opportunities for flexible bond strategies that could benefit from pricing discrepancies across global markets. Market conditions have become more conducive to tactical and relative-value positioning, seeking to profit incrementally from cross-country and cross-asset spread moves across the yield-curve spectrum.

Some central banks are further along the rate-hiking cycle than others, and we are beginning to see early signs of greater divergence in monetary policy expectations. Investors may soon want to allocate more strategically – but incrementally – to those core rates markets that could potentially benefit from a flight to safety. These include markets where substantial rate hikes have already been delivered, positive real yields can be found further down the yield curve, and terminal interest-rate expectations (ie, the peak before rates fall back) are high compared to the perceived neutral rate.

Watch for unorthodox outcomes

There’s also quantitative tightening to consider. If central banks go ahead and accelerate the run-off of their bond holdings, liquidity conditions could turn sour and longer-dated bonds might not behave as expected in a flight-to-safety scenario.

The gilt market turmoil raised another, more unorthodox, possibility. While continuing to hike short-term rates, central banks may have to delay quantitative tightening as a way to restore liquidity at the long end of the curve. They might argue that bond purchases in that context are not inflationary as they do not necessarily encourage lending and spending. Bond and currency markets may beg to differ and nonetheless come under pressure.

Where to move next? Investment-grade credit for starters

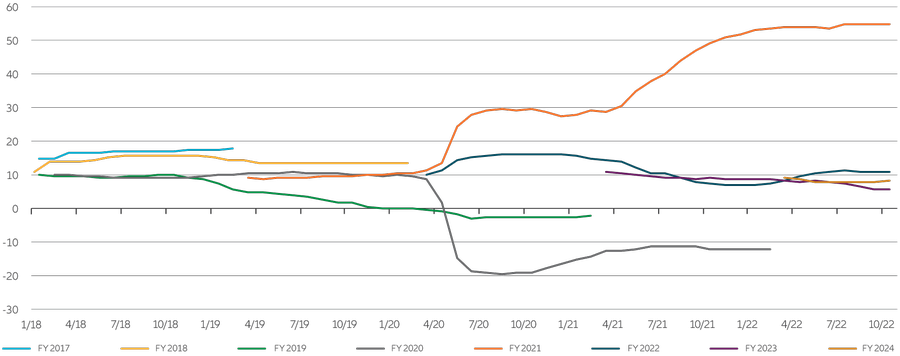

Once inflation and core rates stabilise, we see spread assets following soon after. The credit cycle has barely begun to turn and the full impact of falling consumer demand on corporate sectors has started to show only recently. Market downturns usually require patience, with historical analysis suggesting that three months into a recession provides a possible entry point to add more risk to investment-grade credit. Other potential opportunities to watch include:

- Yields offered by sustainability-labelled debt, such as green bonds mostly issued in the investment-grade space, have reset to more competitive levels. We see the energy crisis boosting long-term demand and yield for green and social financing – even if, in the short-term, there’s a move to more polluting sources and energy bill caps to avert a cost-of-living crunch.

- High-yield corporate bonds and emerging-market external debt have regained value and offer ample income cushion and potentially attractive long-term returns. But such assets may pose greater volatility and default-rate risks, so active management is key.

Fundamentals are a lot better than heading into previous recessionary periods, but there’s still uncertainty over terminal policy rates and the fallout for growth. Our outlook continues to favour underweight beta positioning in fixed income – with a view to reducing this underweight gradually through higher-quality issuers and by allocating freely across geographies.