The China Briefing

Searching for the green shoots

Please find below our latest thoughts on China:

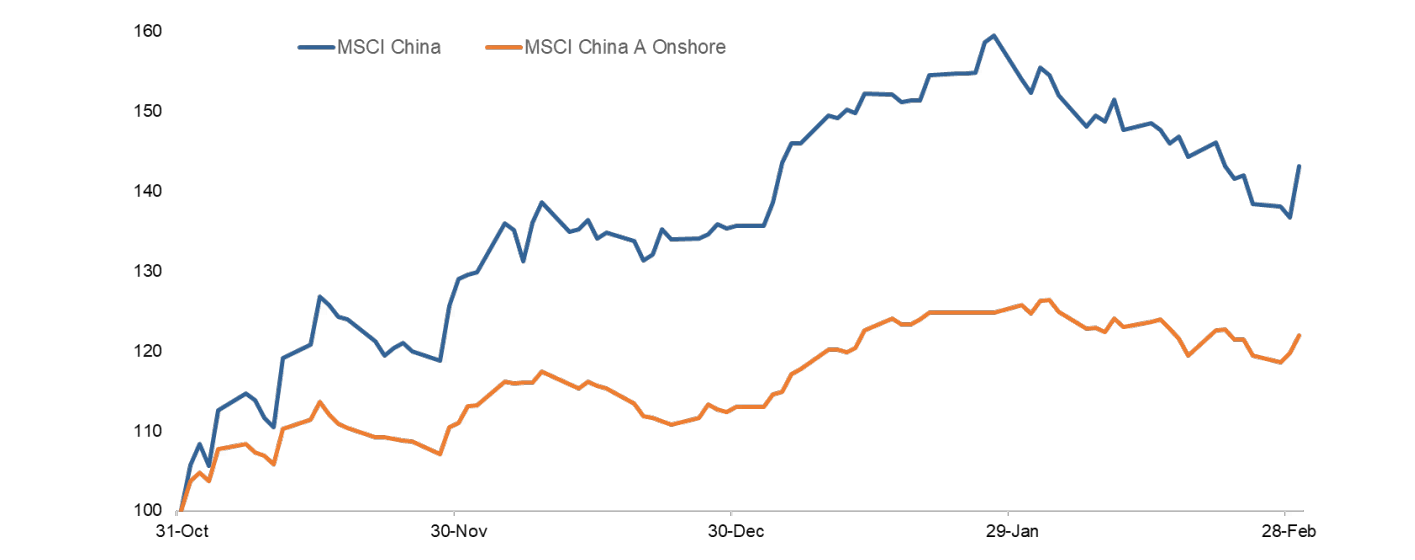

- China equities have continued in consolidation mode in recent weeks, especially offshore markets.

- While offshore market performance remains ahead of China A shares since the low point last October, the gap has narrowed. And year to date, the MSCI China A Onshore Index is ahead of MSCI China.1

- Looking ahead, a key question is whether the hope of China’s recovery post Covid reopening will be matched by economic reality. Trying to assess this is a challenge for markets at the moment as there is somewhat of an information vacuum.

Chart 1: MSCI China A Onshore and MSCI China performance since 31 Oct 2022 (USD, rebased to 100)

Source: Bloomberg as at 1 March 2023

- February is pretty much a blank spot for tracking the economy - due to the distortions created by the shifting lunar new year holiday dates, China does not report separate January and February data for most indicators, instead bundling the two months together for release in March. And many companies are in communications black-out ahead of the upcoming reporting season.

- In the short term, global investors have seemingly been in a ‘better to travel than to arrive’ mindset, locking in some profits especially in the context of a more hawkish US Federal Reserve.

- And following a painful 18 months of domestic equity returns, local investors are in a ‘show me the money’ frame of mind, seemingly waiting for better news on the economy.

- As an example, the level of Southbound Stock Connect flows (ie, mainland China investors buying into Hong Kong-listed equities) is only around 20% of the amount of foreign investor flows Northbound into China A Shares since November. And household cash deposits in China continue to rise.2

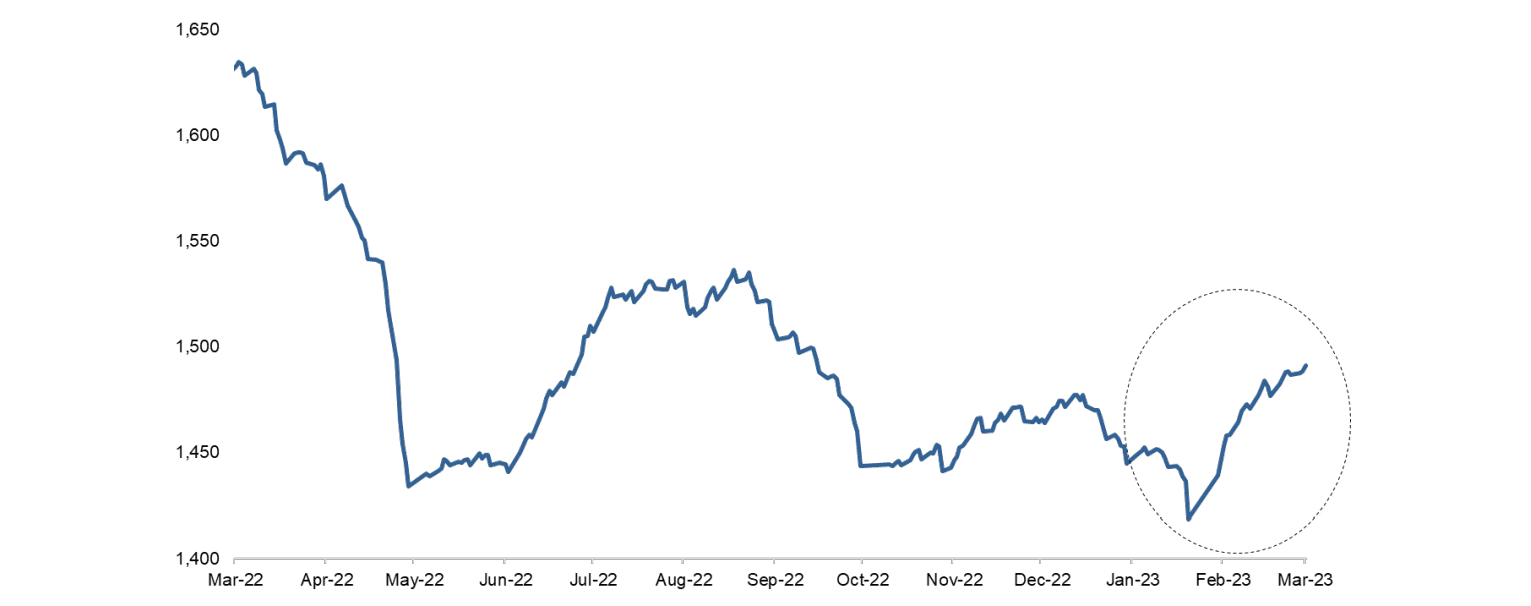

- The level of local margin trading in China A shares, a good real time sentiment indicator, has increased somewhat since Chinese New Year but not dramatically.

Chart 2: Margin trading outstanding balance in China A-Shares (CNY billion)

Source: Wind as at 1 March 2023.

- What economic data there has been recently does point to some green shoots of recovery. The manufacturing PMI in February came in at 52.6% compared to 50.1% in January3 (a figure above 50 reflects economic expansion). And property sales in larger cities are also seeing a pick up. But a clearer picture of the state of the economic rebound will not be available until mid-March.

- In the meantime, there will be a lot of attention on the National People’s Congress which kicks off this weekend.

- On Sunday (5 March), the country’s gross domestic product (GDP) target for this year should be announced. This is expected to be in the range of 5% to 5.5%.

- All 31 provinces have announced their growth targets for the year, varying from the low end of “above 4.5%” in Beijing, to the high end of “above 9.5%” in Hainan.4 This is the island in the south known as ‘China’s Hawaii’ which will be one of the biggest beneficiaries of domestic tourism and ‘revenge spending’.

- The weighted average 2023 growth target for the 31 provinces is 5.6%.5

- It is rare for China to miss its GDP target – it has only happened in 4 of the last 25 years, including last year.6 So, there is an incentive to set a target that generates confidence, while leaving enough margin to be beaten.

- Coming days will also see a significant reshuffle of China’s most high-profile economic policymakers. The coordinator of economic and financial policy (Liu He), the chief financial regulator (Guo Shuqing) and the governor of the People’s Bank of China (Yi Gang) are all expected to retire at the upcoming annual legislative session.

- This outgoing trio pioneered many of the most influential economic initiatives of the last decade. They were appointed in the years following the massive fiscal stimulus in 2008 post the Global Financial Crisis.

- Now widely regarded as a policy mistake, the stimulus was seen as leaving a dangerous legacy of sharply higher leverage which, if left untackled, had the potential to create a financial crisis that could derail China’s economic ambitions.

- Therefore, much of China’s recent economic policy – including the clampdown on shadow banking and targeting highly leveraged property developers – has been part of a broader financial de-risking campaign.

- Regardless of which individuals end up taking over these key positions, it is likely we will see a somewhat different balance between growth and risk prevention going forward. Although the goal of preventing financial risk will not be completely jettisoned, there may well be some rebalancing away from the strict financial discipline agenda of previous years.

1 Source: Bloomberg, 1 Mar 2023

2 Source: Gavekal, 27 Feb 2023

3 Source: National Bureau of Statistics of China, 1 Mar 2023

4 Source: Nomura Securities, 28 Feb 2023

5 Source: Nomura Securities, 28 Feb 2023

6 Source: HSBC, 24 Feb 2023

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of 4 social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).

2767463